Key volumes of supplies go to Algeria, Poland, and Turkey

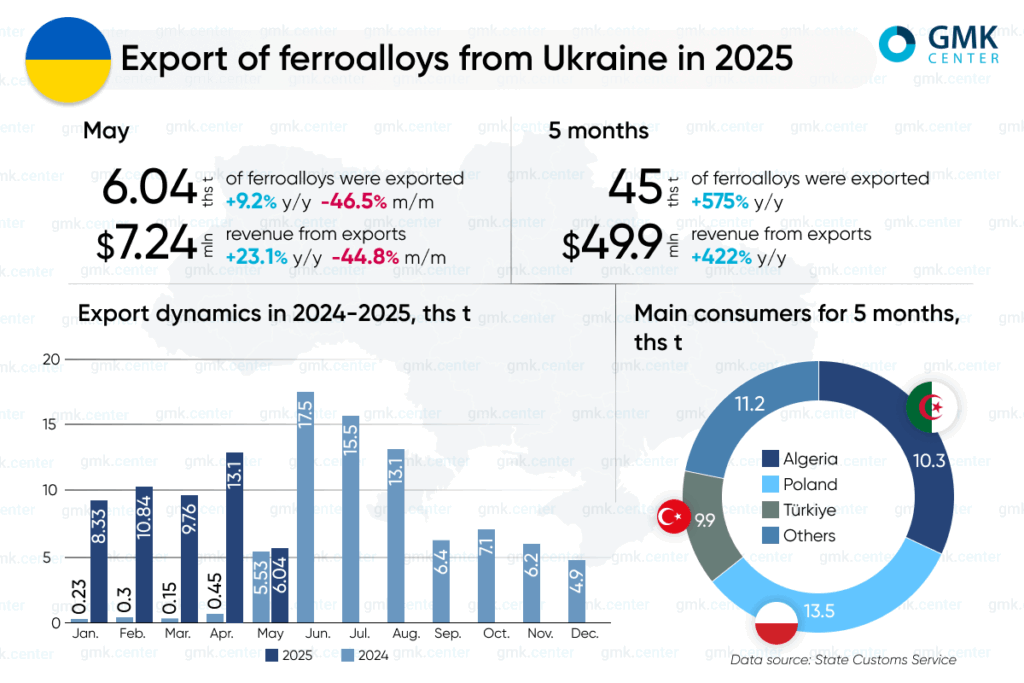

In January-May 2025, Ukraine’s ferroalloy enterprises exported 45,000 tons of products, compared to 6,670 tons during the same period in 2024, when export shipments almost stopped due to the prolonged downtime of key enterprises in the industry. This is evidenced by GMK Center calculations based on data from the State Customs Service.

The largest consumers of ferroalloy products during the period were: Algeria – 10.34 thousand tons, Poland – 13.53 thousand tons, Turkey – 9.92 thousand tons, and Italy – 6.37 thousand tons.

In May of this year, exports of ferroalloys from Ukraine fell by 46.5% compared to the previous month to 6.04 thousand tons, the lowest since December 2024, while in May last year these volumes amounted to 5.53 thousand tons (+9.2%). Algeria did not import Ukrainian products during the month, while Poland decreased by 61.9% m/m to 1.39 thsd tonnes, Italy consumed 2.44 thsd tonnes (0 thsd tonnes in April), and Turkey reduced the imports to 1.65 thsd tonnes (6.77 thsd tonnes in April).

Export revenue for January-May 2025 increased to $49.9 million compared to $9.55 million a year earlier. In May, the figure fell by 44.8% month-on-month to $7.24 million ($5.88 million in May 2024).

It should be recalled that during 2024, Ukraine’s ferroalloy plants reduced their output by 49.4% y-o-y to 108.2 thousand tons. The industry resumed its operations in April-May after a forced shutdown in the fall of 2023.

As a result, ferroalloy exports for the year decreased by 77.5% compared to 2023, from 344,170 tons to 77,320 tons. In 2022, this figure was 349,560 tons, and in 2021, it was 668,540 tons.

The key consumers of Ukrainian-made ferroalloy products last year were Poland – 20.94 thousand tons (189.34 thousand tons in 2023), Turkey – 45.69 thousand tons (45.69 thousand tons), and Italy – 16.96 thousand tons (18.74 thousand tons).

According to Sergiy Kudryavtsev, executive director of the UkrFa association, the key problem for the industry in 2025 is the high cost of electricity and the stability of its supply. Overall, the mood is largely negative with an element of uncertainty.