News Global Market India 3043 13 June 2024

Eexports last month amounted to about 0.5 million tons

According to preliminary data from BigMint, India’s steel exports in May 2024 amounted to about 0.5 million tons, down 24% from 0.66 million tons in April. Thus, exports from the country fell to the lowest level in six months.

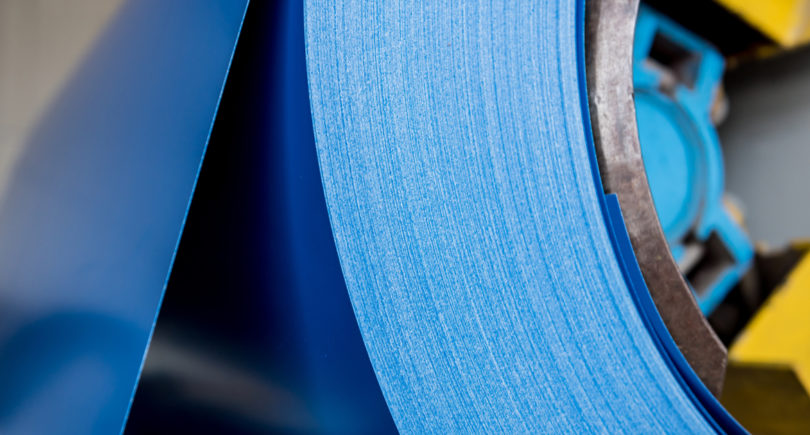

Flat products accounted for about 82% of total exports. Exports of long products and semifinished products in May amounted to about 50 thousand and 40 thousand tons, respectively.

The EU remained the main export destination for India. However, the total supply of steel products to the bloc in May fell by 40% compared to the previous month, exceeding 210 thousand tons. Shipments to Nepal and the United States increased during the period, while exports to the UAE and Turkey declined.

Indian exports last month were affected by a number of factors. In particular, local steel mills prefer the domestic market to exports and have limited export quotas. Scheduled maintenance shutdowns at the plants, particularly at hot strip mills, halted HRC’s exports to Southeast Asia and the Middle East. At some plants, they lasted for about 15 days and were tied to a period of low buying interest in both domestic and international markets.

In addition, Indian exports were also affected by a slowdown in global steel demand, buyer caution in the European market due to new protective measures announced and competitive Chinese prices.

The Indian credit rating agency ICRA has revised its forecast for domestic steel consumption growth in India to 9-10% in FY2024/2025, up from 7-8% previously. These expectations take into account recent trends in the sector. Domestic steel consumption in the country increased by 11.3% between February and April 2024.