The European division of the company increased the indicator by 3.7% y/y

US Steel Corporation, one of the largest steel producers in the United States, increased steel shipments by 3.8% in 2023 compared to 2022, to 15.51 million tons. In the fourth quarter, the figure increased by 13% y/y – to 3.81 million tons. This is stated in the company’s report.

The European division of US Steel Europe shipped 3.899 million tons of steel to consumers last year, up 3.7% compared to 2022. The average selling price was €807 per tonne compared to €1,029 per tonne in 2022.

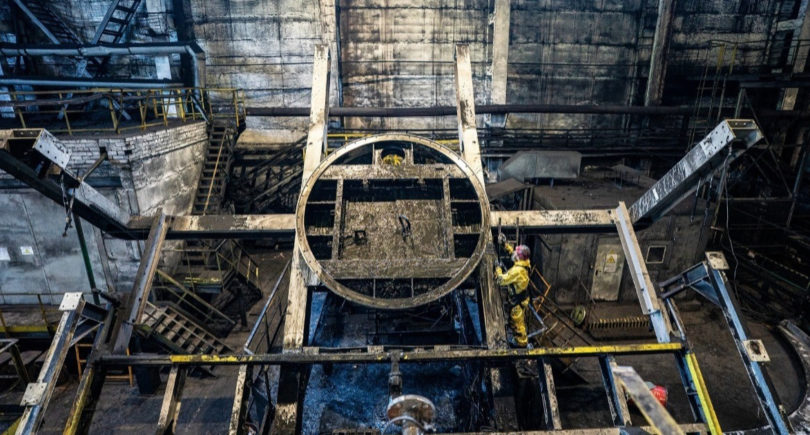

In 2023, US Steel’s European operations produced 4.39 million tonnes of steel, up 14.5% from 2022. The utilization rate of raw steel was 88% compared to 77% a year earlier.

US Steel’s Flat-Rolled, Mini Mill and Tubular divisions shipped 8.71 million tons (+4% y/y), 2.42 million tons (+6%) and 0.48 million tons (-8.6%) of steel last year, respectively. In 2023, US Steel Flat-Rolled increased steel production by 6.2% y/y – to 9.4 million tons, Mini Mil by 11.4% y/y – to 2.95 million tons, and Tubular – by 10.4% y/y. The Flat-Rolled division’s crude steel utilization rate was 71% (67% in 2022), Mini Mil – 89% (80%), Tubular – 63% (70%).

US Steel’s net income in 2023 decreased by 14.3% compared to 2022 – to $18.05 billion. The company’s net profit last year decreased by 64.5% y/y – to $895 million. Adjusted EBITDA amounted to $2.14 billion compared to $4.29 billion in 2022.

«Our hard work over the years is paying off in the form of notable achievements. We are entering 2024 with strong momentum. Lead times are increasing, reflecting strong customer demand, and our production facilities are operating at high utilization rates to efficiently fulfill customer orders,” commented US Steel President and Chief Executive Officer David B. Burritt.

As GMK Center reported earlier, in December 2023 it was announced that Nippon Steel, the largest steel producer in Japan and one of the leading steel producers in the world, will purchase US Steel at a price of $55 per share, which is approximately $14.9 billion including debt obligations.

A group of multinational companies is calling on the U.S. government to conduct an objective analysis of the proposed acquisition of US Steel by Japan’s Nippon Steel without political context. The letter was published by the Global Business Alliance (GBA), which represents international companies in the United States.

In addition, Takahiro Mori, executive vice president of the Japanese steel company, met with members of the U.S. Congress to discuss how the acquisition would benefit all stakeholders.