Infographics Poland 1358 02 June 2025

Raw material supplies to third countries increased by 1.4% y/y, and to the EU – by 10.1% y/y

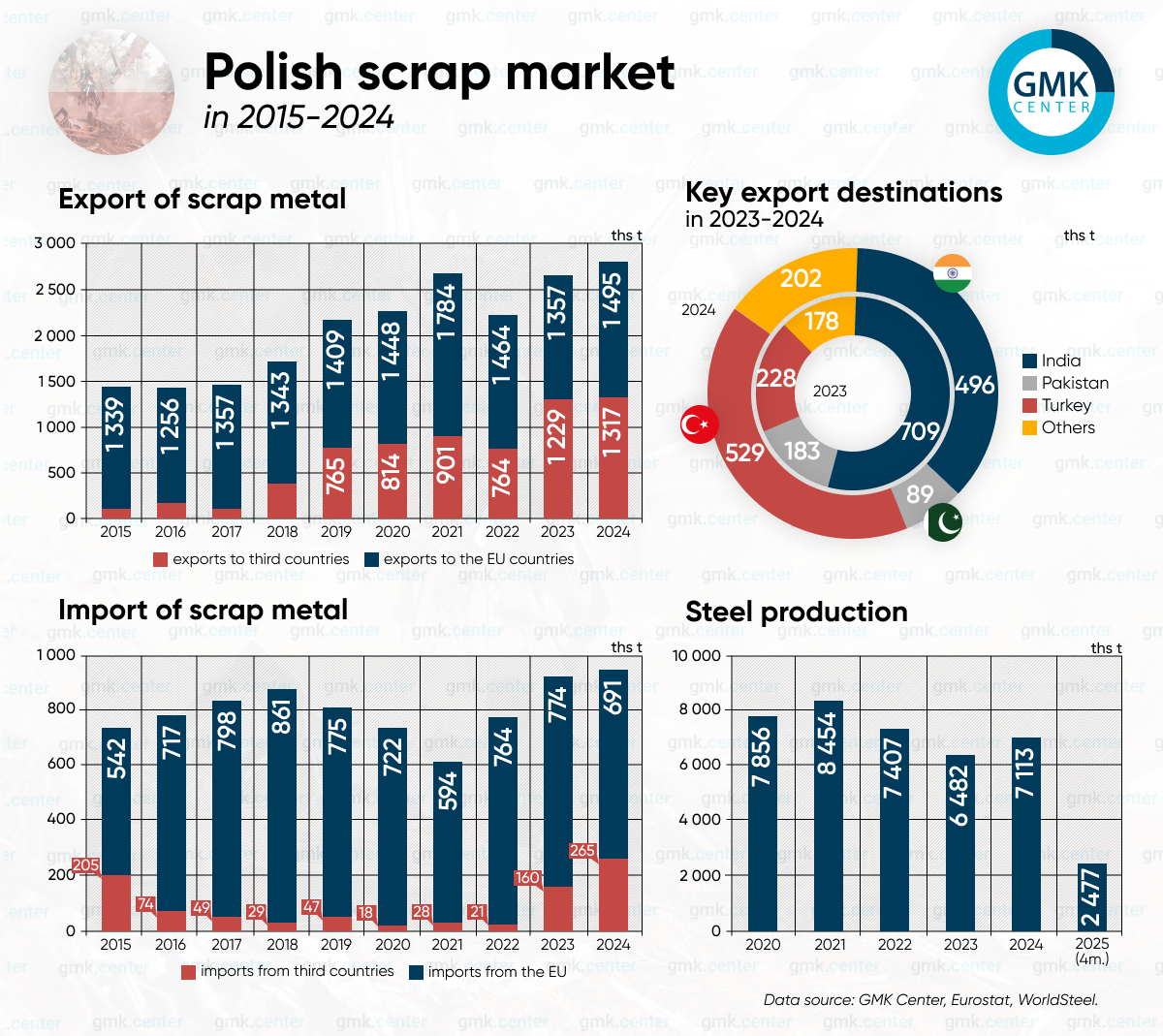

The Polish ferrous scrap market has been undergoing significant changes and growth in recent years. In 2024, exports of raw materials increased by 5.9% compared to 2023 to a record 2.81 million tons. At the same time, imports increased by 2.3% y/y – to 956 thousand tons.

Exports

Exports of raw materials from the country have undergone global changes since 2022, in particular, the geography of supplies has changed. While in 2015-2022, scrap supplies from Poland to third countries accounted for about 26% of total exports, in 2023-2024, the figure rose to 47.8%.

Thus, in 2023, exports of raw materials to third countries amounted to 1.3 million tons (+69.9% y/y), and in 2024 – 1.32 million tons (+1.4% y/y). Deliveries to the EU countries are estimated at 1.36 mln tonnes (-7.3% y/y) and 1.49 mln tonnes (+10.1% y/y), respectively. Total exports are growing for the first time after a two-year decline.

The key markets to which raw materials from Poland are exported are Turkey, India, and Pakistan. In particular, in 2024, 529 thousand tons of ferrous scrap were exported to Turkey, which is 2.3 times higher than in 2023 (228 thousand tons) and almost three times higher than in 2022 (177 thousand tons).

Supplies to India, on the contrary, declined in 2024 after a sharp rise a year earlier – to 496 thousand tons from 709 thousand tons (-30% y/y). In general, the Indian market is somewhat new for Polish suppliers, as in 2015-2021, no more than 65 thousand tons of raw materials were supplied to this destination per year. A significant increase has been observed since 2022.

Pakistan imported 89 thousand tons of scrap from Poland last year, compared to a record 183 thousand tons in 2023 (-51.1% y/y).

Imports

Last year, imports of raw materials to Poland increased by 2.3% to 956 thousand tons. This is the third consecutive annual increase in imports, including 26.3% y/y in 2022 and 19% y/y in 2023.

The main source of imports is the EU – 764 thousand tons in 2022 (+28.6% y/y), 774 thousand tons in 2023 (+1.3% y/y), and 691 thousand tons in 2024 (-10.7% y/y). Most of the supplies come from neighboring European countries, such as the Czech Republic, Slovakia, Hungary, and Romania, where steel production is low compared to Poland due to fewer capacities and problems with existing plants. Thus, in 2024, the Czech Republic supplied 373.59 thousand tons of raw materials to Poland (+0.1% y/y), Slovakia – 177.51 thousand tons (-24.7% y/y), Germany – 93.05 thousand tons (+1.7% y/y), Hungary – 21.98 thousand tons (-22.2% y/y).

Imports from third countries have shown significant growth in the last two years. While in 2016-2022 the average annual figure was 38 thsd tonnes, in 2023-2024 it was 212 thsd tonnes. In particular, in 2023, supplies reached 160 thsd tonnes (21 thsd tonnes in 2022), and 265 thsd tonnes in 2024 (+65.2% y/y).

Ukraine accounts for almost all imports from third countries. In 2023, the figure reached 159.44 thsd tonnes (15.6 thsd tonnes in 2022), and 251.03 thsd tonnes in 2024 (+57.4% y/y). The prospects for growth in 2025 are high, as imports of raw materials from Ukraine amounted to 68.11 thousand tons in the first quarter alone (57 thousand tons a year earlier).

Steel production

Steel production in Poland in 2024 was marked by an increase after two years of stagnation – by 10.6% y/y, to 7.11 million tons. In 2023, the figure fell by 13.2% y/y – to 6.43 million tons, and in 2022 – by 12.4% y/y – to 7.41 million tons.

In 2020-2024, the Polish steel industry was significantly affected by global and regional factors. The COVID-19 pandemic in 2020 led to a decline in steel demand and supply chain disruptions, but in 2021, there was a rapid recovery amid growing construction and industrial production. The war in Ukraine, the imposition of sanctions against Russian steel products and the energy crisis in 2022 led to a drop in production due to rising costs and lower demand. In 2023, the situation was exacerbated by weak economic growth in the EU and a decline in industrial investment, but in 2024 the industry began to recover due to stabilized markets, energy prices and increased domestic steel consumption.

The year 2025 is expected to support the recovery trend, with production already up 3.9% y/y – to 2.48 million tons in January-April. The restart of an important metallurgical plant, Huta Częstochowa, is contributing to the recovery. Since February 3, the plant has been operating at full capacity after more than a year of downtime.

Conclusions and prospects

The ferrous scrap market in Poland is showing steady export growth amid the transformation of supply chains and changes in the geography of supply. The record 2.8 million tons of exports in 2024 indicate an increase in foreign trade, primarily due to increased supplies to Turkey, which has significantly increased its demand for European raw materials in response to geopolitical changes. The growth in exports to Turkey is accompanied by a parallel increase in imports of scrap to Poland from Ukraine, indicating that Poland is taking on a transit role in the European raw materials supply chain.

This situation creates short-term benefits for Polish traders and intermediaries, but risks are on the horizon. The EU is already discussing restrictions on the export of recyclable materials outside the Union – in particular, the updated Waste Transport Regulation, which will come into force in 2026, may impose stricter conditions on the export of scrap to third countries.