News Global Market iron ore prices 2049 28 June 2024

The negative dynamics are related to the weakening of the demand for steel and the increase in port stocks of ore in China

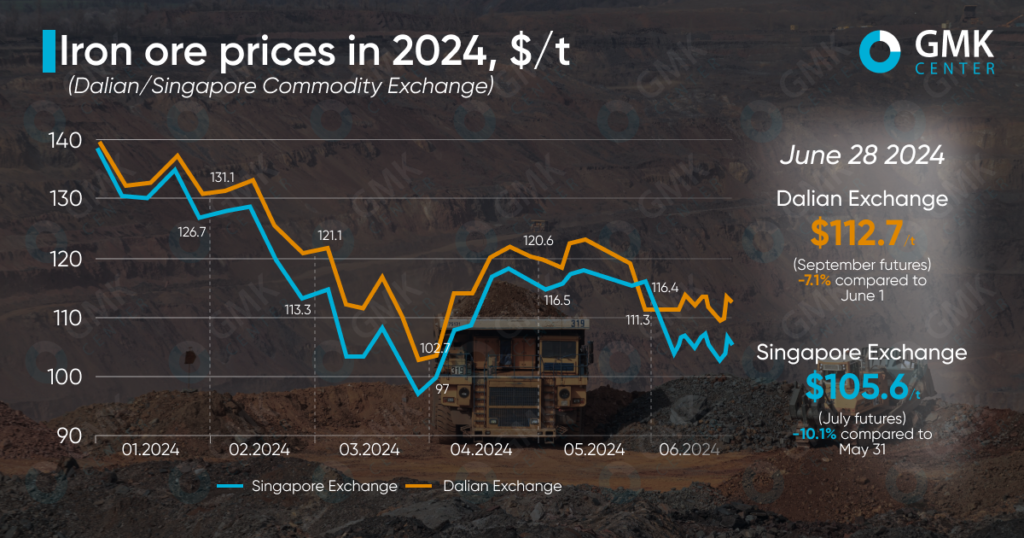

September futures for iron ore, the most traded on the Dalian Commodity Exchange, for the period June 1-28, 2024 decreased by 7.1% – to 819 yuan/t ($112.7/t), according to Hellenic Shipping News.

On the Singapore Exchange, quotations for benchmark July futures as of June 28, 2024, fell by 10.1% compared to the price on June 1 to $105.65/t.

In June, iron ore prices mostly declined, adjusting from the peaks reached in May amid increased activity of Chinese steelmakers. The lowest price level was recorded on June 25 at $109.5/t (Dalian Exchange) and $102.5/t (Singapore Exchange). Since then, prices have risen slightly.

Iron ore prices stagnated in the period under review amid weaker demand and deteriorating expectations of steelmakers. In May, consumers replenished their inventories and took a wait-and-see attitude to assess the outlook for the steel market.

At the same time, in early June, the Chinese government announced stimulus measures in the real estate market worth 1 trillion yuan ($138 billion). This gave a short-term positive boost, but prices soon continued to decline as this support does not have an immediate impact on steel consumption.

The greatest pressure on raw material prices is currently being exerted by a seasonal deterioration in steel demand due to unfavorable weather conditions for construction, with a simultaneous increase in port stocks. In addition, negotiations to introduce controls on steel production in China in 2024 are also increasing market concerns.

At the same time, the market was somewhat supported by the improvement in China’s economic performance – inflation remained stable in May, and the decline in industrial producer prices slowed. This partially offset the ongoing pressure from weakening demand, large port inventories, and a stronger US dollar.

«The market lacks clarity on plans to regulate steel production this year, but it has strong expectations of economic improvement in the second half of the year, which partly explains the resilience of iron ore prices,» Jinrui analysts said.

At the end of June, iron ore prices rose slightly, driven by some improvement in demand amid further stimulus for the real estate market. Investors and traders are awaiting the third plenary session of the Central Committee of the Chinese Communist Party to be held in July, which will focus on deepening reforms and promoting the modernization of the country’s economy.

In addition, traders welcomed the Hong Kong court’s decision to postpone the liquidation hearing of Chinese developer Shimao Group Holdings until July, giving it more time to refine its debt restructuring plan.

It should be noted that the British international commercial bank HSBC Holdings expects iron ore prices to reach $100 per tonne in 2024. The global market remains tense despite the real estate crisis in China, which worsens the outlook for steel demand in the country, the bank said.

«Currently, the most negative factor for the market is the oversupply of iron ore, which is not absorbed by existing demand in China. The arrival of new large shipments of ore to China may create short-term shocks to prices, but we do not expect any significant decline in the long term,» said GMK Center analyst Andriy Glushchenko.

Capital Economics predicts that ore prices will range between $99-100/t. In the second quarter and fourth quarter, prices will be at $100/t, and in the third quarter – $99/t. By the end of next year, prices for iron ore will fall to $85/t. The key reasons for the negative forecast include expectations of weak global steel demand.