News Global Market EU 864 25 October 2023

The main volume of products was shipped from Russia and Libya – 875.9 thousand tons and 313.8 thousand tons, respectively

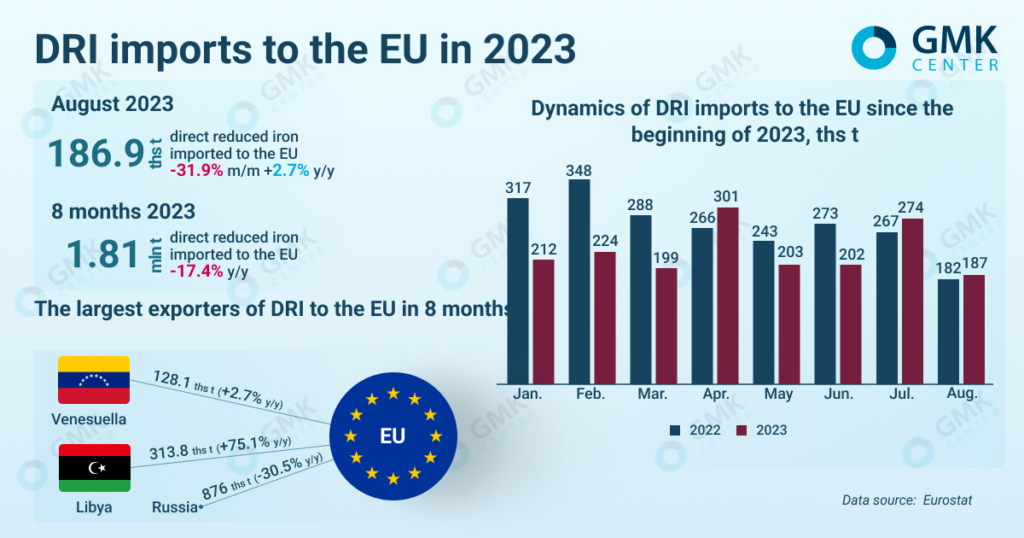

In January-August 2023, the European Union reduced the import of direct reduction iron (DRI) by 17.4% compared to the same period in 2022 – to 1.803 million tons. This is evidenced by Eurostat’s data.

In August 2023, the volume of DRI supplies to European consumers decreased by 31.9% compared to July 2023, and increased by 2.7% until August 2022 – up to 186.91 thousand tons. August import volumes are the lowest since the beginning year.

Italy, Germany, Belgium, Spain and Austria are the main importers of direct reduction iron among the EU countries in January-August, in particular:

- Italy – 609.8 thousand tons (-21.7% y/y);

- Germany – 435.3 thousand tons (-11.6% y/y);

- Belgium – 258.2 thousand tons (+16.5% y/y);

- Spain – 161 thousand tons (-13.6% y/y);

- Austria – 122.7 thousand tons (-12% y/y).

The largest supplier of DRI to the European Union is Russia. In January-August 2023, Russian enterprises shipped 875.9 thousand tons of DRI to European consumers, which is 30.5% less compared to the same period in 2022. In August, the EU imported 63.9 thousand tons of relevant products from the Russian Federation (-51.1% y/y).

The main importer of Russian products is Italy – 496.1 thousand tons, which is 26.1% less y/y. Belgium is in the second place with 205.6 thousand tons (-7.2% y/y).

Libya shipped 313.85 thousand tons of DRI to the EU in January-August, increasing the figure by 75.1% y/y. In August, European steelmakers imported 26.05 thousand tons of direct reduction iron (+146.8% y/y) from Libya. The import of DRI from Venezuela for 8 months amounted to 128.1 thousand tons (+2.7% y/y), and in August – 34.6 thousand tons (the product was not imported in August 2022).

As GMK Center reported earlier, the European Union in January-August 2023 reduced imports of steel raw materials from the Russian Federation by 41.1% compared to the same period in 2022 – to 3.65 million tons. Import costs decreased by 40.4% y/y – to €1.85 billion.