News Industry ferroalloys 1307 19 May 2025

The key export markets are Algeria, Poland and Turkey

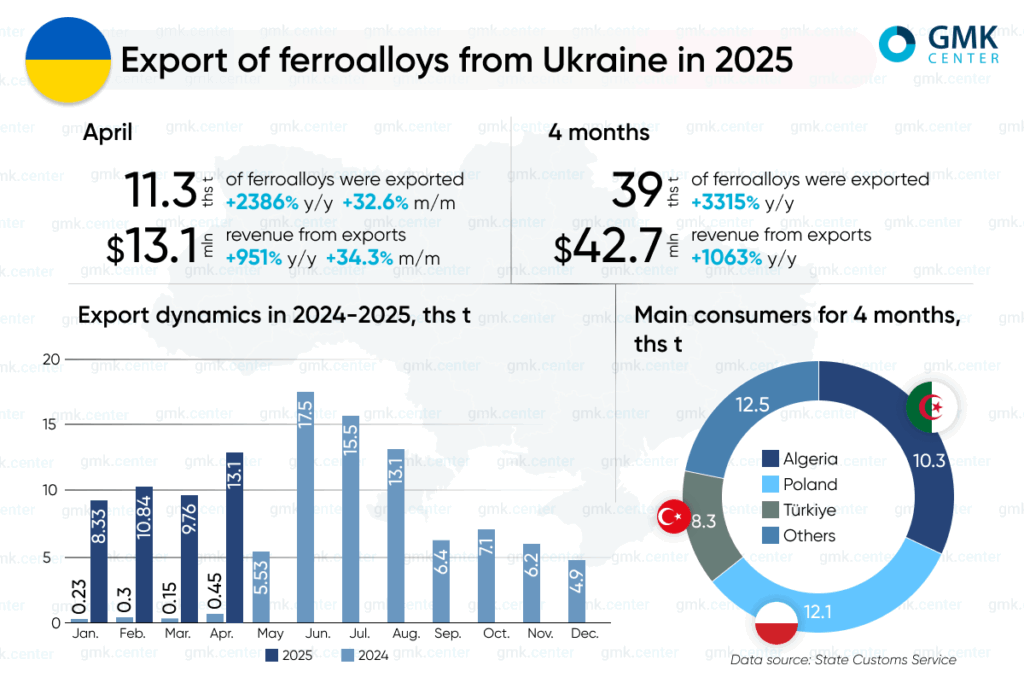

In January-April 2025, Ukrainian ferroalloy companies exported 38.96 thousand tons of products, compared to 1.14 thousand tons in the same period in 2024, when export shipments almost stopped due to the prolonged downtime of key enterprises in the industry. This is according to GMK Center’s calculations based on data from the State Customs Service.

The largest consumers of ferroalloy products during the period included: Algeria – 10.34 thousand tons, Poland – 12.14 thousand tons, Turkey – 8.27 thousand tons, and Italy – 3.93 thousand tons.

In April of this year, exports of ferroalloys from Ukraine increased by 32.6% compared to the previous month to 11.28 thousand tons, the maximum since August 2024, while in April last year these volumes did not exceed 0.5 thousand tons. Algeria and Italy did not import Ukrainian products during the month, while Poland decreased by 10.6% m/m to 3.65 thsd tonnes, and Turkey resumed imports to 6.76 thsd tonnes (0 thsd tonnes in March).

Export revenue in January-April 2025 increased to $42.66 mln compared to $3.67 mln a year earlier. In April, the figure increased by 34.3% month-on-month – to $13.12 million ($1.25 million in April 2024).

As a reminder, in 2024, Ukrainian ferroalloy plants reduced production by 49.4% y/y – to 108.2 thousand tons. The industry resumed operations in April-May after a forced shutdown in the fall of 2023.

Thus, exports of ferroalloys for the year decreased by 77.5% compared to 2023 – from 344.17 thousand tons to 77.32 thousand tons. In 2022, this figure was 349.56 thousand tons, and in 2021 – 668.54 thousand tons.

Last year, the key consumers of Ukrainian-made ferroalloy products were Poland – 20.94 thousand tons (189.34 thousand tons in 2023), Turkey – 45.69 thousand tons (45.69 thousand tons), and Italy – 16.96 thousand tons (18.74 thousand tons).

According to Sergiy Kudryavtsev, Executive Director of UkrFa Association, the key problem for the industry in 2025 is the high cost of electricity and the stability of its supply. Overall, the mood is largely negative with an element of uncertainty.