News Global Market China 3144 29 February 2024

Most Chinese steel mills have adequate raw material inventory levels

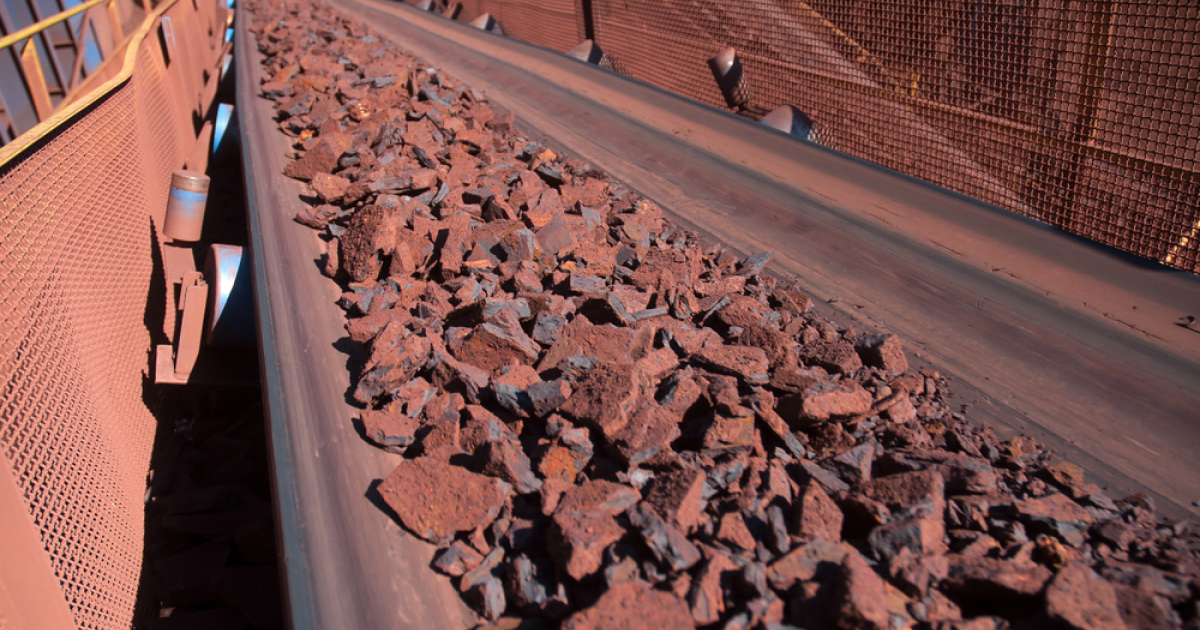

Demand for iron ore in China is likely to be supported in the short term by the resumption of construction sites after the Lunar New Year holidays and the associated increase in steel consumption. This was reported by S&P Global with reference to market sources.

In the first week after the holidays, the domestic market saw weak demand for rolled steel and a decline in blast furnace productivity. In turn, this led to a decline in demand for ore and raw material prices.

However, market expectations are that sentiment will strengthen as construction sites resume operations and amid expectations of political stimulus from two sessions of the country’s legislature scheduled for early March.

The market is expecting a recovery in rolled steel consumption in the spring. For example, after the holidays, demand for rebar in North China increased slightly due to construction needs. And some steel mills in the east of the country tried to shift production from long products to flat products, as the latter enjoyed better domestic and export demand.

According to the China Iron and Steel Association (CISA), total steel output at China’s largest steel mills rose by 1.5% to 21 million tonnes between 11 and 20 February, compared to the first 10 days of the month. Rolled stocks in the period totalled 18.98 million tonnes, up 17.6% compared to the same period in 2022.

Chinese market participants are primarily concerned about the recovery in demand after the holidays in the short term. However, most of them believe that there is no oversupply situation yet. However, steel production may decline as several steel mills have planned to suspend production in late February and early March.

Amid a slow market and low margins, steel mills plan to voluntarily cut production in March. In addition, iron ore cargo arrivals at major Chinese ports have not increased recently. Most steelmakers currently maintain a good level of iron ore stocks, which will last for 7-30 days, depending on the location of the plant.

As GMK Center reported earlier, China’s steelmakers produced 1.019 billion tonnes of steel in 2023, up 0.6% from 2022. The downward trend in the country’s steel industry has thus stopped after two consecutive years of declining production.