News Industry ferroalloys 1320 14 November 2024

The shipment of ferroalloys is kept at minimum levels after the restart of part of the capacities

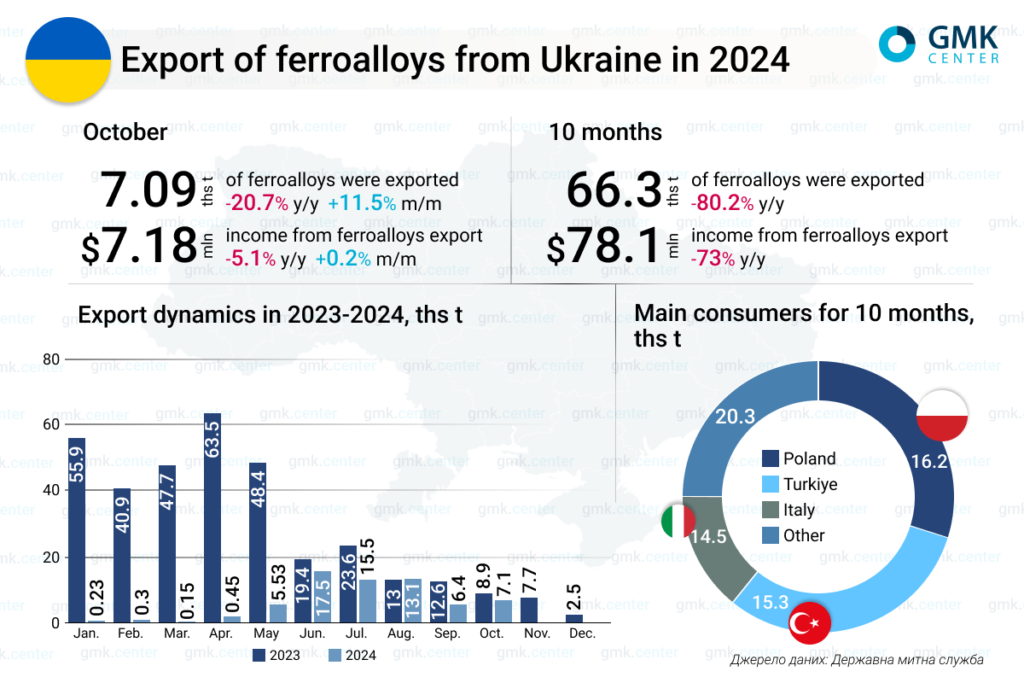

In January-October 2024, Ukraine’s ferroalloy industry reduced exports by 80.2% compared to the same period in 2023, to 66.26 thousand tons (334.01 thousand tons in January-October 2023). This is evidenced by the data of the State Customs Service of Ukraine.

In October, Ukrainian producers exported 7.09 thousand tons of ferroalloys, up 11.5% month-on-month and 20.7% less than in the previous month. Export volumes increased month-on-month for the first time after a three-month decline.

The main consumers of the products are Poland – 16.2 thousand tons over 10 months, and 2.05 thousand tons in October (-21.7% m/m), Turkey – 15.3 thousand tons (did not import in October), and Italy – 14.46 thousand tons and 2.4 thousand tons (-0.1% m/m), respectively.

Ferroalloy shipments have resumed since May this year after being almost completely halted in January-April due to the partial resumption of operations at Zaporizhzhia Ferroalloy Plant (ZFP). As previously reported, the plant is operating two furnaces, which is only 7% of its total capacity, and has no visible plans to increase its utilization. Since the end of June, the concentrator has also been operating at a minimum level. Pokrovsk Mining, Marhanets Mining, and Pobuzhsky Ferronickel Plant (PFP) are idle.

At the same time, Ukraine’s heavy industry is facing many challenges, including a decline in demand for products, problems with energy supply, a shortage of personnel due to mobilization, etc. The ferroalloys industry is particularly pressured by high electricity tariffs and energy shortages, as the production of ferroalloys is an energy-intensive process.

Revenue from ferroalloy exports in 10 months of 2024 decreased by 73% y/y – to $78.14 million, and in October it fell by 5.1% y/y and increased by 0.2% m/m – to $7.18 million.

As GMK Center reported earlier, in 2023, Ukraine’s production of ferroalloys decreased by 57.4% compared to 2022. Exports fell by 4.9% y/y – to 344.2 thousand tons. Compared to pre-war 2021, shipments of ferroalloys abroad decreased by 48.5%, or 324.4 thousand tons. Poland was the largest consumer of Ukrainian-made ferroalloys in 2023, accounting for 52.8% in monetary terms. Turkey accounted for 14.1% of export shipments and the Netherlands for 8.5%.

In 2024, according to Serhiy Kudryavtsev, Executive Director of the Ukrainian Ferroalloy Producers Association (UkrFA), the state of Ukraine’s ferroalloy industry will depend on three factors: shelling, logistics, and affordable electricity. In particular, in January-August, production decreased by 4.6 times y/y – to 41.05 thousand tons.