This move could help reduce the group's debt

Spanish steelmaker Celsa ended 2024 with losses of €281 million and is considering selling its Polish steel plant (Huta Ostrowiec) to reduce its debt. This was announced by the group’s non-executive chairman, Rafael Villaseca, according to Cinco Dias.

The company’s debt has decreased by 48% since the change of ownership in April this year and currently stands at €1.896 billion.

Villaseque does not rule out further asset sales and mentioned the sale of the business in Poland, which generates 20% of the group’s revenue, as one of the steps. A possible scenario could be the end of the war in Ukraine, which would increase the value of the Polish asset due to reconstruction needs.

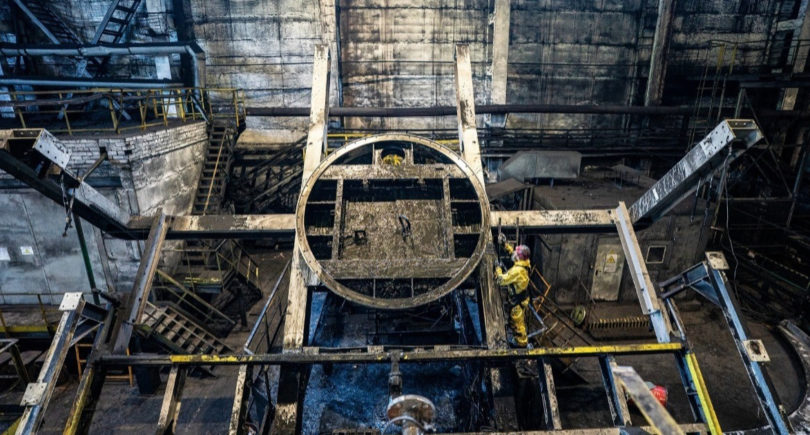

Huta Ostrowiec is one of the largest metallurgical plants in central Poland. The company produces reinforcing steel and special grades of boron steel. The plant in Ostrowiec employs over 2,000 people.

The company’s fundamental goal is to improve its operating results and achieve higher profitability. Another goal is to reduce debt. Villaseque made it clear that the company had gone through a two-year transition period – a change of ownership in 2023 and restructuring last year.

The company’s CEO, Jordi Casorla, also called 2024 a “transitional, completely atypical” year for the group. Celsa expects to turn a profit in 2026.

In addition to the sale of assets, debt refinancing is being discussed. Another alternative was the entry of a Spanish industrial investor in accordance with commitments made to the country’s government.

The non-executive chairman of the board explained that the group had fulfilled its obligations by bringing the process to the announcement of a preliminary agreement. However, the investment holding company CriteriaCaixa recently decided not to invest in Celsa. Celsa currently sees no industrial alternatives and has decided to suspend the search process, but does not rule out resuming it.

In April this year, Celsa Group announced that it had closed a deal to sell 100% of its subsidiaries in the UK and Northern Europe to the Czech investment group Sev.en Global Investments. The proceeds from the sale were intended to reduce debt.