News Industry collection of scrap 1028 19 August 2024

Monthly export volumes are approaching pre-war levels

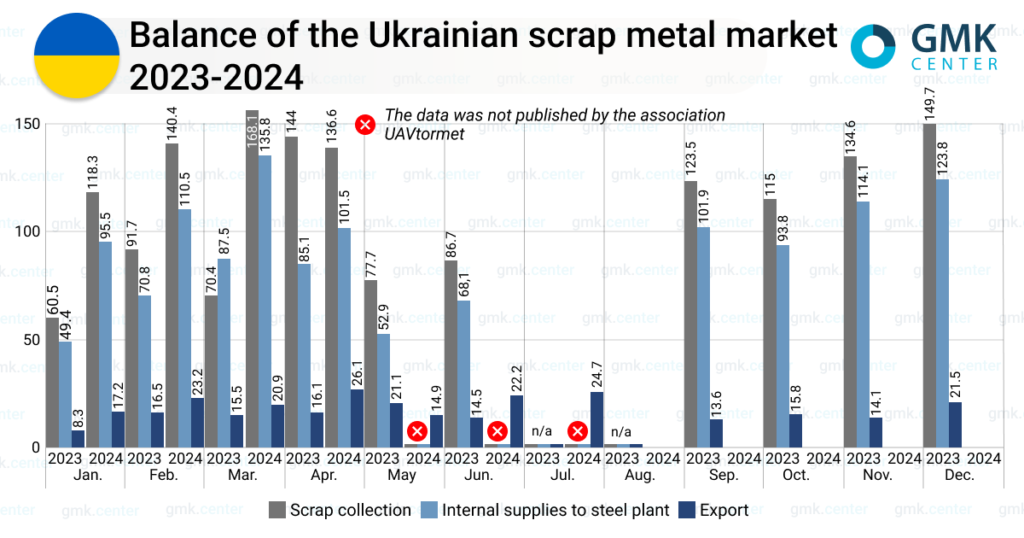

In January-July 2024, Ukraine’s scrap industry increased exports of ferrous scrap by 46.9% compared to the same period in 2023, to 149.23 thousand tons. This is evidenced by the data of the State Customs Service.

The bulk of exports went to Poland – 127.31 thousand tons. 16.9 thousand tons of scrap were exported to Greece, and 4.76 thousand tons – to Germany. The average monthly export volume in January-July amounted to 21.32 thousand tons, up from 14.52 thousand tons a year earlier.

In July, Ukraine exported 24.7 thousand tons of scrap, up 11.5% month-on-month and 158.2% compared to July 2023. Revenues from scrap exports increased by 60.4% y/y over 7 months – to $47.8 million, and by 16.7% m/m and 215.6% y/y in July – to $8.04 million.

Ukrainian scrap companies export about 15% of their scrap, and the volumes consistently exceed 20 thousand tons per month, approaching pre-war levels.

The increase in shipments is taking place amidst the difficulties in collecting scrap due to the hostilities, as most scrap companies were located in the temporarily occupied territories or in the war zone before the full-scale war.

An additional factor putting pressure on the scrap market is the lack of sales of scrap by one of its main suppliers, Ukrainian Railways (UZ). The railroad operator stopped selling scrap in September 2023, which had an extremely negative impact on the market and the entire Ukrainian steel industry.

This situation with scrap exports and the lack of volumes from Ukrainian Railways pose risks to the operations of domestic steelmakers, as the partial unblocking of sea exports helps to increase the utilization of the plants’ capacities. The improved prospects for the industry are also evidenced by the steel production data for January-July, which increased by 33.6% y/y – to 4.58 million tons.

Earlier, Oleksandr Kalenkov, president of Ukrmetalurgprom, stated that scrap is exported through the European Union, which has a preferential export duty of €3 per ton, and from there the raw materials are redirected to real consumers in Turkey. He noted that exporting raw materials directly to Turkey would cost €180 in export duties, and the Ukrainian budget has already lost UAH 350 million.

The head of the association called for a temporary ban on the export of ferrous scrap to provide steel companies with strategically important raw materials in the context of the ongoing war. He also clarified that a ton of scrap processed into steel contributes 10 times more to the budget than the export duty on scrap sales to the EU, which is about $300 per ton.

As GMK Center reported earlier, in 2023, the volume of ferrous scrap collection in Ukraine increased by 28.1% to 1.27 million tons compared to 2022. Over the same period, scrap supplies to steelmakers amounted to 1.034 million tons (+15.4% y/y). Exports increased by 3.4 times compared to 2022 to 182.48 thousand tons.