The deal is expected to close in the fourth quarter of this year

American steel producer Cleveland-Cliffs Inc. buys Canadian rival Stelco Holdings Inc. for $2.5 billion (3.4 billion Canadian dollars). This is stated in the press release of the company.

Cleveland-Cliffs will pay 60 Canadian dollars plus 0.454 own shares for each share of Stelco. Thus, the shares of the latter are valued at 70 Canadian dollars.

After closing, Cleveland-Cliffs shareholders will own 95% of the combined company, Stelco shareholders – 5%. The boards of directors of both companies unanimously approved the transaction, it is expected to be closed in the fourth quarter of 2024, subject to the approval of Stelco shareholders, obtaining regulatory approvals and fulfilling other customary conditions.

Upon completion of the transaction, Stelco will operate as a subsidiary of Cliffs, while retaining its former name.

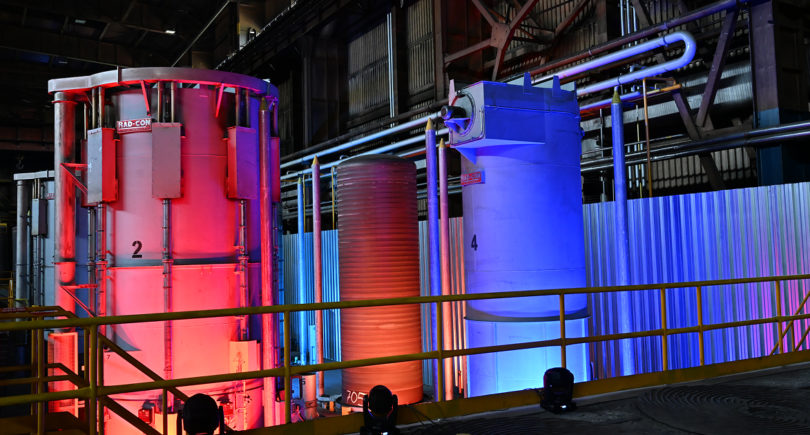

Stelco has two operational sites in Ontario: the state-of-the-art and low-cost integrated steel mill Lake Erie Works and the Hamilton Works facility for steel finishing and coke production. The company annually ships approximately 2.6 million short tons of flat rolled products to customers of service centers.

The acquisition of Stelco should strengthen Cliffs’ position in the spot flat-rolled market. The Canadian company adds capabilities that complement the current operations and product portfolio of the American steel producer, as well as diversifying its customer base in the construction and industrial sectors.

As GMK Center reported earlier, in May, it was reported that Cleveland-Cliffs was negotiating the acquisition of NLMK assets in the United States. The steel capacity of the latter in Indiana and Pennsylvania, with a possible sale, can be estimated at more than $500 million.