News Global Market EU 1422 23 October 2023

The main share of imports is semi-finished products – 71.2% of the total volume of supplies

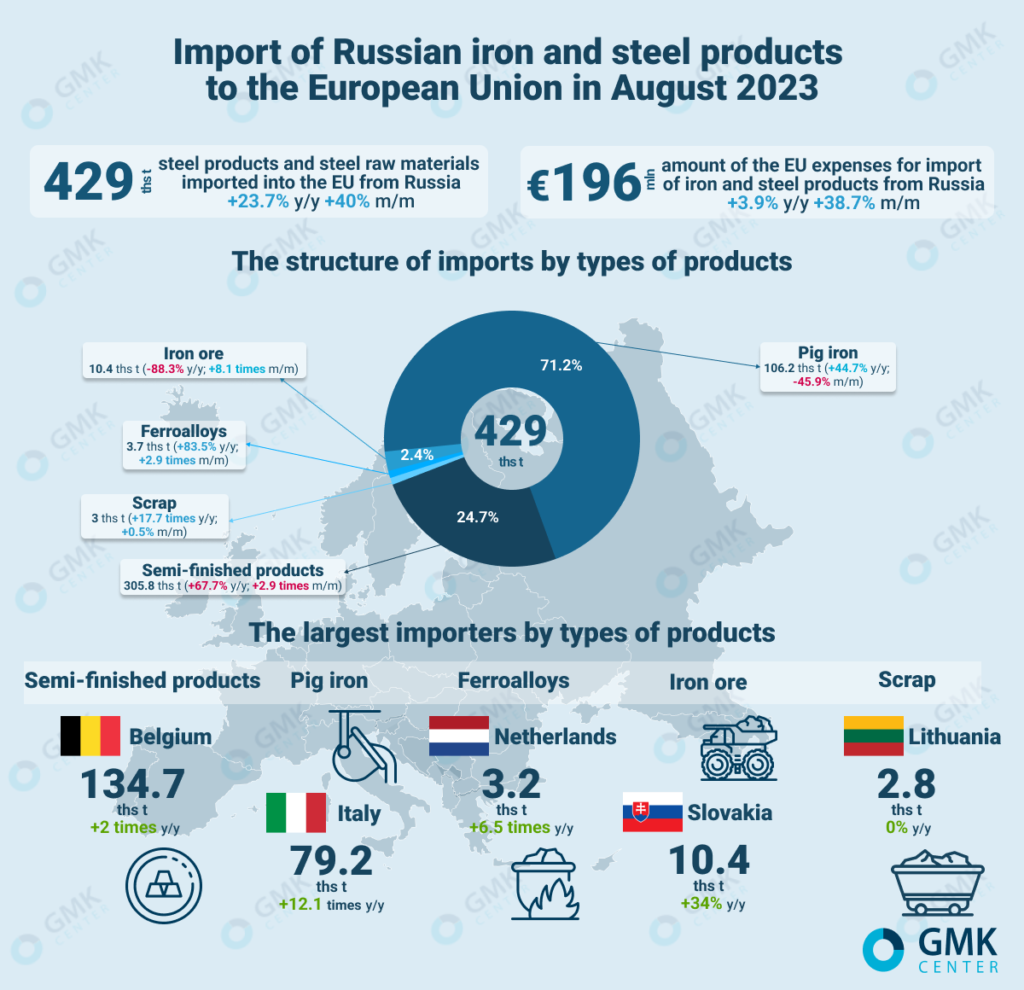

In August 2023, the European Union increased the import of products of the iron and steel complex from Russia by 40% compared to the previous month – to 429.2 thousand tons. Compared to August 2022, the EU reduced the import of such products by 23.7%. This is evidenced by Eurostat’s data.

Spending on the import of Russian products by European consumers in August amounted to €195.7 million, which is 38.7% more compared to July 2023 and 3.9% more by July 2022.

The main share of imports is semi-finished products – 71.2% of the total volume of supplies. Deliveries of such products from the Russian Federation to the European Union in August increased by 2.9 times m/m and by 67.7% y/y – up to 305.8 thousand tons. Most of the Russian-made semi-finished products are sent to Belgium – 134.7 thousand tons.

Deliveries of iron ore from the Russian Federation to the EU in August increased by 8.1 times m/m and decreased by 88.3% y/y – to 10.4 thousand tons. The import of pig iron amounted to 106.2 thousand tons, which is 45.9% less month-on-month and 44.7% more y/y, ferroalloys – 3.75 thousand tons (+2.9 times m/m; 83.5% y/y), scrap – 2.99 thousand tons t (+0.5% m/m).

Among the main consumers of this Russian production of MMC in August were:

- iron ore – Slovakia – 10.4 thousand tons (+34% y/y);

- pig iron – Italy – 79.25 thousand tons (+12.1% y/y);

- ferroalloys – the Netherlands – 3.2 thousand tons (+6.5 times y/y);

- semi-finished products – Belgium – 134.7 thousand tons (+2 times y/y);

- scrap – Lithuania – 2.8 thousand tons (not imported in August 2022).

In January-August 2023, the European Union reduced the import of steel raw materials from Russia by 41.1% compared to the same period in 2022 – to 3.65 million tons. Import costs decreased by 40.4% y/y – to €1.85 billion.

The import of semi-finished products decreased by 24.7% y/y – to 2.22 million tons, iron ore – by 85.5% y/y, to 321.5 thousand tons, ferroalloys – by 76.5% y/y, to 27.9 thousand tons , and scrap – by 69.2% y/y, to 23.43 thousand tons. The consumption of Russian pig iron increased by 27% y/y, to 1.06 million tons.

Despite the sanctions introduced against Russia, the iron and steel complex of the Russian Federation continues to receive significant profits from the export of products to the European Union. Although the indicators have significantly decreased compared to 2022, in particular last year exports amounted to 7.92 million tons for €3.87 billion, deliveries still remain at a high level.

As GMK Center reported earlier, despite the sanctions, Russia still has loopholes that allow it to export steel to EU countries. CEO of the Metinvest group Yuri Ryzhenkov emphasized it in an interview with the Italian publication Corriere della Sera. On the one hand, the Russian steel industry found itself in a difficult situation in terms of market share. In October 2022, the EU introduced the eighth package of sanctions against Russia, including a ban on the supply of steel products to the EU. However, it provides for a two-year deferment for Russian manufacturers regarding the supply of semi-finished products to the EU.

Recently, within of the 11th package of sanctions against Russian Federation, the EU tightened restrictions on the import of steel goods to the bloc. The new requirements will come into effect on September 30, 2023.