News electricity prices 4493 09 November 2022

The cost of electricity is still higher than at the beginning of the year

Wholesale electricity prices in Europe at the end of October 2022 fell by about half compared to September 2022, but for now there is no sign that the energy crisis has subsided.

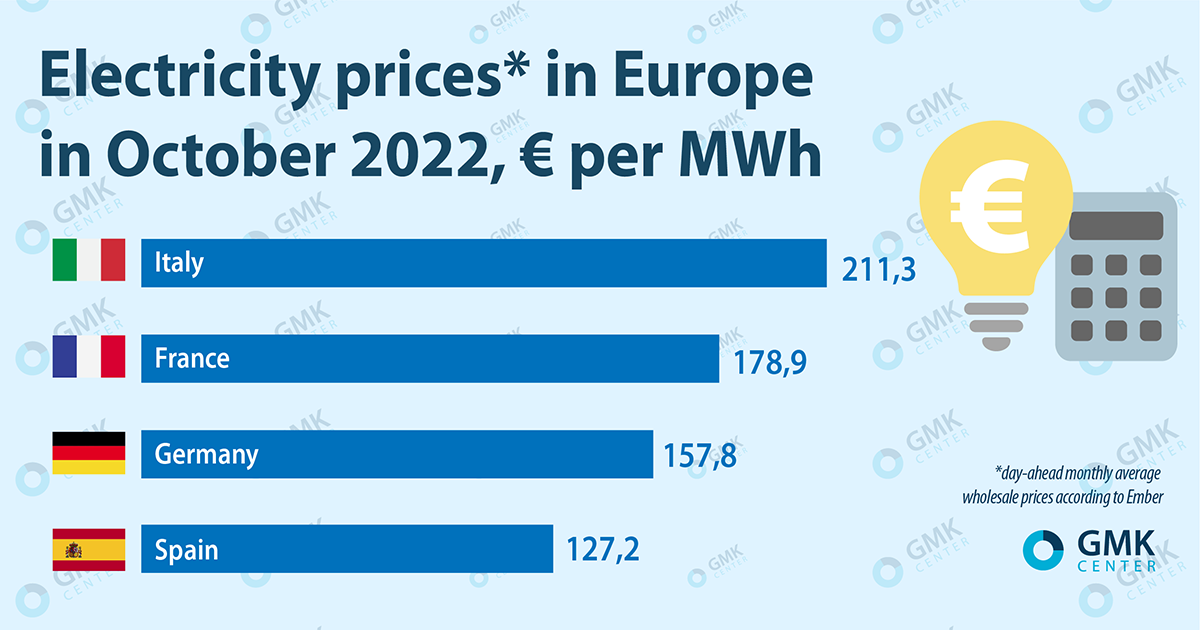

According to Ember’s data, in Europe the average monthly wholesale prices for the day ahead in October 2022 were:

- Italy – €211, 2/MWh;

- France – €178.9/MWh;

- Germany – €157.8/MWh;

- Spain – €127.22/MWh.

In the UK, according to Nordpool’s data, the average monthly spot price for a day ahead in September was €136.60 per MWh.

Russia’s full-scale invasion of Ukraine in February drove up gas prices and the cost of power generation at gas-fired power plants across Europe, while the summer heat affected hydropower and nuclear power generation. In August 2022, prices in some EU countries reached record levels of €600-700/MWh.

Currently, energy prices in the EU have fallen thanks to abnormally warm weather, falling EU spot gas prices and sufficient filling of European gas storage facilities, as well as the European Commission’s plans to reform the electricity market. However, prolonged cold weather can change the situation. In addition, the decline in gas futures prices was more restrained than the decline in spot prices, noted Luis de Guindos, Vice President of the European Central Bank, and this suggests that the supply situation is still volatile.

The volatility of prices, which are still significantly higher than at the beginning of 2022, is still affecting energy-intensive sectors of the EU industry, although it may reduce the pressure on the steel industry. However, companies are still considering worst-case scenarios. In Europe, there are also fears about the escalation of the situation with the Russian Federation and the factor of emergency situations, such as the explosion of the Nord Stream gas pipeline, which can affect the supply of energy resources.

Although the energy crisis in the EU has reduced momentum, it is about the risk of shifting investments from energy-intensive production sectors of the EU to other countries where the cost of energy is lower. In particular, Moody’s credit rating agency warned about this possibility. Given competitors with low electricity costs, particularly the US, this factor could weaken the region’s long-term price competitiveness.

In addition, to the problems of energy-intensive industries are added concerns about the new EU rules on carbon emissions — it is about the CBAM, which is called to be implemented gradually. Recently, representatives of five emission-intensive industrial sectors, in particular EUROFER and European Aluminium, reminded about the current challenges for the industry: rapid growth of energy costs, inflation, shortage of raw materials. In their view, a rapid phase-out of free carbon allocations will lead to risks for the EU’s industrial base, which is already severely affected by energy prices.

As GMK Center reported earlier, the EU is working on price restrictions on gas used for electricity production. The proposal requires gas-fired power plants to sell electricity at discounted prices in short-term markets.