News Global Market Australia 304 03 July 2025

Amid declining demand from China and rising production, iron ore prices will continue to fall until 2027

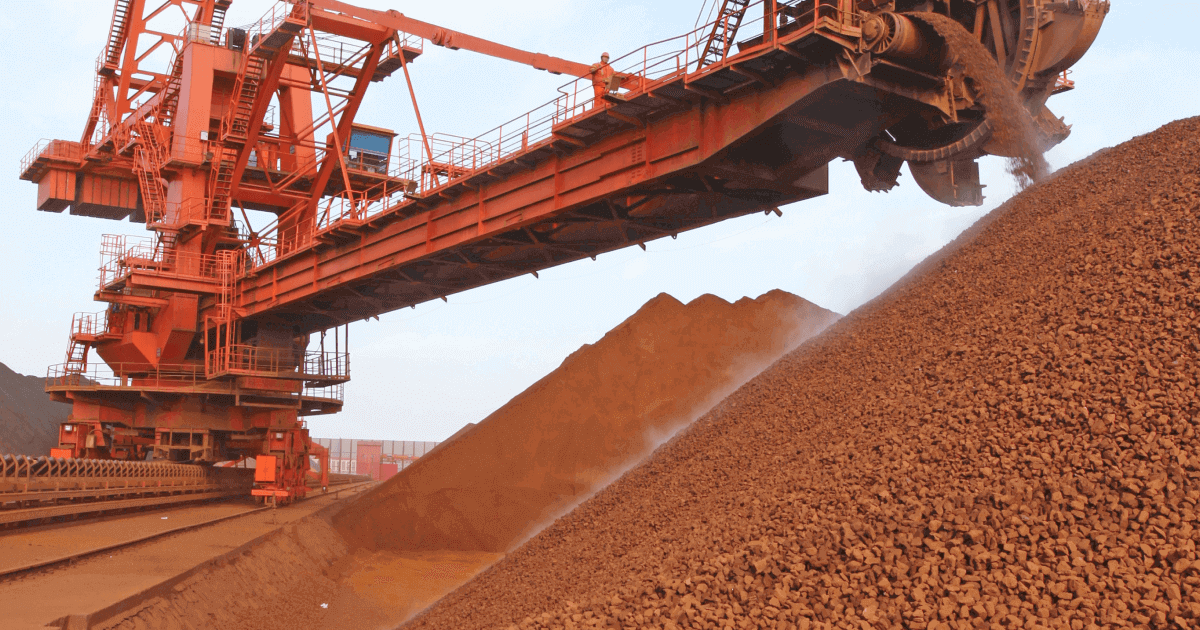

Australia forecasts a decline in iron ore export revenues from $116 billion in the 2024-2025 fiscal year to $97 billion in 2026-2027. This is stated in the country’s government’s June Resources and Energy Quarterly report. The main reasons for the decline are weak global demand for steel, reduced production in China, and gradual market saturation from Brazil and Africa.

The report notes that FOB iron ore prices (62% Fe) will fall on average from $93 per ton in 2024 to $83 in 2025 and $74 in 2027. At the same time, China, the largest importer, is reducing steel production due to falling plant profitability and weak demand in the real estate market. In the first five months of 2025, steel production in China fell by 1% year-on-year.

Against the backdrop of weak demand from China, Australian iron ore exports also declined in the first quarter of 2025, by 1.5% year-on-year. Although the government expects supplies to recover to 927 million tons in 2026-2027, falling global prices and a stronger Australian dollar will limit exporters’ profits.

Despite the decline in revenue, Australia remains the stable leader in the global market, accounting for over 50% of global iron ore exports. At the same time, the government expects growing capacity in Africa (in particular, the launch of the Simandou project in Guinea) and Brazil to intensify competition in the second half of the decade.

As GMK Center reported earlier, September iron ore futures on the Dalian Commodity Exchange (DCE) rose by 2.1% compared to the previous week and by 2.4% since the beginning of the month to $99.95/t, a psychological threshold for the market, as of June 27, 2025. At the same time, July contracts on the Singapore Exchange at that time were $94.4/t, which is 1.2% more than the previous week, but 1.7% less than at the end of May.