News Global Market iron ore prices 1990 15 December 2023

Steel plants have slowed down purchases of raw materials amid negative expectations of economic stimulation in China

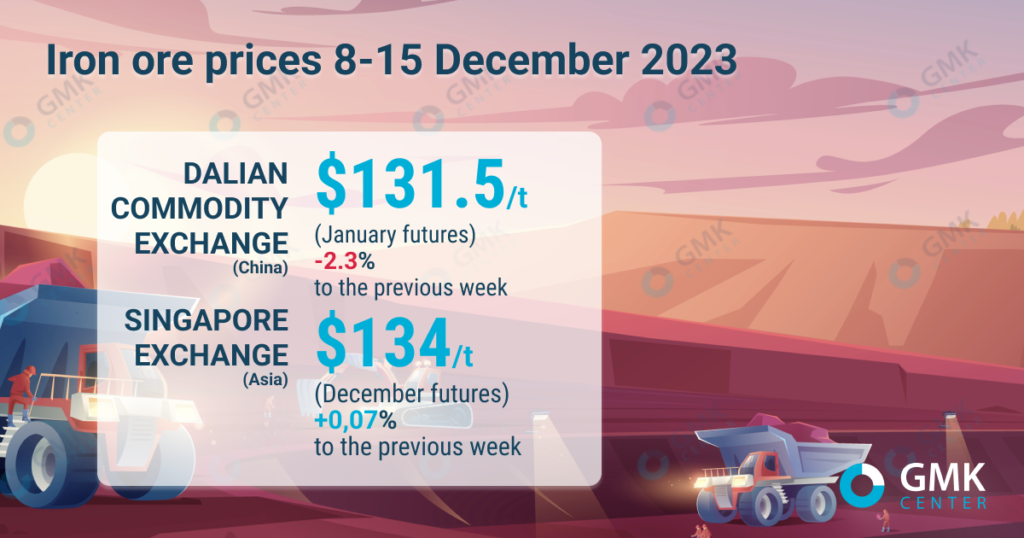

May iron ore futures, the most traded on the Dalian Commodity Exchange, decreased by 2.3% compared to the previous week – to 935 yuan/t ($131.51/t) for the period December 8-15, 2023. This is evidenced by Nasdaq data.

On the Singapore Exchange, quotes for January benchmark futures as of December 15, 2023, increased by 0.07% compared to the price a week earlier – to $134/t.

Iron ore futures started December with a decline after a long and significant rise in October-November. Market sentiment deteriorated amid softening demand and a forecast of a lack of strong economic stimulus from the authorities in 2024.

«It is normal to see a price correction to the downside, as the recent flurry of price growth was largely driven by strong expectations for macroeconomic stimulus,» said Chu Xinli, an analyst at China Futures.

Recently, Chinese leaders at their annual economic meeting approved a budget deficit of 3% of GDP in 2024. At the same time, the figure was expected to be 3.8%. This indicates that Beijing is not considering significant fiscal stimulus next year, which has dampened market participants’ confidence in improving trade.

In addition, the steady decline in demand for iron ore is also having a negative impact on pricing. According to Mysteel, average daily pig iron production at Chinese steel mills has been declining for 7 weeks in a row.

«Rising coke prices are putting pressure on the industry. This could lead to steel mills cutting production, which would have a negative impact on iron ore demand,” ANZ analysts said.

At the same time, last week, Beijing and Shanghai lowered the minimum deposit ratio for down payments for homebuyers, indicating renewed efforts by the Chinese authorities to restore the weak real estate market. This supported market sentiment and limited the fall in iron ore prices.

Iron ore prices are expected to remain at current levels in the short term amid still robust demand. Steelmakers will have to replenish inventories amid limited supply.

As GMK Center reported earlier, analysts predict that prices for seaborne iron ore may rise to $150 per tonne in the first half of 2024. Next year, prices will be supported by relatively limited supply and increased demand in China. In addition, demand for raw materials in India is expected to remain steady.