News Green steel green steel 216 23 June 2025

Higher power demand of low-carbon technologies makes steelmakers increasingly vulnerable to electricity price volatility

The transition to low-carbon steelmaking technologies dramatically increases electricity consumption, making power prices a decisive factor in the competitiveness of future “green” steel production. This trend is especially pronounced in hydrogen-based and electrolysis-driven processes, where electricity accounts for a great share of production costs.

These ideas are unveiled in a new study of GMK Center “EU electricity market: challenges for green transition in steel Industry.”

The report outlines that scrap-based electric arc furnace (EAF) production already uses five times more electricity than traditional blast furnace-basic oxygen furnace (BF-BOF) route. The electricity intensity rises eightfold in DRI-EAF setups.

For more advanced decarbonization routes, such as hydrogen-based DRI combined with EAF or smelter and BOF, electricity demand can soar to 37-40 times that of BF-BOF production. The most power-intensive option, molten oxide electrolysis (MOE), uses 41 times more electricity than conventional steelmaking.

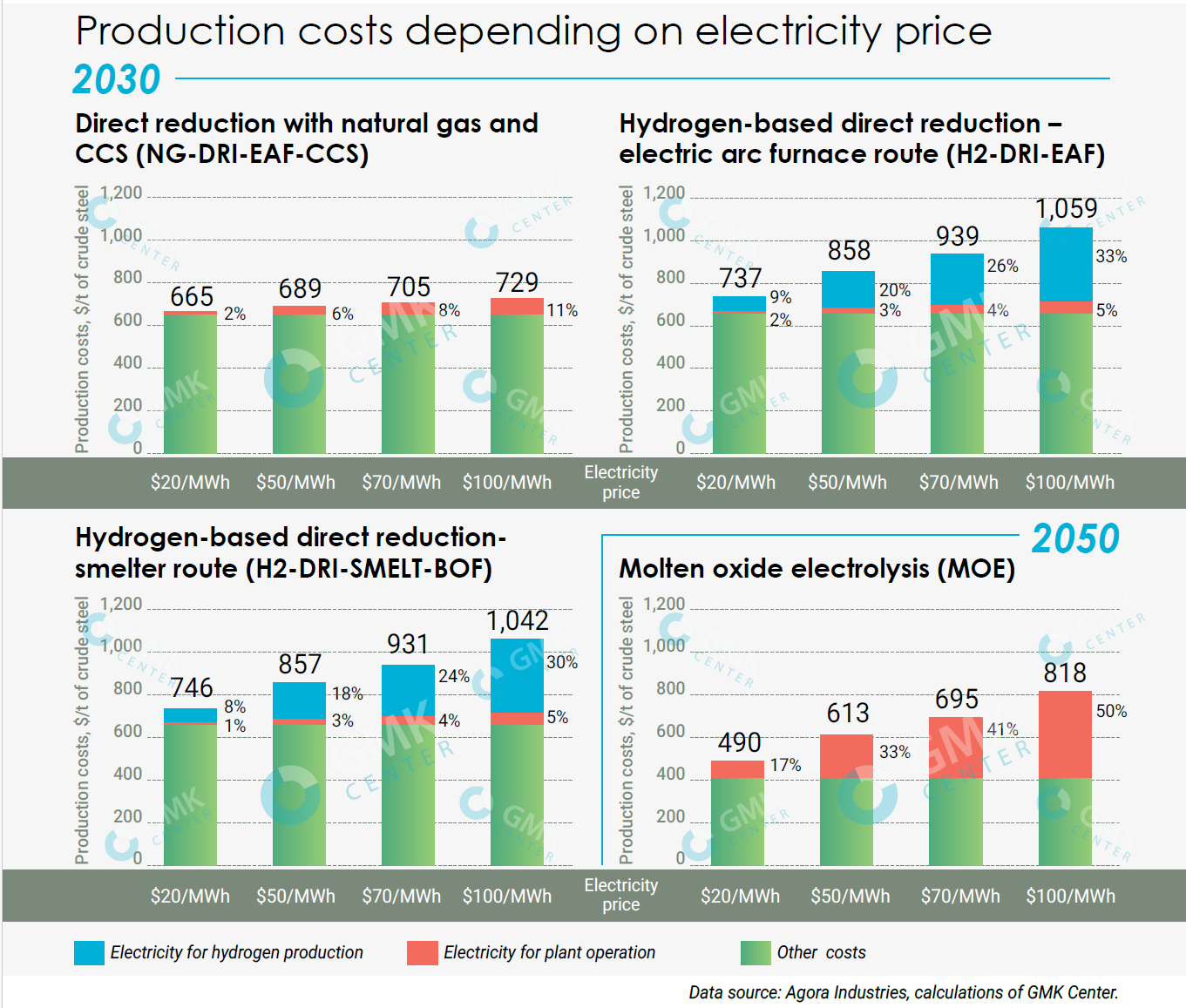

As a result, electricity prices will have a growing impact on production costs. For example, in the natural gas-based DRI route with carbon capture, electricity’s share of production costs can rise from 2% to 11% as prices increase from $20/MWh to $100/MWh. In hydrogen-based DRI-EAF production, the cost share jumps from 11% to 38% under the same price scenario. The hydrogen-based DRI-smelter-BOF route follows a similar pattern.

This sensitivity stems from the fact that “green” hydrogen (the core input for many decarbonized steel technologies) is itself energy-intensive to produce, making its cost directly tied to electricity prices.

As previously reported by GMK Center, average monthly day-ahead wholesale electricity prices across most EU markets continued to decline in May. The downward trend was largely driven by higher output from renewable sources, particularly wind and solar, and weaker demand, even as gas and carbon prices remained volatile.