Infographics decarbonization 284 26 June 2025

Despite funding approvals, construction has only begun on 8 out of 23 projects

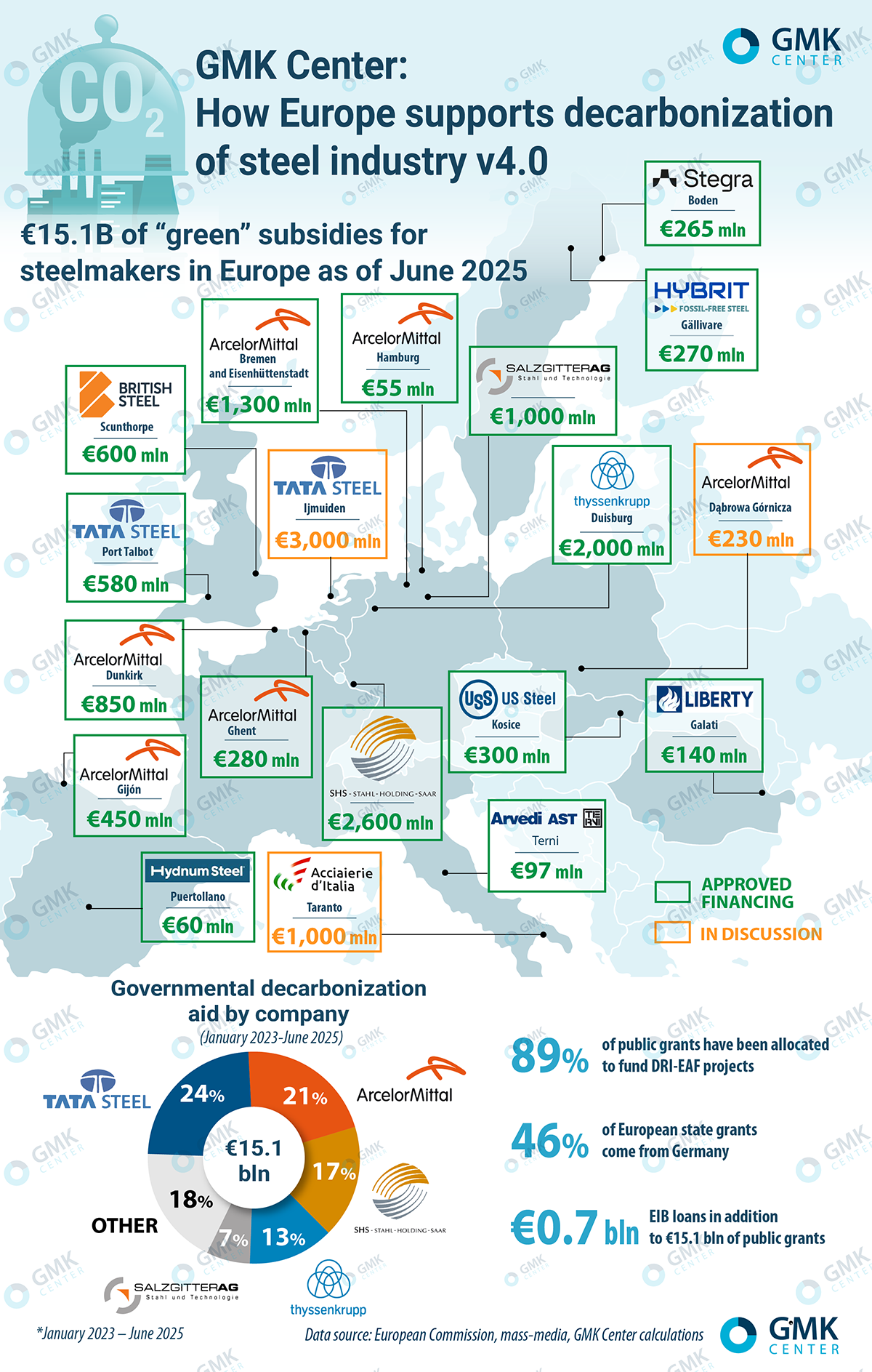

Over the past six months, government grants for decarbonizing Europe’s steel industry have grown by €500 million, reaching a total of €15.1 billion. Additional support comes via concessional loans, including €700 million allocated by the European Investment Bank (EIB) for three steel projects in 2024–2025.

Nearly 90% of public grants target DRI-EAF (Direct Reduced Iron-Electric Arc Furnace) projects, the primary decarbonization pathway adopted by European steelmakers.

Germany leads in subsidies, contributing 46% (€7 billion) of total grants, that is disproportionately high relative to its 35% share of Europe’s (EU-27 + UK) basic oxygen furnace steel output. The Netherlands will rank second once its expected €3 billion grant for Tata Steel IJmuiden is finalized.

Recent Funding Announcements (Dec 2024–June 2025):

- Italy’s Ministry of Business allocated €97 million to Arvedi AST under an Environmental Protection Contract.

- Poland’s parliament debated €230 million to modernize ArcelorMittal Dąbrowa Górnicza’s blast furnace.

- Romania pledged €150 million to cut emissions at Liberty Galați.

- Spain approved €60 million for Hyndum Steel’s DRI-EAF complex in Puertollano.

Of 30 announced decarbonization projects in the EU-27 and UK, only 7 have not received state grants (excluding R&D funding). Critical decisions remain pending for Tata Steel IJmuiden and Acciaierie d’Italia, with the latter awaiting confirmation of its new owner’s decarbonization plan.

Despite heavy subsidies, only 8 of 23 approved projects have broken ground. Steelmakers cite low steel prices, high energy costs, and insufficient demand for low-carbon steel as key barriers. These factors cast doubt on the viability of DRI-EAF in Europe over the next decade, given non-EU competitors’ cost advantages and lukewarm market readiness.

In March 2025, the European Commission unveiled its Action Plan on Steel and Metals, which includes measures to:

- Strengthen CBAM;

- Restrict scrap metal exports to ensure affordable feedstock for EAF-based production;

- Introduce incentives for low-carbon steel demand;

- Expand energy cost subsidies to ease operational pressures.

Implementation of the proposed measures in the coming year will create conditions for the implementation of decarbonization projects and will provide steel companies with certainty about the effectiveness of their climate investments.