News Companies Thyssenkrupp 3175 15 February 2024

The German conglomerate depreciated the assets of its steel business for the second time in three months

German industrial conglomerate Thyssenkrupp has lowered its sales and net profit forecasts for the 2023/2024 financial year, in particular due to a drop in sales in the steel and commodities businesses. The company said in a statement.

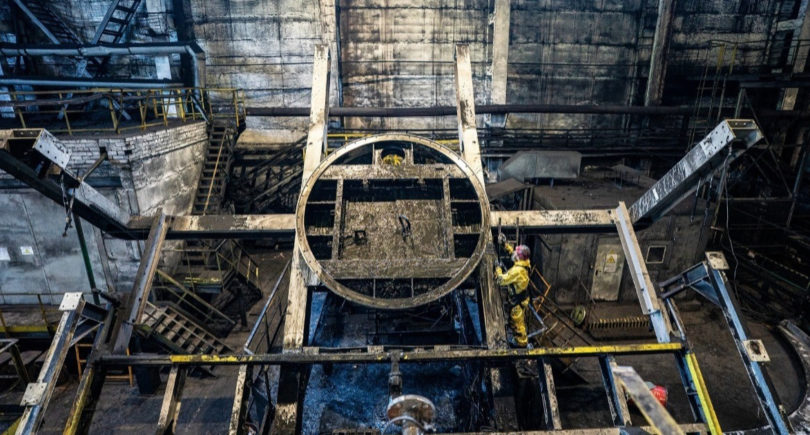

One of the reasons for the decline in the planned profit figure is losses from impairment of fixed assets. In the first quarter (October-December 2023), the group impaired its steel business by another €200 million, adding this amount to the €2.1 billion impairment of assets in November due to high gas and other raw material prices.

According to the company, in the first quarter of fiscal year 2023/2024, Thyssenkrupp’s operating performance was in line with expectations in a persistently challenging market environment. The total volume of orders received decreased to €8.0 billion compared to €9.2 billion in the same period last year, mainly due to lower prices and demand in the Materials Services and Steel Europe divisions.

Sales amounted to €8.2 billion (€9.0 billion in the first quarter of the previous fiscal year).

«In the face of continued weakness in the global economy and geopolitical conflicts, Thyssenkrupp delivered a relatively strong first quarter, in line with our expectations,» said CEO Miguel Lopez.

He added that the group will continue to move forward vigorously in its transformation process. This applies to both performance and portfolio indicators, as well as the restructuring that has been launched in preparation for the “green” transition.

As for the steel division, Thyssenkrupp noted that European steelmakers are being affected by a weak economy, steadily rising raw material prices, high energy prices and strong competition from non-European market participants.

In the first quarter of fiscal year 2023/2024, Steel Europe’s orders and sales amounted to €2.4 billion, compared to €3 billion in the same period last fiscal year (for both indicators). As noted, this was primarily due to a strong decline in prices. Order intake fell mainly due to lower demand from the automotive industry.

Thyssenkrupp expects sales in the 2023/2024 financial year to be at the level of the previous year (€37.5 billion), while a slight increase was previously forecast.

As GMK Center reported earlier, in FY2022/2023 (up to the end of September), Thyssenkrupp posted a net loss of €2 billion, which includes asset impairment losses, mainly in Steel Europe. In the previous fiscal year, the company’s net profit was €1.2 billion.