Opinions Industry collection of scrap 1175 19 August 2024

Scrap collection is growing, but the industry is experiencing a number of problems that limit its potential

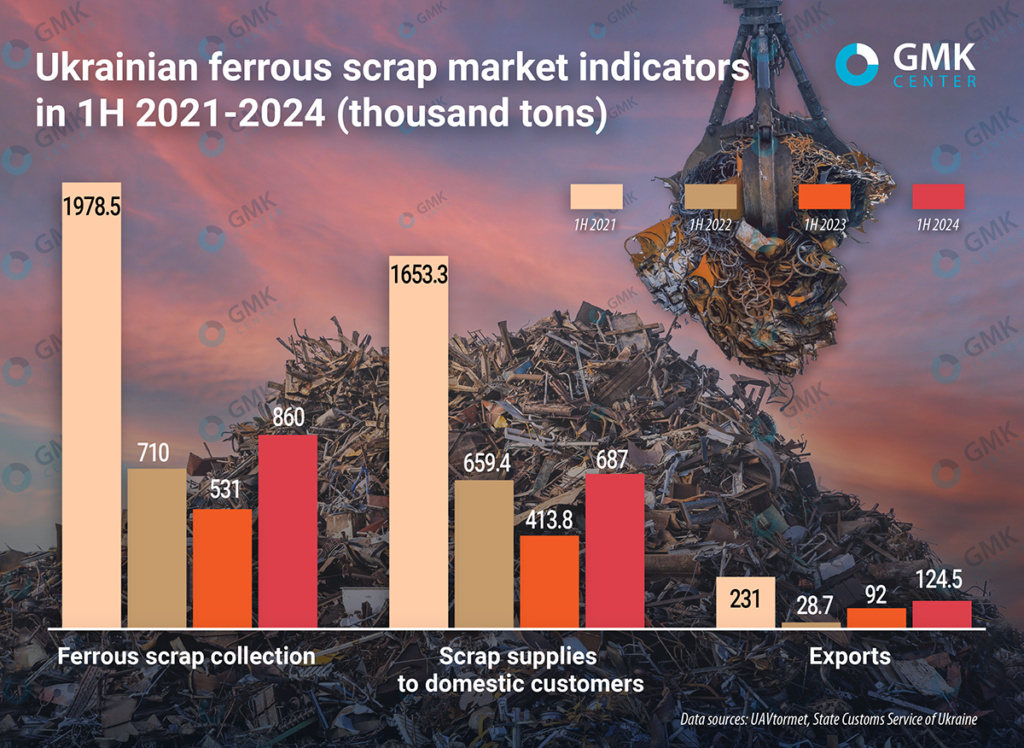

In H1 2024, the volume of scrap collection and consumption increased by more than 60% compared to the same period of 2023. Such high dynamics allows us to say that at the end of the year, the collection of raw materials may reach 1.75-1.85 million tons, supplies of raw materials to domestic consumers may reach 1.4-1.5 million tons.

Half-year results

In 2024 the Ukrainian scrap market showed high growth dynamics. In H1 2024, the main market indicators showed such positive dynamics compared to the same period of 2023:

- scrap collection – growth by 62%, up to 860 thousand tons;

- supply of raw materials to domestic consumers – growth by 66%, up to 687 thousand tons;

- export of scrap – growth by 35.3%, up to 124.5 thousand tons.

For reference: steel production in January-June increased by 37% – to 3.87 million tons. Steelmakers are on track to exceed our steelmaking forecasts.

The major challenges for the scrap industry in 2024 include:

- Complexity of employee booking. Our industry is not categorized as critical to the economy, and the employee booking procedure itself is in complete chaos – we do not understand who to book and how to book.

- Deterioration of logistics. Mass mobilization has caused a transportation problem – inter-region transportation of scrap by road has dropped sharply. No one knows whether a car with scrap will reach its destination or a team of workers to the dismantling site: somewhere along the way, both the driver and the transport itself may be mobilized. Transportation within one region is less affected.

- Restrictions on work in frontline regions. Regional military administrations impose restrictions on the collection of scra in frontline areas. The export of raw materials is possible in limited volumes and with a lot of paper approvals.

- The difference between domestic and European prices for scrap is $160-180 per ton. The level of СRT prices in Ukraine is $200-210/t, in the European Union – $360-380/t. At the same time, the requirements of European consumers to the quality of scrap metal are higher.

- Electricity deficit. At the same time, it cannot be said that power supply interruptions in May-July had any critical impact on the industry companies. Mechanisms and technologies without power supply started to be used for scrap processing.

We estimate that the availability of scrap in Ukraine has slightly increased due to the destruction of infrastructure. Such scrap is considered to be depreciable, but its introduction into circulation will require many papers (expertise, damage assessment, etc.) and at least 2-3 months for their processing. Already now there are many examples of dismantling for scrap the rubble of destroyed factories, warehouses, etc.

Problems in scrap export

The priority for scrap collectors remains deliveries to the domestic market, where consumers feel quite comfortable now: the system of quota supply to steel plants is working. We are ready to supply the market with those volumes of raw materials that are needed by domestic consumers.

Some raw materials are exported, although there are certain restrictions on this, which restrain its increase:

- A large number of “paper” procedures (obtaining permits, export documents, etc.) that must be completed to export scrap.

- High requirements to the quality of scrap. European consumers require deeper processing of scrap than Ukrainian consumers. However, not all Ukrainian scrap collectors have the necessary technical capabilities to ensure the required depth of processing of raw materials.

- Scrap exporters have to “freeze” working capital for a relatively long period.

- Logistical limitations. Due to different gauges, the need for transloading at the border, etc., the throughput capacity of western railway border crossings does not exceed 50 thousand tons of scrap per month. Currently, about 20-25 thousand tons of scrap is exported per month.

Expectations for the end of 2024

As of today, we see that the industry will be able to achieve the estimated indicators, which were sent by us to the Ministry of Strategic Industries to be taken into account in the balance of steel production and scrap consumption. For example, the actual scrap collection figure for January-June of 860 thousand tons allows us to reach the expected range by the end of 2024.

The forecast balance of the scrap market is based on the premise that in 2024 steel production will amount to 7-7.2 million, assuming the achievement of such indicators at the end of the period:

- scrap collection – 1.75-1.85 million tons;

- domestic consumption – 1.4-1.5 million tons;

- export of scrap – 250-300 thousand tons.

If the general situation on the global market develops in a positive direction, then in 2025 we can expect an increase in scrap collection to 2 million tons.