News Global Market iron ore 221 23 June 2025

July futures on the Singapore Exchange are under increased pressure, while September offers on the Dalian Exchange remain stable

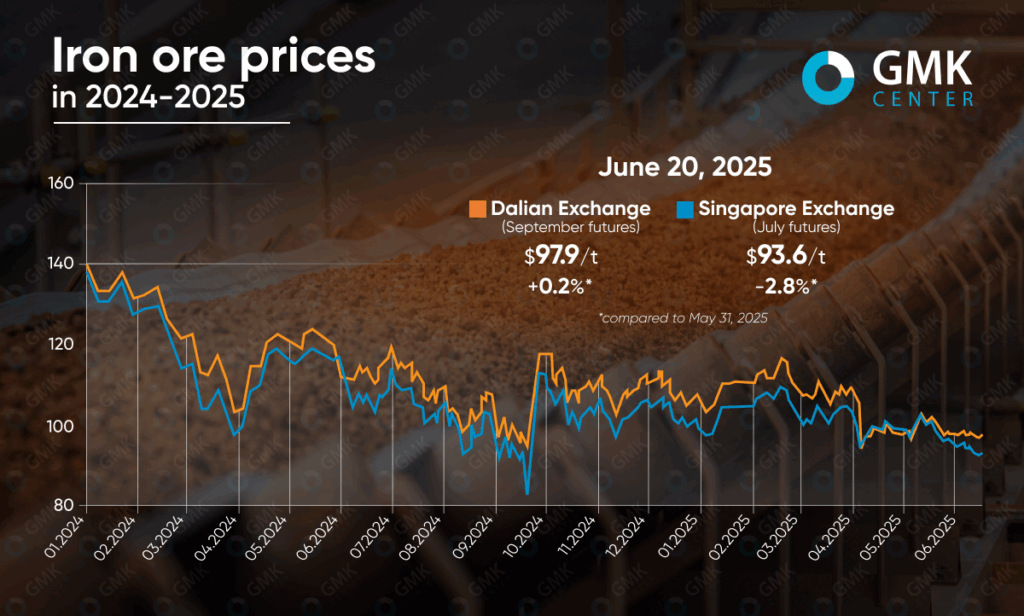

As of June 20, 2025, September iron ore futures on the Dalian Commodity Exchange (DCE) fell 0.2% from the previous week – to $97.9/t. At the same time, the level of offers rose 0.2% compared to the end of May, indicating overall stability in the market. July contracts on the Singapore Exchange came under greater pressure, falling 1.1% from the previous week and 2.8% from the beginning of the month to $93.6/t, the lowest level since April.

Last week, the global iron ore market balanced between sluggish statistics and hopes for a seasonal recovery. Despite overall pressure from weak demand in China, some market signals pointed to increased activity amid declining inventories and a revival in imports.

In the first half of the week, prices remained under pressure. Chinese steelmakers were cautious in concluding new deals, while the real estate market continued to weigh on steel consumption prospects. Investment in the sector fell by more than 10%, and the area of new projects by almost 23%, depriving the market of its traditional demand driver.

However, the trend began to change on Wednesday. Data on the reduction of finished product inventories in warehouses, the resumption of production activity, and the increase in iron ore imports supported market sentiment. According to forecasts, June ore deliveries to China will reach their highest level since the end of 2023, exceeding 109 million tons. This indicates an increase in restocking amid falling prices.

At the end of the week, the market recouped some of its losses. Prices rose despite news of production restrictions in Tangshan. The reaction was muted, with traders focusing more on actual activity than on regulatory intentions. Stable prices for billets and signs of a seasonal increase in consumption in the hot-rolled segment also had a positive impact.

The iron ore market is expected to remain within a narrow trading range, approximately $91-95/t, with possible short-term spikes. The balance between weak demand in construction and activity on the part of processors is maintaining the status quo for now. Further dynamics will depend on the weather, China’s policy on the steel sector, and the depth of the decline in real estate.

As reported by GMK Center, Moody’s expects iron ore prices to remain at $80-100/t over the next 12-18 months. This forecast is due to weak demand from China and high supply on the global market.

A similar view was expressed by analysts at BMI Country Risk and Industry Research. They maintain their forecast for the average annual price in 2025 at $100/t, although they acknowledge the pressure from weak demand.