News Global Market coke 1049 12 March 2025

The coke market in China has reached a local «bottom» amid falling production volumes in the metallurgy industry

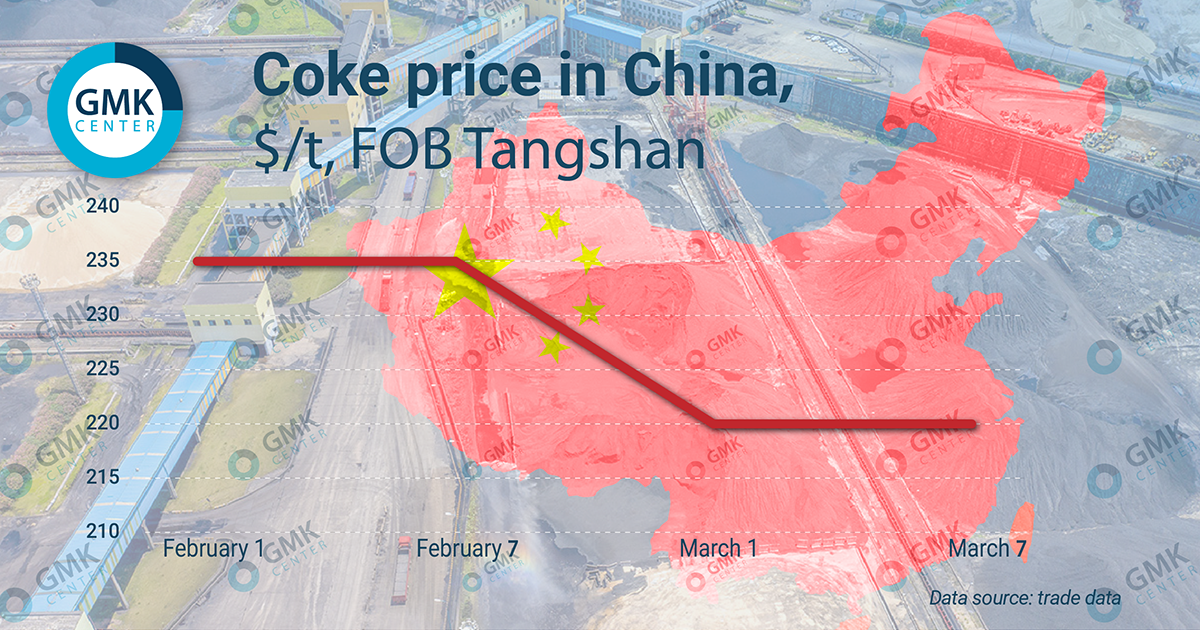

The cost of coke on the Chinese market in the first week of March remained unchanged at $220/t, FOB Tangshan, according to MetalPlace. Since the beginning of the year, the commodity has lost 13%. Low activity from buyers forced coke plants to lower price requests in the hope of maintaining production volumes.

Metalworks took a wait-and-see attitude, reluctantly replenishing coke stocks. According to trade sources, they expect further price declines.

Coke in the port of Rizhao fell by $7/t in the first week of March, to $191/t under spot contracts. On the Dalian Commodity Exchange, coke futures for May delivery lost $3.7/t compared to April. The unfavorable situation for coke chemists is mainly due to situational factors at the beginning of the year. This is primarily a decrease in economic activity in the pre-New Year and post-New Year periods (the celebration of the New Year itself according to the Chinese calendar lasted from January 29 to February 12). Steel production in China in January decreased by 5.6% year-on-year, to 81.9 million tons.

The government’s decision to reduce steel production for the duration of the annual National People’s Congress (which began on March 5, the session lasts 8-15 days) also contributed to sluggish demand.

Export opportunities remain limited amid the difficult situation on foreign markets. In particular, in India, one of the world’s largest consumers of coke, there is a ban on its import. The authorities are already considering the possibility of its further extension after June 30, 2025.

The European coke market is on the rise, as shown by statistics from the largest southern producer, Polish Jastrzębska Spółka Węglowa. According to the results of 2024, the Company announced colossal losses of $1.87 billion. In early March, JSW announced a reduction in investments by $310 million in 2025 compared to previous plans approved in mid-2024.

Let us recall that, according to the estimates of the GMK Center, Ukraine has lost about 64% of its coke and chemical capacities in 2014-2024. The transition to imported resources (coke and coking coal) significantly improves the financial position of metallurgical companies, their ability to support business, investments, debt servicing, and social initiatives. Due to the deterioration of competitiveness, there is a threat of a reduction in metallurgical production and exports.