News Global Market scrap metal 3749 09 July 2024

A significant increase in prices is not expected

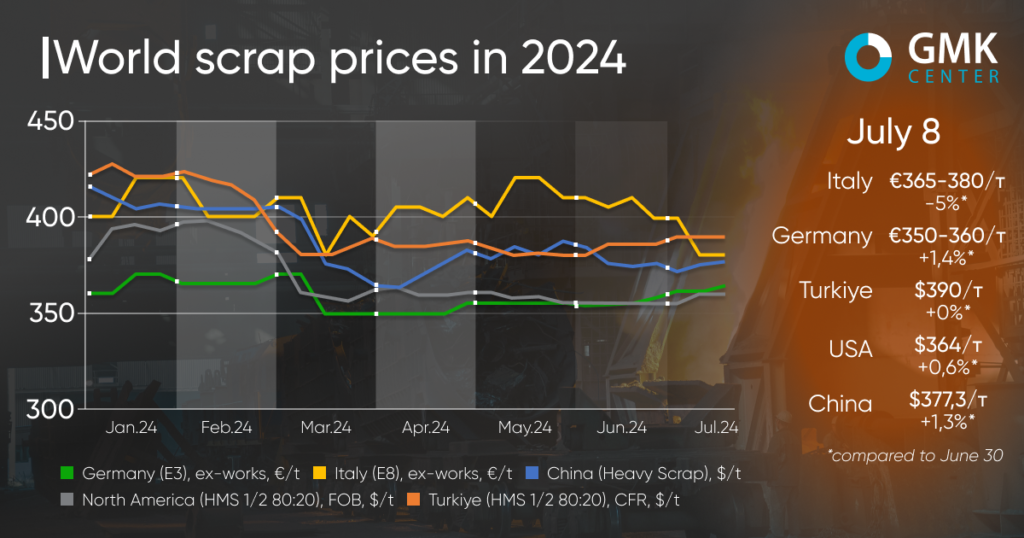

Scrap prices during the first week of July 2024 rose slightly in most regions or remained stable. Most market participants predict the immutability of prices in the short term, since there are no factors for the formation of a stable price trend.

Prices for HMS 1&2 80:20 scrap in Turkey, according to Kallanish, increased by 2.6% in June and stabilized at $390/t CFR in early July (as of July 8). There are slight fluctuations within $2/t, which is explained by the lack of demand from steelmakers. Steel producers have covered their immediate needs for raw materials for July and have taken a wait-and-see attitude, although August orders are almost non-existent.

Local steel mills are trying to put pressure on suppliers, citing the weak steel and scrap markets, but the latter emphasize that scrap prices are unlikely to fall in the near future as raw material collection is difficult. In addition, steel producers are facing high production costs, in particular due to high energy prices, and do not see positive prospects for the steel market in the current environment.

Turkey’s steelmakers are expected to enter the market soon to purchase August cargoes. Although the mills are trying to put pressure on prices, pent-up demand is likely to lead to prices stabilizing at $390/t or rising within $10/t.

In North America, prices for HMS 1/2 Scrap (80:20) scrap have risen by 0.6% to $364/t since the beginning of July. In June, raw material quotations on the market increased by 2.3%. At the same time, the current price level is the highest since early April.

Sentiment in the US scrap market remained weak in July. Despite differences in expectations, negative forecasts prevail, fueled by lower domestic steel prices and the cancellation of deliveries of previously ordered steel products.

Market participants expect prices for high-quality scrap to remain stable compared to June, while prices for lower-quality grades will fall within $20/t.

The European scrap market is showing a mixed trend. In Germany, prices for E3 scrap have risen by 1.4% since the beginning of July, while in Italy (E8) they have fallen by 5% to €360/t and €380/t Ex-Works.

Despite a slight increase in prices in Germany, the local market remains largely stable due to unchanged domestic and export demand.

«Trade volumes remain significantly low. In particular, the German automotive industry is consuming significantly less steel due to reduced production, which is reflected in a sharp decline in demand for scrap. However, several export orders from Turkey were concluded at slightly higher prices. This prompted some German steelmakers, who needed raw materials before the upcoming summer vacation, to return to the market,» a market participant said.

Most market participants do not expect any changes in scrap prices in Germany in the coming weeks, but if export demand continues to grow, some increase is possible.

In Italy, scrap prices fell mainly due to low sales of flat and long products. Steelmakers are putting pressure on raw material suppliers to restore some of their profits. At the same time, some of them are cutting back on steel production to balance supply and demand, indicating that this year’s August maintenance shutdowns could last at least three weeks. The third quarter is expected to be challenging for the scrap market due to a slowdown in end-user activity.

Prices for Chinese scrap have risen slightly since the beginning of July, by 1.3% – to $377.3 per tonne. At the same time, in June, the dynamics were negative, with prices falling by 3.1%. The current rise in prices is driven by a reduction in supply due to unfavorable weather conditions for the collection of raw materials and delivery to steel mills. This has led to some scrap shortages in some regions of the country. However, there are rumors in the market that steel mills in Jiangsu have received notices of power supply restrictions, which may reduce their production and demand for raw materials. This event is expected to restrain a possible price increase in the short term.