News Global Market EU 3025 04 October 2024

The main share of imports is iron ore – 44.1 million tons

In January-July 2024, the European Union increased imports of mining and metals products from third countries by 1.8% compared to the same period in 2023, up to 76.1 million tons. This is according to GMK Center’s calculations based on Eurostat data.

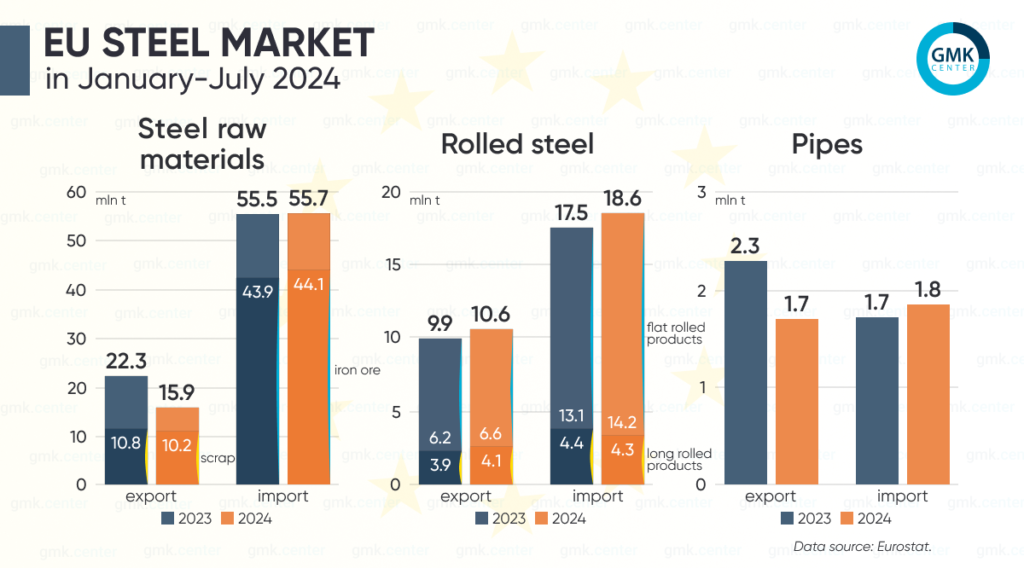

Metallurgical raw materials accounted for the bulk of imports – 55.67 million tons (+0.3% y/y). In particular, over 7 months, the EU imported 44.06 million tons of iron ore (+0.3% y/y), 4.32 million tons of semi-finished products (+4.8%), 2.86 million tons of scrap (+16.9% y/y), 1.69 million tons of direct reduced iron (+2.1% y/y), 1.34 million tons of ferroalloys (-17.8%), and 1.39 million tons of pig iron (-18.4% y/y). The increase in demand for steel raw materials corresponds to the growth of steel production in the bloc countries – by 1.5% y/y in January-July, to 78 million tons.

Imports of rolled steel products to the European market in January-July 2024 reached 18.58 million tons, up 6% compared to the same period in 2023. In particular, shipments of flat products increased by 8.8% y/y – to 14.25 million tons, while long products decreased by 2.1% y/y – to 4.32 million tons. The main volumes were accounted for by flat hot-rolled steel products – 7.36 million tons (+4.5% y/y), and coated flat products – 4.1 million tons (+21.4%).

Import trends of finished products indicate an improvement in demand for flat products, the main consumers of which are the automotive, machine-building and household goods sectors. At the same time, the decline in imports of long products indicates the weakness of the construction industry.

Imports of pipes to the EU increased by 7.3% over 7 months compared to January-July 2023, to 1.85 million tons.

Exports of EU iron and steel products to third countries amounted to 28.21 million tons in the period, down 18.5% compared to the same period in 2023.

Shipments of steel raw materials decreased by 29% y/y – to 15.86 million tons, mainly due to a deep drop in iron ore exports – by 55.5% y/y – to 4.79 million tons. This is explained by the increased demand for raw materials within the block amid higher utilization of steel mills. Exports of pig iron amounted to 49.12 thousand tons (-32.4% y/y), ferroalloys – 223.82 thousand tons (+51.8%), scrap – 10.21 million tons (-5%), and semi-finished products – 583.68 thousand tons (+8.6%).

Exports of rolled steel products in January-August 2024 increased by 6.7% y/y – to 10.65 million tons. In particular, exports of long products increased by 5.2% y/y – to 4.06 million tons, and flat products – by 7.6% y/y, to 6.59 million tons. Among the key export items:

- flat rolled products from other alloy steels – 1.98 million tons (+17.4% y/y);

- coated flat rolled steel – 1.73 million tons (+12.3%);

- hot-rolled flat rolled steel – 1.48 million tons (-7.7%);

- corners, shaped and special profiles – 1.29 million tons (+3.9%).

Exports of pipes decreased by 26% compared to January-July 2023 – to 1.7 million tons.

As GMK Center reported earlier, in January-July 2024, the EU imported 10.21 million tons of iron and steel products from Ukraine, up 4% compared to the same period in 2023. Steel raw materials accounted for the bulk of imports – 9.37 million tons, up 2.9% y/y. Imports of rolled products increased by 18.5% y/y – to 740.59 thousand tons, and pipes by 11.1% y/y – to 104.31 thousand tons.

Supplies of steel raw materials from the Russian Federation amounted to 4.09 million tons during this period. The bulk of the supplies were pig iron – 965.38 thousand tons, direct reduced iron – 887.65 thousand tons, and semi-finished products – 1.91 million tons.