News Global Market iron ore prices 2813 07 April 2025

So far, the changes have affected only low-grade products, but there are prerequisites for further price increases for the entire line

Chinese quotations for low-grade Fe 58 ore rose to $91/t CFR Qingdao by April 2, up from $89/t as of March 21, according to Kallanish. This was driven by strong demand due to the refusal of Chinese steel mills to carry out scheduled maintenance.

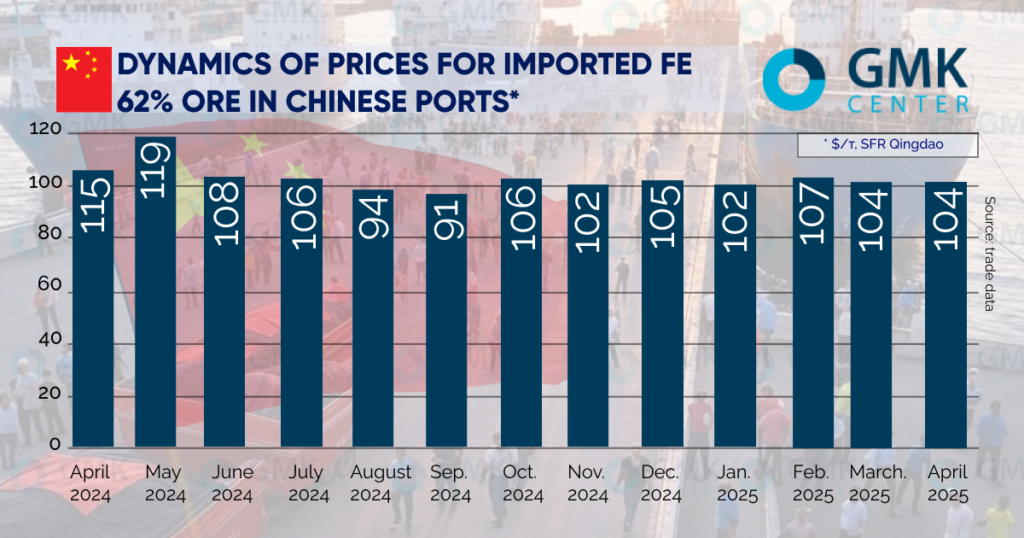

At the same time, prices for high-grade ore remained stable at $117.04/t CFR for Fe 65 and $104/t CFR for Fe 62.

According to the China Iron and Steel Association (CISA), stocks of the main types of finished rolled products in the warehouses of 21 major Chinese cities decreased by 3.3% to 10.85 million tons in the second decade of March.

In particular, stocks of hot-rolled coils decreased by 5.7%, cold-rolled coils – by 4%, plates – by 7%, wire rod – by 4.3%, and rebar – by 1%. This creates preconditions for an increase in steel production in April. This, in turn, should support ore prices. However, a large-scale price increase is not expected.

On the Singapore Exchange, futures for Fe 62 ore for May delivery were trading at $103/t as of April 2. Spot prices in China on that date amounted to $104/t. That is, ore for delivery next month is slightly cheaper than under current agreements.

Indian prices for Fe 57 ore as of April 3 amounted to $32/t EXW Karnataka excluding VAT, according to BigMint. High-grade Fe 62 ore was priced at $56/t EXW Karnataka, excluding VAT. For both products, the price remained unchanged compared to March 21. Market participants explain the lack of dynamics by the fact that no major ore auctions were held during this period.

At the same time, there are prerequisites for a rise in prices in April. India’s largest iron ore miner NMDC reported a 5% m/m decline in production in March to 2.02 million tons. Overall, the company reduced production by 2% in FY2024-2025 (ended March 31).

The decline is attributed to a large-scale strike in March by NMDC employees demanding higher wages. The protest was suspended on March 21. However, as the dispute between the administration and the unions has not been resolved, there is a possibility of further deterioration.

Meanwhile, demand for ore from steelmakers remains high. In January-February 2025, they increased steel production by 6.8% to 26.3 million tons, according to the Indian Ministry of Steel and Steel Industry. Deloitte estimates that steel demand in India will grow by 5-7.3% annually until 2030. Thus, a decrease in local supply of iron ore may lead to higher prices and an influx of imports.

As GMK Center reported earlier, some Chinese steel mills have begun to cut steel production due to an oversupply of finished steel products on the market and low profitability.