News Global Market iron ore prices 3928 07 February 2024

In December, raw material quotations probably reached peak values

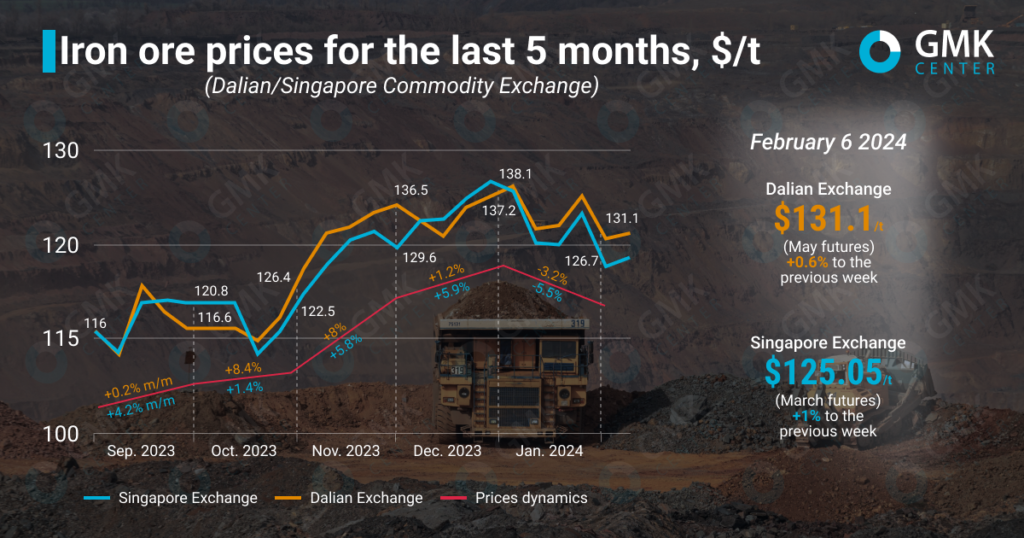

May futures for iron ore, the most traded on the Dalian Commodity Exchange, for the period January 30 – February 6, 2024, increased by 0.6% compared to the previous week – to 941 yuan/t ($131.07/t), according to Nasdaq.

On the Singapore Exchange, quotations of basic March futures as of February 6, 2024, increased by 1% compared to the price a week earlier – up to $125.05/t.

In January 2024, iron ore futures on the Dalian Commodity Exchange decreased by 3.2% compared to prices at the end of December, and on the Singapore Exchange by 5.5% – to $133.74/t and $129.7/t, respectively. Thus, the prices for raw materials decreased month-on-month for the first time in the last 4 months. This indicates that prices may reach a peak in December under current market conditions.

Market trends during January

Last month, iron ore prices were volatile, which is typical for this market due to its dependence on demand in China, the world’s largest consumer of iron ore. Initially, prices exceeded $140/t and RMB 1,000 in January, driven by improved market sentiment due to expectations of additional fiscal stimulus in China and forecasts of industrial production growth.

Additional support for China’s economy was demonstrated by the Central Bank of China’s provision of loans of 350 billion yuan ($49.1 billion) to banks under the program of additional lending, which are intended to support the weak real estate sector. In addition, Chinese President Xi Jinping announced his intention to strengthen the positive trends of economic recovery in 2024.

However, the upward trend did not last. Starting January 5, commodity prices began to fall due to lower demand and increased port stocks. In addition, high prices prompted some companies to adopt a wait-and-see strategy, limiting their purchases to urgent volumes of raw materials.

Nevertheless, the decline in prices was limited as steel companies needed to replenish stocks before the week-long break for the New Year holidays (January 21-27).

Despite market expectations, trading ahead of the Chinese holidays was weak and prices continued to fall. The lowest level of quotations during January 8-19, 2024 was $125.95/t (Dalian Exchange). Demand for steel products was weak, so steelmakers remained cautious in purchasing raw materials.

«Due to the constant drop in demand for construction steel, both steel traders and end-users of steel showed limited interest in replenishing steel product stocks, which hindered the enthusiasm of mills in purchasing raw materials,» commented Huatai Futures analysts.

Another negative factor for the market was the fact that the Central Bank left the medium-term discount rate unchanged. Increased macroeconomic uncertainty put additional pressure on iron ore prices and weakened the market.

As of the end of January, prices recovered to a 3-week high on hopes of improved demand amid government support for the real estate market and expectations of further stimulus. The government announced new plans to expand commercial real estate lending.

«Currently, all the announced incentives do not include direct financial injections into steel projects. Instead, the government uses indirect instruments that have little impact on the market. I don’t see any signals that could indicate a change in the situation in the future,» GMK Center analyst Andriy Glushchenko said.

Expectation

The price outlook for iron ore will continue to be determined by the state of the Chinese economy and steel market. In the short term, prices will remain volatile due to the market’s sharp reaction to any economic measures taken by the Chinese government. At the same time, steel demand and macroeconomic indicators are quite weak.

Iron ore prices are likely to rise slightly in the near term on the back of possible stimulus measures to boost the steel market and a reduction in port stocks due to a seasonal decline in production.