News Global Market electricity prices 911 08 September 2023

In the EU, there is an ongoing discussion regarding the curtailment of energy support measures by national governments

In the EU, the average monthly wholesale prices for the day ahead in August increased substantially compared to the previous month. The exception was Italy, where they actually remained at the level of July.

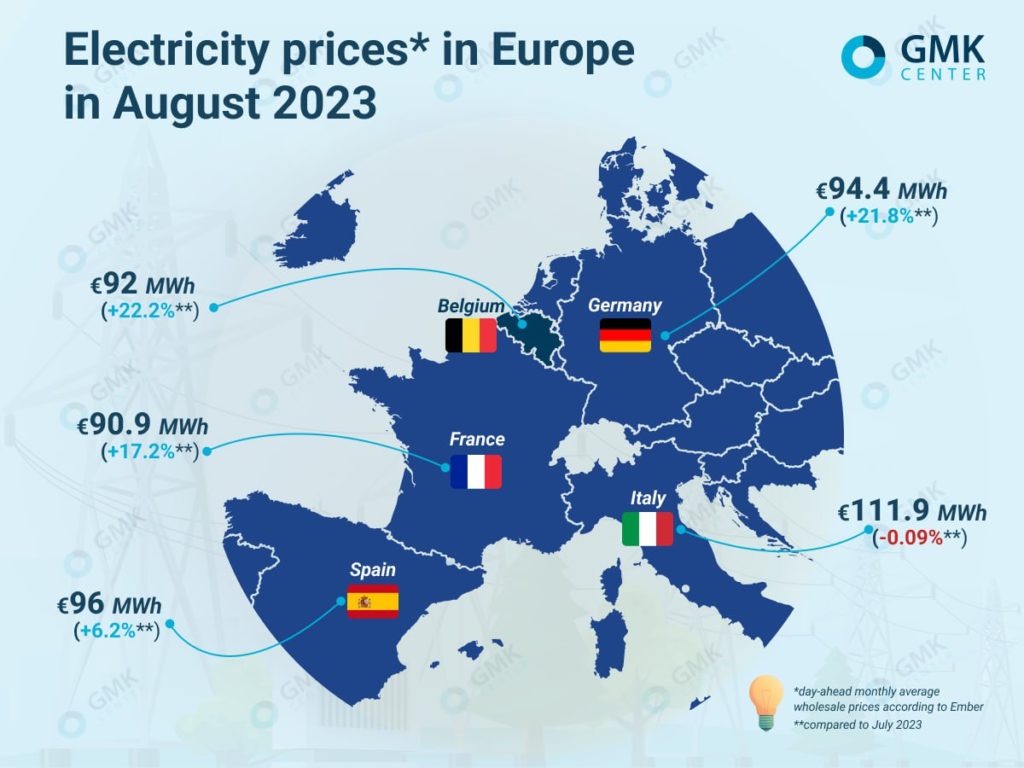

According to Ember, prices were as follows:

- Italy – €111.97/MWh (-0.09% m/m);

- France – €90.9/MWh (+17.2%);

- Germany – €94.4/MWh (+21.8%);

- Spain – €96.09/MWh (+6.2%);

- Belgium – €92.05/MWh (+22.2%).

Electricity prices in August, GMK Center

In Great Britain, according to Nordpool, the average monthly day-ahead spot price in August 2023 was €95.7/MWh, which is 16.6% more compared to the previous month.

In August, the trend in the European electricity markets was heterogeneous. In the first week of the month, according to AleaSoft Energy Forecasting, its prices in Europe decreased compared to the last week of July – this was due to the drop in the cost of CO2 and gas prices, a general increase in wind energy production and a decrease in daily temperatures.

On August 21-27, high prices of the level of late 2022-early 2023 returned to European markets (average weekly indicators exceeded €110/MWh in almost all countries) due to low volumes of renewable energy production and increased demand. In the last week of the month, the cost of electricity fell due to an increase in wind generation combined with a decrease in electricity demand and average temperatures.

EU measures

In the EU, there is a discussion on the curtailment of energy support measures by the end of the current year – the European Commission (EC) called for this in May. At the end of July, according to Politico, the EC sent out a survey to national governments about this. However, France and Germany are reluctant to completely eliminate subsidies for fear that their industries will lose competitiveness and investors will see incentives to focus on projects in the US and China.

As the publication notes, further subsidies for industry were still being discussed in Germany at the end of August. Berlin is expected to try to negotiate with Brussels to extend these payments. The €200 billion support scheme introduced by the country in 2022 will operate until April 2024. However, a new hot topic for the coalition is the guaranteed price for electricity for industry, proposed by the Minister of Economy Robert Habek.

At the same time, the prime ministers of 16 German federal states called on the EU in early September to enable subsidizing electricity prices to support industry, reported Handelsblatt. In a joint Brussels Land Declaration, they are asking the EC to allow national governments to introduce the so-called transition price for the industrial sector, which is currently being discussed in the country.

Meanwhile, the Polish government approved in August 2023 support package of energy-intensive industries, in particular steel industry. It is planned to allocate PLN 5.5 billion (€1.23 billion) for these purposes in 2023-2024. The funds are intended to mitigate high gas and electricity prices and will help companies maintain liquidity, profitability, jobs and production capacity. The Polish authorities recalled that a similar program had already been implemented in the country in connection with the costs incurred by enterprises in 2022.

Gas

The EU achieved its goal of filling gas storage facilities by 90% by the November 1 deadline, already in mid-August. According to Montel, this meant that the block will enter the winter heating period with full storage of about 100 billion cubic meters of gas – these volumes are able to cover approximately 30% of the expected annual demand for it.

According to the head of the General Directorate for Energy of the European Commission Ditte Juul Jorgensen, this is a much better position than in 2022, when at the beginning of winter the storages were filled on average by only 40%, and the capacities belonging to Russia’s Gazprom – by 15%, that is, they were considered technically empty.

As Jorgensen noted, the EU is still experiencing an energy crisis, despite being better prepared than at the same time last year – prices and global markets are still volatile. The EU is also on track to phase out dependence on Russian pipeline gas by 2027 as planned, replacing it with LNG, diversifying supply and reducing demand.

As GMK Center reported earlier, electricity prices in Europe in July fell thanks to renewable energy. The exception was Italy, where the share of more expensive sources in the generation mix increased.