News Global Market iron ore prices 5199 14 March 2024

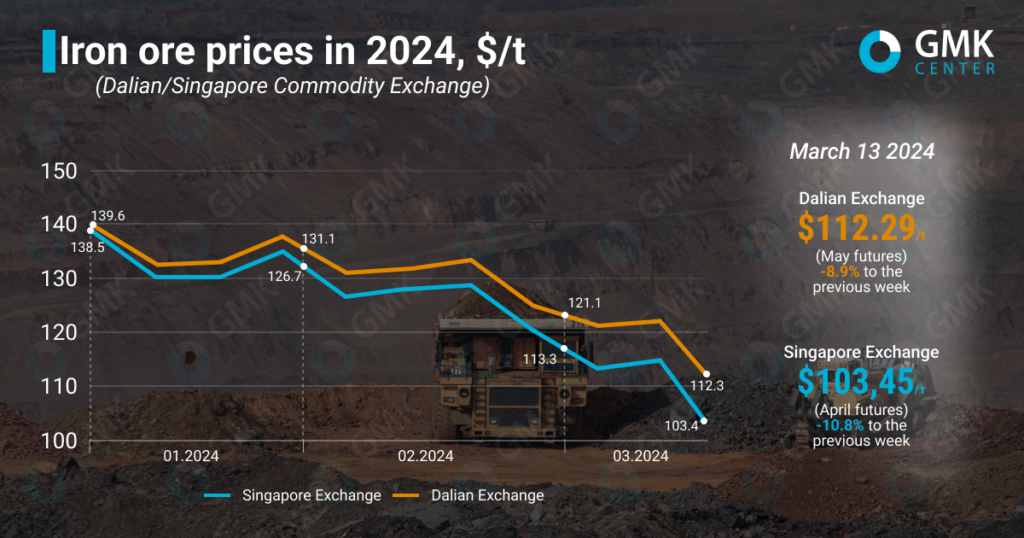

As of March 13, iron ore quotations on the Dalian Exchange amounted to $112.29/t, and on the Singapore Exchange – $103.45/t.

May futures for iron ore, the most traded on the Dalian Commodity Exchange, for the period March 6-13, 2024, fell by 8.9% compared to the previous week – to 807.5 yuan/t ($112.29/t), according to Nasdaq.

On the Singapore Exchange, quotations of basic April futures as of March 13, 2024, decreased by 10.8% compared to the price a week earlier – to $103.45/t. Thus, prices for raw materials fell to their lowest level since August 2023.

In February, iron ore prices fell by 10.6% on the Singapore Exchange and by 7.6% on the Dalian Exchange, and since the beginning of the year, the decline was -19.5% and -25.3%, respectively.

Iron ore prices experienced a significant decline in the second half of February. The negative trend was driven, in particular, by the long New Year’s holidays in China and unjustified expectations of a recovery in demand for raw materials after a week-long break. Steel companies restrained purchases amid lower steel and raw material prices.

The Chinese government is trying to support domestic steel consumption by stimulating the real estate market. In particular, at the end of February, the main five-year lending rate was cut by 25 bps to 3.95%. At the same time, one-year lending rates remained unchanged, which caused some concern among real estate market participants about the near-term outlook. In January alone, sales of new homes fell by 34% y/y.

Analysts at Commonwealth Bank of Australia believe that the continued negative state of the Chinese real estate sector, which accounts for 30-35% of steel demand in the country, will continue to put pressure on the steel and metallurgical raw materials market in 2024, albeit at a slower pace.

«In the near future, the growth of demand for iron ore will be relatively slow, and everything will depend on the profitability of steel production,» Sinosteel Futures analysts comment.

An additional blow to iron ore prices in late February was caused by an increase in raw material stocks in Chinese ports. They reached their highest levels since April 2023 as expected cyclones in Australia bypassed the iron ore states and Vale, the world’s second largest iron ore supplier, said the train incident would not affect the company’s supply and production.

«Global iron ore supplies are hovering near their highest level in three years. If high supply rates continue into a season of slower demand, ore prices are unlikely to find support,” Sinosteel Futures added.

In early March, iron ore prices continued to decline as the fundamentals of the steel industry were lower than expected. Doubts about the recovery in demand for raw materials in the near term, as well as in the medium and long term, have increased.

«Iron ore demand remains under pressure due to lower-than-expected pig iron production, and we do not see any strong drivers for a price recovery at this time,» First Futures analysts said.

The annual parliamentary meeting, the National People’s Congress, held on March 12, 2024, was hoped to support the iron ore market, but China’s key economic targets for the year did not meet expectations for significant support for steel consumption.

«The Chinese government is refraining from introducing fiscal stimulus that could directly increase steel demand, but at the cost of a higher budget deficit. The monetary policy is softer and is not able to remedy the situation in the short term,» said Andriy Glushchenko, GMK Center analyst.

In the short term, iron ore prices are expected to continue to decline due to low demand and large stocks of raw materials. In particular, some steel companies have announced their intention to postpone the restart of production after the holidays, and some of them plan to cut production in March or start maintenance to reduce losses. In addition, Tangshan announced restrictions on steel production amid severe air pollution. These factors are likely to push iron ore prices down to $100/t in the coming weeks.