Infographics EU 1194 17 March 2025

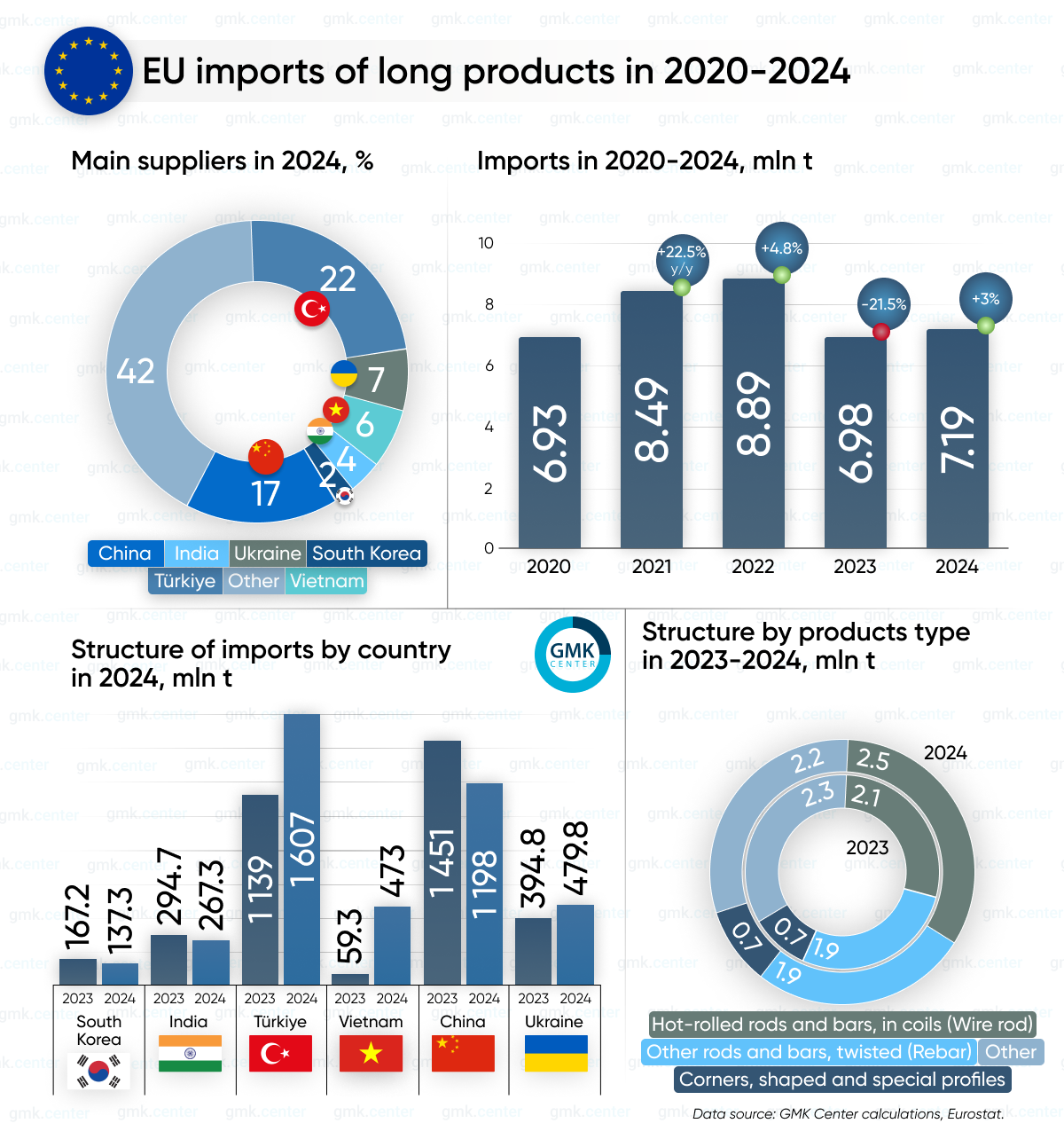

Imports grew by 3% y/y

In 2024, the European Union (EU) increased imports of long products from third countries by 3% compared to 2023, to 7.19 million tons. This is evidenced by GMK Center’s calculations based on Eurostat data.

Hot-rolled rods and bars made of carbon steel in coils (HS 7213) accounted for the largest import volumes, amounting to 2.48 million tons, up 20.3% compared to 2023. Also imported were 1.88 million tons (-1.6% y/y) of other rods and bars of carbon steel, without further processing, twisted (HS – 7214), 678.15 thousand tons (+0.8%) of angles, shapes and special profiles of non-alloy steel (HS – 7126), and 647.77 thousand tons (-27.8%) of other bars and rods of other alloy steels, hollow bars and drill bars of alloy or non-alloy steels (HS 7228).

Turkey, Ukraine, Vietnam, India, South Korea, and China accounted for about 58% of the supply. In particular, Turkish steelmakers shipped the largest share of longs to the EU – 1.61 million tons, up 41.1% compared to 2023. China shipped 1.19 million tons of long products (-17.5% y/y). Ukraine increased its exports to the EU by 21.5% y/y – to 479.84 thousand tons. Deliveries from Vietnam amounted to 472.97 thousand tons (+697% y/y), India – 267.34 thousand tons (-9.3%), South Korea – 137.3 thousand tons (-17.5%).

“The full implementation of CBAM will have a negative impact on the prospects for Ukrainian exports of long products to the EU. Ukrainian producers use BF-BOF route to make steel, while the EU has a reserve of capacities that can produce long products using EAF-based route (which has a lower carbon footprint). We expect that in the long term, by 2030 Ukraine may completely lose the ability to export long products to the EU in the absence of tools that would help modernize its production facilities,” said Andriy Glushchenko, GMK Center analyst.

The key importers of long products among the EU countries in 2024 are:

- Romania – 1.19 million tons;

- Belgium – 818.54 thousand tons;

- Netherlands – 650.18 thousand tons;

- Italy – 633.14 thousand tons;

- Germany – 554.77 thousand tons.

Thus, in 2024, imports of long products to the EU recovered slightly after a significant decline in 2023, with Turkey, China, Ukraine and Vietnam remaining the main suppliers. Despite the overall increase in supplies, anti-dumping restrictions imposed by the EU, especially on Chinese products, could significantly affect the import structure in 2025. The share of Turkey and Vietnam is expected to grow further, while Ukrainian exports are expected to stabilize and supplies from China are expected to decline. Total imports are likely to remain at 7 million tons, but the distribution between countries will change due to market competition, EU environmental requirements, and macroeconomic factors.