News Global Market Fitch 3419 19 June 2024

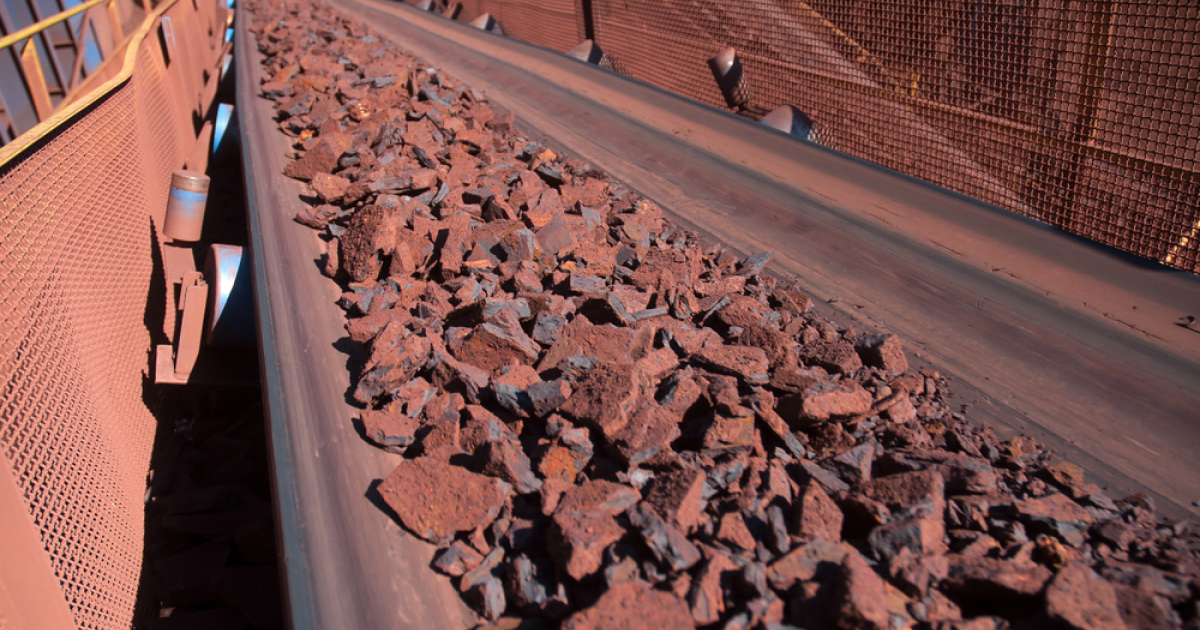

As in the March forecast, the price is expected to be $105/t this year

International rating agency Fitch Ratings has left unchanged its forecast for iron ore and coking coal prices for 2024-2026 compared to its March review. This is stated in the agency’s report.

As before, the price for these raw materials is expected to reach $105/t in 2024, $90/t – in 2025, and $85/t – in 2026.

As for coking coal, Fitch expects its price to reach $240/t in 2024, $190/t – in 2025, and $170/t – in 2026.

At the same time, the agency raised its price forecast for Australian thermal coal for 2024-2027, in particular, from $100 to $115/t this year. These expectations reflect higher temperatures in many Asian countries, which leads to an increase in energy demand, increasing the demand for coal in countries with a significant amount of coal-fired generation. At the same time, the supply of Australian coal is likely to be limited as diversified miners reduce their focus on this product.

Fitch Ratings has also expanded its set of global metal price and production assumptions to include platinum group metals (PGMs), lithium and cobalt.

As a reminder, HSBC Holdings, a British international commercial bank, expects iron ore prices to reach $100 per tonne in 2024. The global market remains tense despite the real estate crisis in China, which worsens the outlook for steel demand in the country, the bank said.

Capital Economics predicts that ore prices will range from $99-100/t. In the second quarter and fourth quarter, prices will be at $100/t, and in the third quarter – $99/t. By the end of next year, prices for iron ore will fall to $85/t. The key reasons for the negative forecast include expectations of weak global steel demand.