News Global Market scrap prices 2937 24 April 2025

All major markets are falling

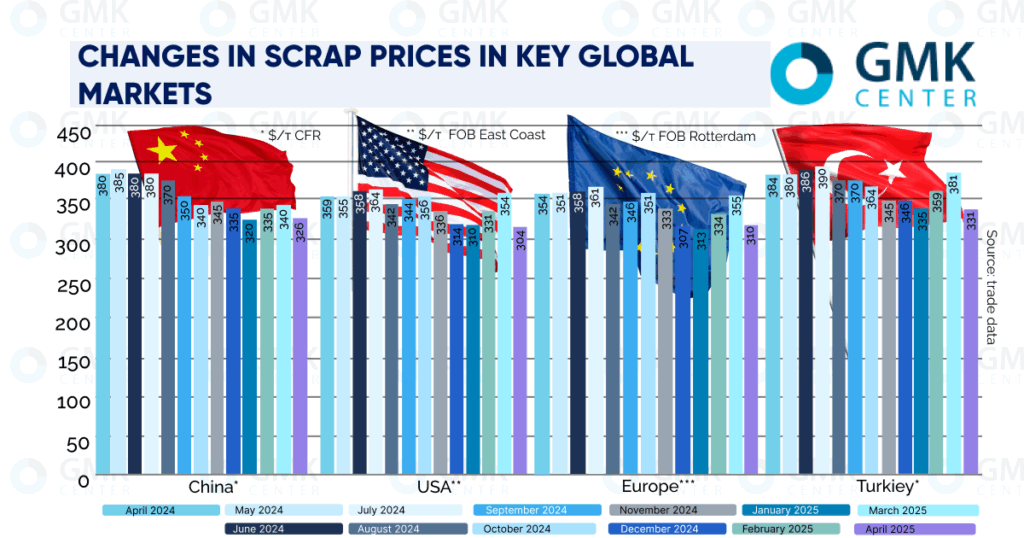

European quotations for HMS 1/2 (80:20) steel scrap fell by $45/t from April 1 to April 24, to $310/t FOB Rotterdam, according to Kallanish. Market participants attribute this to a 20% reduction in purchases by ArcelorMittal, the largest buyer in the Western European region.

According to traders, a number of Italian steel companies have also suspended purchases. First, their rebar sales in April were low. Secondly, factory warehouses are full to the brim with scrap. This allows producers to refuse new deliveries, demanding an average decrease in requests by $11/t.

US quotations for HMS 1/2 (80:20) scrap fell by $47/t in April to $304/t FOB East Coast as of April 24. Despite the high cost of finished steel in the US, electric mills expect concessions from scrap suppliers as iron ore prices fall.

Rebar producers prefer to buy billets from blast furnace and converter plants. Electricity generating plants have to look for ways to reduce the cost of scrap, the main raw material.

Bids for HMS 1/2 (80:20) scrap in China fell to $326/t CFR by April 18, down from $344/t at the beginning of the month. This is attributed to a decrease in purchases by electric power plants due to falling production volumes.

In mid-April, capacity utilization at 49 electric power plants in China fell to 50% compared to 66.9% at the beginning of the month. The absence of proposals to import scrap from Japan did not lead to an increase in prices on the Chinese market.

It is also worth noting that rebar production in China in January-March decreased by 2.9% y/y – to 48.107 million tons, according to the General Bureau of Statistics. This means a decrease in scrap purchases by producers.

The price of HMS 1/2 (80:20) scrap in Turkey fell by $49/t this month – to $331/t CFR. As in the US, amid falling iron ore prices, rebar mills prefer to use cheaper billets from third-party producers to produce rebar.

“The growth in scrap prices in the Turkish market has not been as steady as we expected. Trade wars have led to a drop in prices for Asian steel exports, which has resulted in export prices from Turkey losing competitiveness. In addition, cheap semi-finished products shifted the balance of demand for scrap in Turkey. Turkish steel companies are better than anyone else at driving down scrap prices by stopping purchases. Usually, such sharp drops in scrap prices lead to a drop in steel prices in Europe,” said Andriy Tarasenko, Chief Analyst at GMK Center.

As GMK Center reported earlier, in January-February 2025, Turkish steelmakers increased imports of steel billets by 52.4% y/y, up to 628 thousand tons. At the same time, supplies from Ukraine increased by 64.7% y/y – to 50.51 thousand tons. At the same time, imports of billets rose by only 36.6% to $325.4 million, reflecting the global drop in steel prices.