Interviews steel prices 16153 02 March 2023

In the first two months of the year, sales of rolled steel seasonally decreased, but with the start of the construction season, they may increase

The Ukrainian steel trade market is experiencing a decrease in the level of business activity. The demand for rolled steel fell significantly in the fall of 2022, when missile attacks on the energy infrastructure and interruptions in the supply of electricity began. Serhiy Kovalenko, commercial director of the national network of steel centers Vartis, said what is the general and price situation on this market now in an interview with GMK Center.

What are the results of the first two months on the steel trading market?

– There were no significant changes in the steel trade market in the first two months of 2023. Demand has decreased in proportion to seasonality – we observe this every year in the winter period. Some experts predicted a significant drop in sales in the winter, but this did not happen.

In the second half of February, a noticeable factor in the decrease in demand was the fear of an escalation of hostilities. Now that date is behind us, we expect demand to pick up seasonally.

The current situation is as follows: our sales in January 2023 are 50% less than in January 2022, when there was no war. We hope that the market will show more activity in the coming months.

What is the situation with the demand for steel in certain regions?

– Over the past few months, the demand for steel products in Ukraine has decreased because it is out of season. However, if you look at the situation in individual regions, you can see some positive dynamics. In the western regions, the demand for steel products is higher than in the central regions. This pattern has persisted since the spring of 2022, and this is due to a more stable situation and distance from the territories where hostilities are taking place.

I would like to note that the predominance of demand in the western regions is also related to business relocation. We predict that this will also be visible in sales in 2023, because there are companies that last year planned to build their warehouses, etc., in the west of the country.

Do you feel an increase in demand for steel products in the context of war-ravaged industries and infrastructure reconstruction, as well as in connection with the transfer of industrial capacities to the western regions?

– Unfortunately, today we are not observing a mass recovery that could increase the consumption of rolled steel. Small works are carried out on infrastructure facilities, works related to business relocation, as well as restoration of destroyed housing at the expense of the population.

However, it should not be forgotten that the reconstruction of infrastructure and production after the war is a long-term process. We expect demand for steel products to grow over time.

What is happening in the fittings market? How have the prices for these metal products changed?

– Over the past few weeks, we have seen the consumption of rebar at a seasonally low level, but in the wholesale segment, consumption is higher than in the retail segment. This may be due to the fact that retail sales decrease during the winter. However, we expect an increase in demand in this segment already at the beginning of spring.

In February, rebar on the market rose in price. This is due to the fact that producers adjust their prices in parity with export prices. The next increase will take place at the beginning of March. We predict a price increase of about $20-40 per ton.

Another factor that affected the price was the stoppage of rebar production at ArcelorMittal Kryvyi Rih after the rocket attacks. Work resumed only at the beginning of February 2023.

While the production of rebar at ArcelorMittal Kryvyi Rih did not take place, assistance to the domestic market was provided by another producer – Metinvest at the facilities of Kametstal. Due to low demand and sufficient product stocks in traders’ warehouses, clients did not experience shortages.

What are the general price trends in the domestic steel trade market?

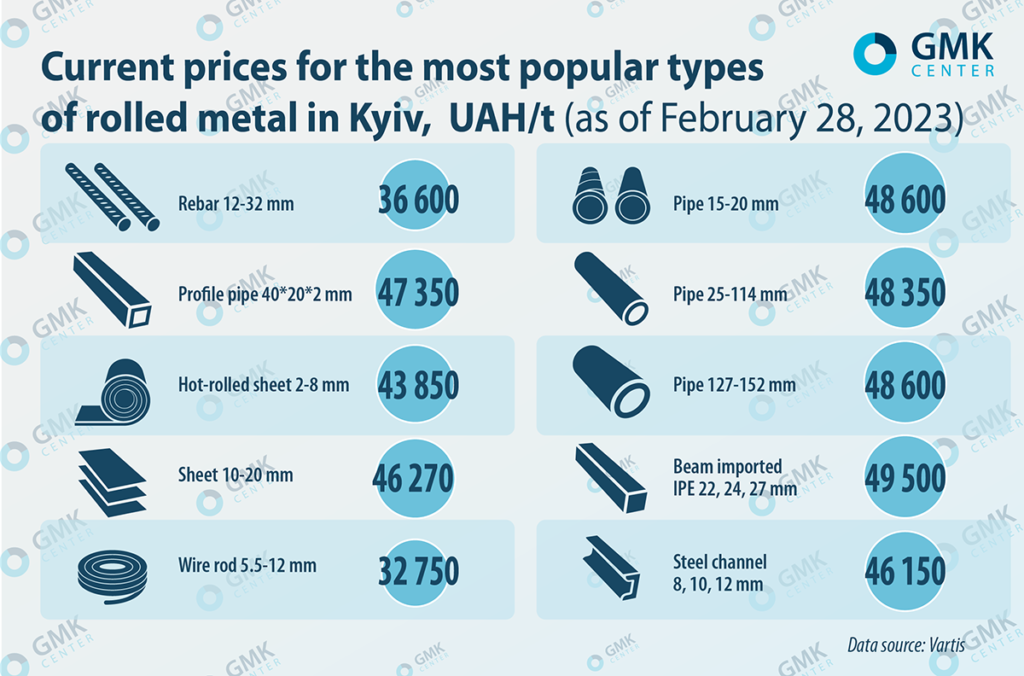

– We selected the most popular products and indicated the prices as of February 28, 2023, (in Kyiv):

Prices for rolled steel in Kyiv

You can track as prices for the same groups of rolled steel have changed from the summer of 2022.

Sheet 10-20 mm became cheaper by almost 23.2%. Then, at the beginning of the season, it was a dangerously scarce product that began to be imported into the country, because the capacities of Ukrainian producers of thick sheets were destroyed by the occupiers. Now the situation has stabilized, and the market dictates such a price for thick sheets.

Prices for hot-rolled sheet 2-8 mm increased by 3.2%. A small percentage increase is observed for pipes – up to 1%. In the first half of March, an increase in the prices of sheets and pipes is predicted due to the increase in prices on export markets.

Prices for rebar 12-32 mm and wire rod 5.5-12 mm increased by 30% and 13.4%, respectively. The 8, 10, 12 mm steel channel rose in price the most – by 36%.

The price of imported categories is dictated by the European market today, but products that continue to be produced in Ukraine are the most competitive. It is of high quality and available to the client.

Also, the trend of rising steel prices at the beginning of the construction season is relevant every year. This trend falls on March, and this year will not be an exception.

How has the demand for steel products changed compared to the fall of 2022? Have the consumers of steel products recovered after the strikes on the energy infrastructure that began in October last year?

– Compared to autumn, the demand seasonally decreased. Also, the decrease in demand is felt precisely in those weeks when massive rocket attacks take place. Buyers need 2-3 days to recover.

How did the company rebuild its operations in the face of missile attacks and power outages?

– In order not to depend on outages, Vartis since November 2022 made maximum efforts to ensure the autonomous operation of its warehouses. In order to fulfill customer orders, the company changed loading schedules, including weekends, and, if necessary, loaded at night, but all, of course, in accordance with safety regulations.

In December, we started work on providing our wholesale warehouses with powerful generators. Thus, loading mechanisms in warehouses, where there is an autonomous energy source, can work regardless of blackouts. The process of transferring warehouses to work in offline mode continues.

What are your forecasts for the volume of metal trade in the first quarter of the current year and for the year as a whole? What are the expectations for fittings?

– Our expectations regarding the volume of steel trade in the spring are quite optimistic. This is due to the fact that the country has already partially adapted to work under shelling, which has become a common phenomenon for Ukrainian business.

We forecast a 10-15% increase in sales in 2023, due to reconstruction, relocation and due to business adaptation to war conditions. The volume of the rebar market in 2023, according to our forecasts, will be 350-400 thousand tons. For comparison: in 2021, the market size of this rolled steel was more than 1 million tons.

What are Vartis’ plans for 2023?

– We hope that Ukraine will win in 2023 thanks to the Armed Forces and the Ukrainian people.

As for the plans, it is, first of all, a full-fledged restoration of the Zaporizhzhia branch. Also, the strategic plan of Vartis is the expansion of the network of steel depots by 8-10 warehouses and getting closer to customers in order to improve service services.