Infographics electricity prices 871 04 June 2025

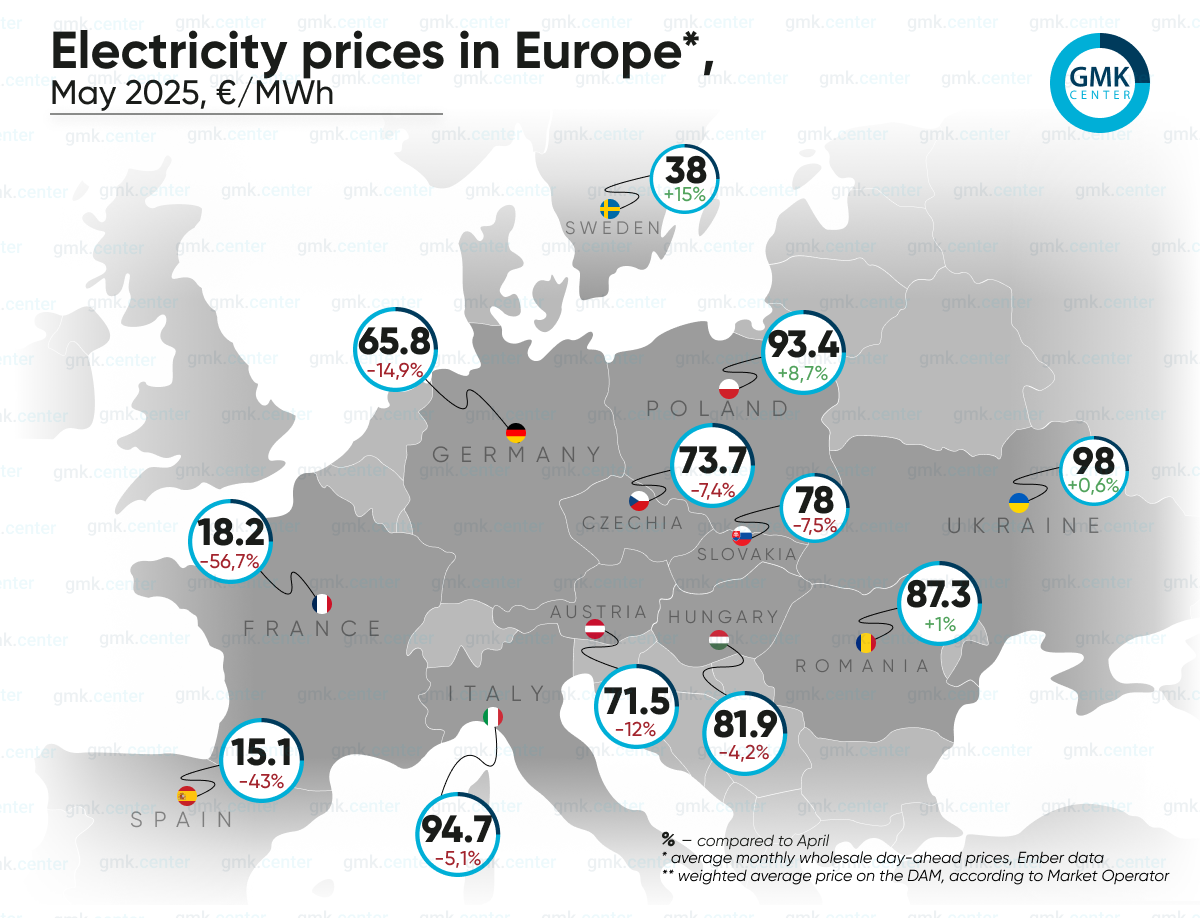

In Ukraine, the weighted average price of the DAM was €98/MWh

In the EU, average monthly wholesale day-ahead prices continued to fall in May in most European markets.

According to Ember, they were, in particular, as follows:

- Italy – €94.73/MWh (-5.1% m/m);

- France – €18.21/MWh (-56.7(%);

- Germany – €65.85/MWh (-14.9%);

- Spain – €15.15/MWh (-43%);

- Sweden – €37.98/MWh (+15%).

The fall in electricity prices in May was generally driven by an increase in renewable energy production (wind and solar) and a decline in demand despite fluctuations in gas prices and carbon emissions. Most European markets also recorded negative hourly prices during the month.

“From the energy sector’s point of view, negative prices are bad, but the consumer benefits. For example, if we look at the price of electricity in Spain and Italy, we see a significant difference, which gives advantages to Spanish producers,” said Andriy Tarasenko, Chief Analyst at GMK Center.

European politics

The blackout in the Iberian Peninsula in April revived the debate on the European agenda for renewable energy and the revival of nuclear power, The Guardian reports. In Spain, this has exacerbated the debate over the government’s plans to gradually decommission the country’s remaining seven nuclear reactors by 2035. At the time of the April outage, the Spanish power system depended on renewable energy sources by about 70%, which, according to experts, could make it difficult for the operator to maintain a stable grid frequency. However, this assumption was later rejected by Spanish Prime Minister Pedro Sanchez.

At the same time, Germany is already softening its tough stance on this issue. Thus, the Merz government will stop blocking France’s efforts to treat nuclear energy on a par with renewable energy sources. This was reported by officials from both sides. Approximately 70% of French electricity comes from the country’s 56 nuclear reactors. Earlier, Germany – along with Austria, Portugal, Denmark and the Netherlands – opposed the classification of nuclear energy as “sustainable” at the bloc level.

In addition, at the end of May, the European Commission presented its assessment of the National Energy and Climate Plans (NECPs) of the bloc member states. The countries that have not yet submitted their final updated NECPs are Estonia, Belgium, and Poland.

The assessment showed that the countries have significantly narrowed the gap in achieving the 2030 energy and climate goals, but further work is needed. In particular, the EU’s goal is to reduce final energy consumption by 11.7% by 2030, while the NECPs show that there is a gap, and the EU is on track to reduce it by 8.1%.

As noted, according to the plans, energy security is being strengthened by lower gas consumption and more diversified energy sources, including an increased role for nuclear power, as well as heat production in several member states. However, Europe needs to continue to adapt its infrastructure to a decarbonized energy system, take additional measures to develop cross-border interconnections and further integrate markets.

The situation in Ukraine

In Ukraine, the weighted average price for the purchase and sale of electricity on the DAM in May 2025, according to the Market Operator, increased slightly by 0.6% m/m – to 4638.31/MWh (€98/MWh at the average monthly hryvnia exchange rate to the euro).

Demand for the DAM in May increased by 4.29% compared to April, while supply increased by 0.95%.

Last month, according to ExPro Electricity monitoring, electricity imports increased by 3.6% compared to April. The largest volumes continue to come from Hungary (40%). Exports of electricity from Ukraine in the period under review decreased by more than 40% compared to April – to 92.5 thousand MWh.

At the end of May, the regulator, the National Energy and Utilities Regulatory Commission (NEURC), maintained the current price caps in the electricity market for another six months. At the same time, the commission’s chairman, Yuriy Vlasenko, suggested that the Department of Energy Market should start the procedure of revising them in the near future to respond promptly to the situation in the country, including those related to the war.

On May 27, Ukrainian power engineers connect another unit of one of the nuclear power plants to the grid after scheduled preventive maintenance, which will add 1000 MW of capacity to the grid. This is the second nuclear power plant unit to undergo the necessary repairs this year, and several more were being prepared for repair at the end of May.

Fullness of gas storage facilities. According to the AGSI platform, European gas storage facilities were 48.8% full as of June 1, 2025 (compared to 70% as of the same date in 2024).

On May 8, MEPs approved the EC’s proposal to extend the EU gas storage scheme from 2022 to the end of 2027. They also proposed to reduce the target occupancy rate from 90% to 83%, which should be reached at any time between October 1 and December 1 of each year.

According to the proposal, Member States would be allowed to deviate from the target occupancy rate by up to four percentage points in case of unfavorable market conditions (supply disruptions or high demand). The EC may further increase this deviation to four percentage points if these market conditions persist. However, Member States will have to ensure that the cumulative effect of the flexibility does not lead to a reduction in the overall level of the fill obligation below 75%.

These changes are yet to be adopted, which will affect the current storage season.

Significant gas reserves, the Financial Times writes, are a crucial factor in smoothing prices and reducing the risk that countries will have to compete on the open market during winter demand surges.

At the beginning of the month, the futures price of the Dutch TTF (according to ICE, the contract for June) was €32.2/MWh, and at the end (May 30) it was €34.2/MWh. It reached its highest level for the month on May 26 (€37.3/MWh).