News Global Market gas prices 2670 14 March 2025

The driver was the statement by the German Ministry of Economy

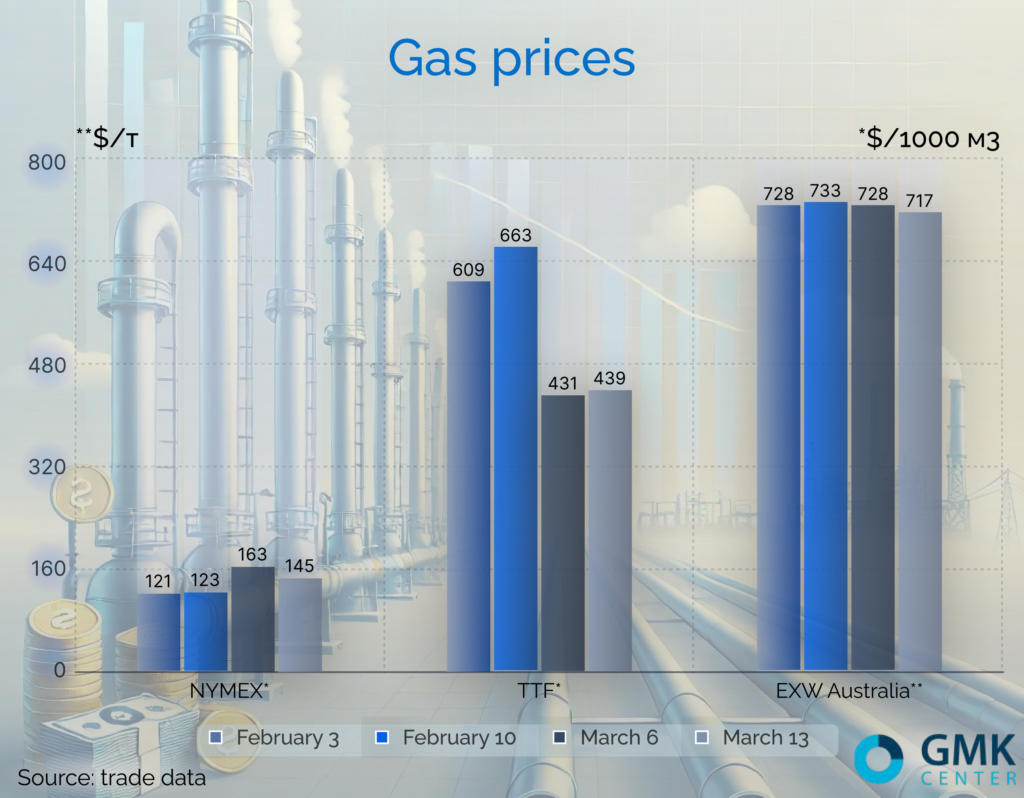

The spot price of natural gas in the EU fell from $506 to $477/1000 m3 in the first half of March, according to trading data from the Dutch TTF exchange. The decline began after reaching the current annual maximum of $665/1000 m3 on February 10. The price was decreasing against the background of stable demand in industry and the approaching end of the heating season.

The rebound occurred after the statement by the German Ministry of Economy about the refusal to negotiate with Russia regarding the resumption of supplies via the partially damaged Nord Stream gas pipeline. The same statement, dated March 4, became the driver for the price of natural gas on the American market.

The price of the resource on the New York Mercantile Exchange in the first half of March increased from $109/1000 m3 to $147/1000 m3. According to overseas traders, the final refusal of Germany, the main European consumer of gas, from Russian supplies means the continuation of large volumes of imports from the United States.

The absence of Russian gas supplies to the EU will create additional pressure on the Asian LNG market, said Scott Darling, Managing Director of Haitong International Securities, in a commentary to Bloomberg. High prices on the European market will encourage Australian and Middle Eastern producers to send their volumes there.

In Australia, domestic LNG prices in the first half of March fell from $737/t to $718/t. According to the forecast of the Rystad Energy agency, Australia will be forced to abandon LNG exports as early as 2027 amid the depletion of existing offshore fields.

The resumption of growth in gas prices in the EU in the first half of March was caused by a situational non-market factor. The approaching end of the heating season will restrain further price increases.

The main industrial consumers of gas, metallurgy and the chemical industry, will be able to offset the negative effect due to the seasonal expansion of production caused by increased demand for construction rolled products and mineral fertilizers.

Earlier, the executive director of the Association of Gas Producers of Ukraine A. Petrenko expressed the opinion that the high cost of gas in Europe will affect the domestic market, primarily industry – taking into account Ukraine’s need for gas imports.