News Global Market China 926 24 October 2023

Limited support for the market will be provided by increased demand in India after the monsoon season

Asian steel prices may come under pressure in the fourth quarter of 2024 due to loosening production controls and low domestic consumption in China. The market will have limited support from rising demand in India after the monsoon season. It is stated in the S&P Global review.

It is expected that in October-December in China, if the government does not limit production at steel plants, there may be sufficient supply of steel. However, domestic demand is likely to be insufficient to balance these volumes. Earlier, market sentiment was improved by news about the introduction of restrictions, but at the end of the third quarter there were fewer such signals.

If the state does not introduce control over steel production this year, production volumes will remain at a high level, and exports will become a reliable sales channel for the products of Chinese steelmakers.

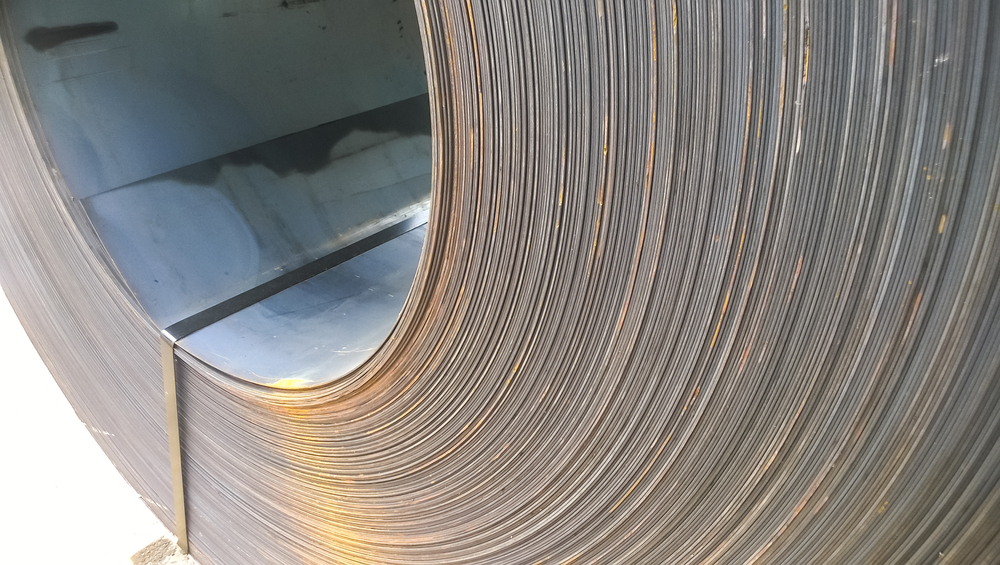

As Paul Bartholomew noted in a Ferrous Market Analytics report released at the end of August, rolled steel exports from China will reach a seven-year high this year as domestic demand will not be able to absorb the amount of steel products produced in 2023.

The Chinese steel market in the fourth quarter may be supported by high prices for iron ore and coal, one of the traders believes, but demand is unlikely to improve due to high capital costs of enterprises. Strengthening prices can also be supported by the government’s economic policy.

Several sources from Bharata (India), writes S&P Global, reported that the country will import hot-rolled coil in the fourth quarter amid a favorable price spread in maritime markets. Currently, there is a demand for these products in very few countries and the Indian market is one of them, especially since the monsoon season has passed.

Meanwhile Japan remains the main exporter of scrap in the region. In the third quarter, Asian prices for these raw materials remained limited. The lack of demand in the marine market was balanced by purchases from Japanese mills at high prices, a trend that is likely to continue in the fourth quarter.

Japanese steelmaker Tokyo Steel is trying to reduce the country’s ferrous scrap exports by keeping prices competitive. Major importers of Japanese scrap, such as Vietnam and South Korea, have switched to domestic raw materials.

However, the country remains the dominant supplier of scrap to East Asia. In particular, it accounted for 61.6% of imports of these raw materials by South Korea in August 2023. In June, Japanese scrap exports to Taiwan exceeded those from the United States for the first time in three years. However, according to a Japanese trader, the Tokyo-based steel company will eventually raise domestic prices to levels that will discourage overseas supplies.

As GMK Center reported earlier, in early October Chinese steelmakrs were forced to react to falling prices and demand by announcing maintenance and limiting shipments. In particular, Baowu Echeng Steel, Wuhan Steel and Jinshenglan Steel published a joint message on limiting sales prices and volumes starting October 10.