News Industry scrap metal 1510 11 April 2025

About 90% of raw materials are sent to Poland

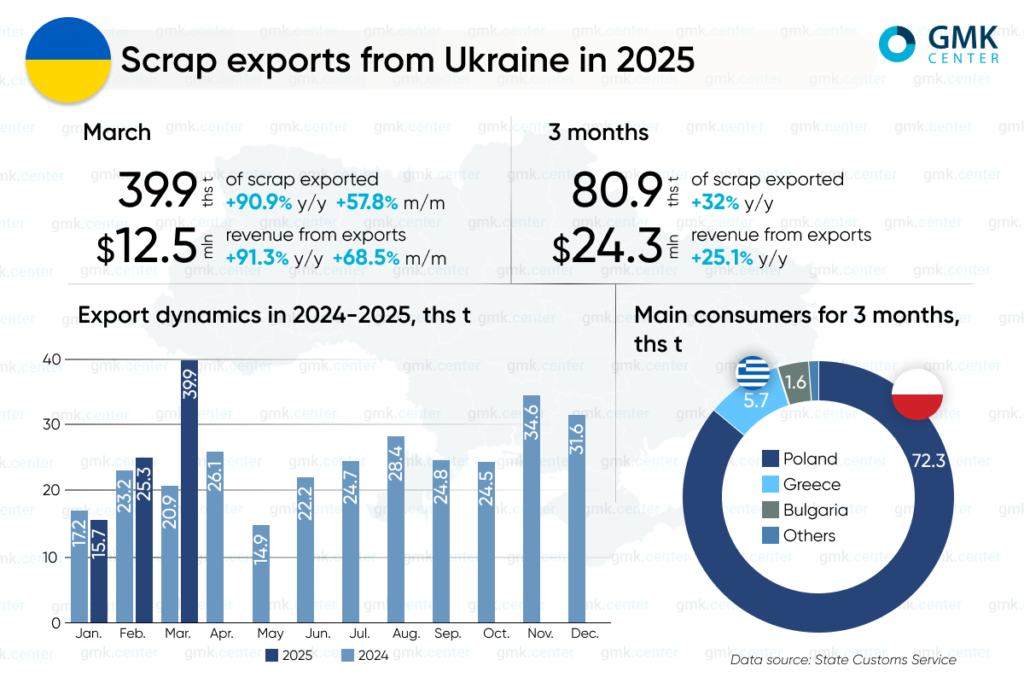

In January-March 2025, Ukraine’s scrap industry increased exports of ferrous scrap by 32% compared to the same period in 2024, to 80.9 ths tons. The figure decreased by 10.9% quarter-on-quarter. This is based on GMK Center’s calculations based on data from the State Customs Service.

Poland remains the key export destination for raw materials. The Polish market was supplied with 72.34 ths tons of scrap, which is 89.4% of the total supply. A small part was exported to Greece – 5.73 ths tons, Bulgaria – 1.57 ths tons, and Germany – 1.14 ths tons.

In March of this year, scrap exports from Ukraine reached a maximum since 2021 – 39.91 ths tons, which is 57.8% more than in the previous month and 90.9% more than in the previous year. In February, 33.49 thsd tonnes of raw materials were shipped to the Polish market (+43.2% m/m), and 5.73 thsd tonnes to the Greek market (no exports took place in January-February). Germany received 0.6 kt of raw materials (+89.6% m/m).

Revenues from scrap exports in March increased by 68.5% month-on-month and 91.3% y/y – to $12.49 million. In the first quarter, the figure increased by 25.1% y/y – to $24.3 million.

In 2024, Ukraine’s scrap exports increased by 60% compared to 2023, to 293.2 ths tons. In 2023, shipments of raw materials abroad exceeded 182.5 ths tons, up 3.4 times year-on-year, while in 2022 the figure was 54.1 ths tons. The key consumers of raw materials last year were Poland (248.6 ths tons), Greece (34.2 ths tons), and Germany (6.5 ths tons).

As previously Oleksandr Kalenkov, President of Ukrmetprom, noted, the Ministry of Economy of Ukraine is considering introducing a zero export quota for scrap metal by the end of 2025. The decision is expected to be made in the near future.