It's likely that the issue of VAT refunds will stay relevant until the war is over

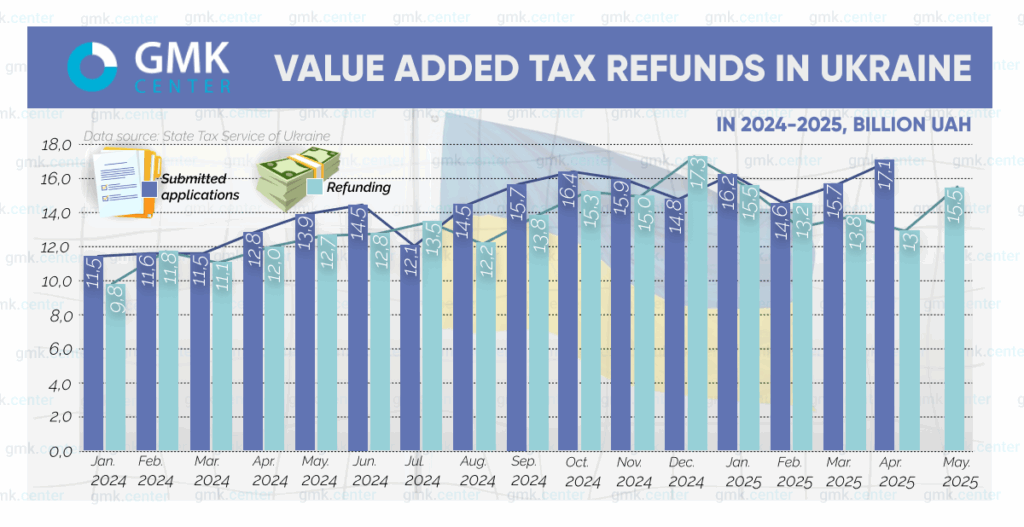

The situation with VAT refunds in Ukraine remains difficult. As of the end of May, the balance of unreimbursed VAT amounted to UAH 30.3 billion, which is almost identical to the amount a month earlier. At the same time, in January-May 2025, the volume of VAT refunds increased by 23.8% or UAH 13.3 billion to UAH 70.9 billion compared to the same period in 2024. And in May, this figure increased by 22.3% year-on-year to UAH 15.5 billion.

Medium and large Ukrainian businesses, especially exporters, are highly dependent on timely VAT refunds. Without receiving this tax refund, enterprises are effectively deprived of part of their working capital. At the same time, it is difficult or impossible to obtain loan financing in the current conditions – bank loans are expensive, and the possibilities for raising funds on Western markets are extremely limited. That is why a significant VAT refund for a particular enterprise can quickly turn into a reduction or complete suspension of its activities.

«Ferrexpo makes a significant contribution to the Ukrainian economy and society, especially during the war. The suspension of VAT refunds will put significant pressure on our business, at a time when we are already dealing with many other problems. Ferrexpo calls on the Ministry of Finance and the State Tax Service of Ukraine to take urgent and effective measures to resume VAT refunds,» emphasizes Lucio Genovese, CEO of Ferrexpo.

The financial authorities have failed to resolve the issue of timely VAT refunds. The head of the relevant parliamentary committee, Danylo Getmantsev, cites three reasons for the increase in debt:

- failure of the treasury to transfer funds to VAT payers (UAH 4.4 billion),

- failure to comply with court decisions (UAH 7.7 billion),

- a 22.3% year-on-year increase in the number of documentary checks of refund applications.

Delays in payments by the treasury show that the problem of non-reimbursement of VAT is partly artificial.

The problem will not be solved in the coming months, as the factors mentioned by the State Tax Service in May – an increase in imports and a decline in business activity – will continue in the foreseeable future.

Since the beginning of the year, imports have grown significantly. In January-May, imports of goods to Ukraine grew by 13.8% year-on-year to $31.3 billion, while exports grew by only 0.5% to $16.9 billion. At the same time, the economy is experiencing a decline in industry and construction, which is occurring against the backdrop of rising industrial inflation, labor shortages, and high electricity and gas prices.

The problem is exacerbated by the fact that the increase in VAT revenues should be used to cover the new state budget deficit of UAH 400 billion, which had accumulated by May this year. The problem of VAT non-reimbursement is likely to remain relevant until the end of the active phase of the war, when the state will finally be able to balance its budget expenditures.

As previously reported, the non-reimbursement of VAT amounting to hundreds of millions of hryvnia has also affected several iron and steel companies, including Ferrexpo, Centravis, and the Kryvyi Rih Iron Ore Plant. As a result, these companies were deprived of working capital and were forced to reduce production or cease operations altogether.

This situation can be partly attributed to a significant drop in iron ore exports. Ukrainian mining companies reduced iron ore exports by 12.8% year-on-year in January-May, to 13.54 million tons.