Infographics railway transportation 1748 23 January 2025

The reason for the sharp increase in the export of agricultural and mining products by rail was the opening of the sea corridor

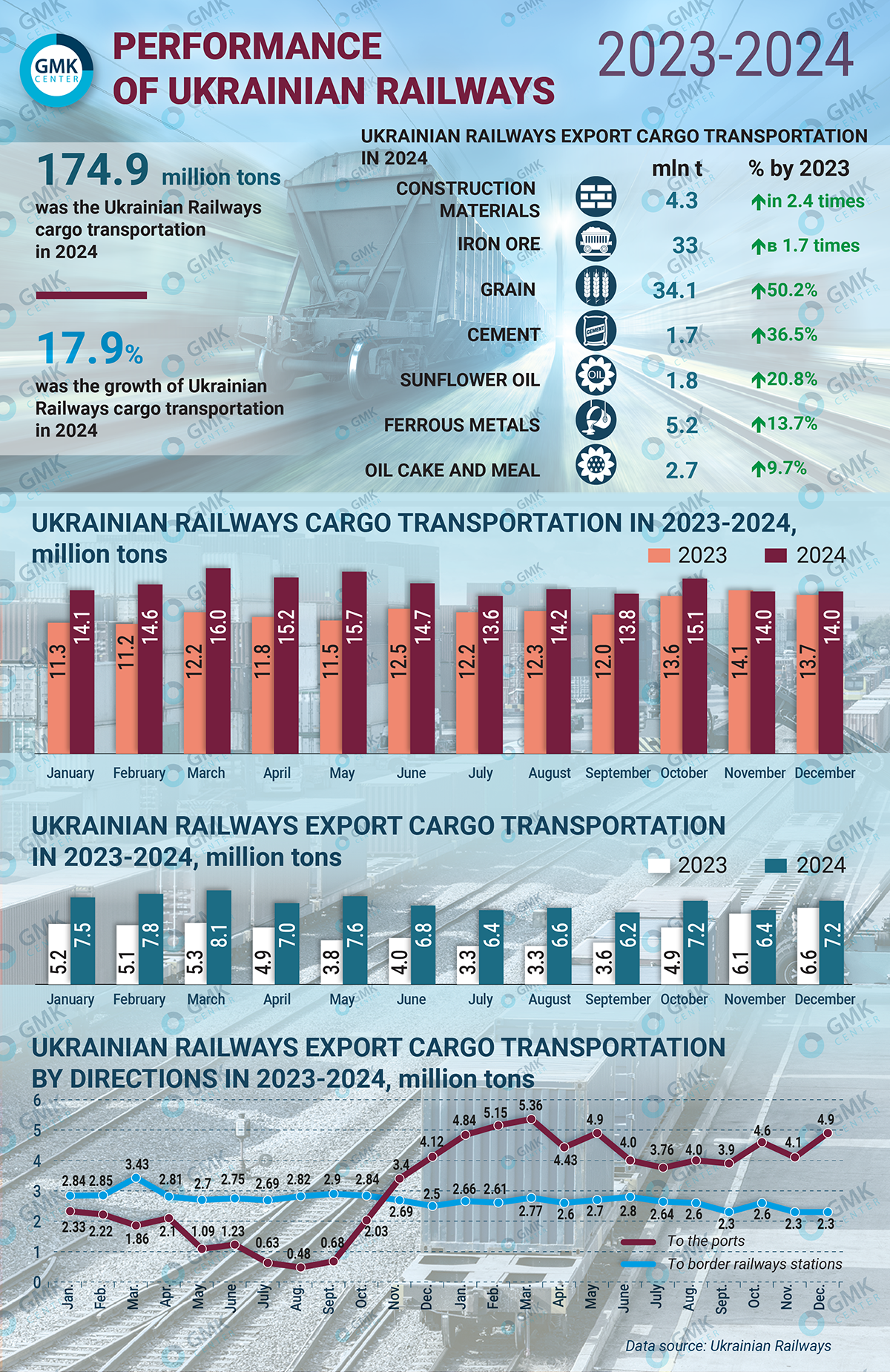

At the end of 2024, Ukrainian Railways (UZ) has significantly increased the volume of freight traffic – by 17.9% or 26.5 million tons more compared to 2023 – up to 174.9 million tons. The decline in freight transportation in 2022-2023 amounted to 1.5% y/y and 52.1% y/y, respectively.

The main driver of rail freight transportation growth in 2024 is the increase in exports due to the opening of the sea corridor in August last year. Due to this, the share of exports in the total freight transportation volume increased to 48% (38% in 2023). Last year, the volume of Ukrainian Railways’ export transportation grew by 51.2% y/y, or 28.7 million tons, – to 84.7 million tons. At the same time, domestic transportation in 2024 decreased by 5.5% y/y – to 80.2 million tons, while import cargo transportation grew by 40.9% y/y – to 9.6 million tons.

The first three positions in the structure of export cargo transportation were occupied by grain cargo (40% or 34.1 mln tons), iron and manganese ore (39% or 33 mln tons) and ferrous metals (6% or 5.2 mln tons). The growth dynamics of export rail transportation by individual types of cargo in 2024 was as follows:

- mineral construction materials – by 2.4 times, to 4.3 million tons;

- iron ore – by 1.7 times, up to 33 million tons;

- grain cargoes – by 50.2%, to 34.1 million tons;

- cement – by 36.5%, to 1.7 mln tons;

- sunflower oil – by 20.8%, to 1.8 mln tons;

- ferrous metals – by 13.7%, to 5.2 mln tons;

- oilcake and meal – by 9.7%, to 2.7 million tons.

Last year the volume of cargo transportation for export by rail in the direction of ports amounted to 53.8 million tons (2.4 times growth), in the direction of land crossings – 30.9 million tons (-8.6% y/y). In particular, 18.3 million tons of ore were transported in the direction of ports (3.7 times more than in 2023), and 14.7 million tons were transported in the direction of land border crossings (-0.4% y/y).

These statistics are due to a sharp increase in exports along the sea corridor and reorientation to ports of some cargoes that were previously exported by land. A total of 97.9 million tons of cargo will be transported through sea crossings in 2024 (+28.2% y/y), while 64.3 million tons (-8.1% y/y) will be transported through land crossings.

At the same time, even despite the growth in freight transportation, Ukrainian Railways wants to index freight tariffs by 37%, increasing financial pressure on shippers. Such a decision will lead to an additional UAH 8-10 bln increase in logistics costs for iron and steel enterprises alone.

The increase in tariffs predictably will not lead to the growth of Ukrainian Railways’ freight base and will only worsen financial results. Due to the unjustified increase in freight transportation tariffs, some sectors of the domestic economy refuse to use UZ services, preferring alternative means of transportation, and in the worst case – reduce production or suspend economic activity altogether. According to the business community, to improve the financial condition of Ukrainian Railways, it is necessary to increase the efficiency of UZ’s operations and optimize the state carrier’s expenses.