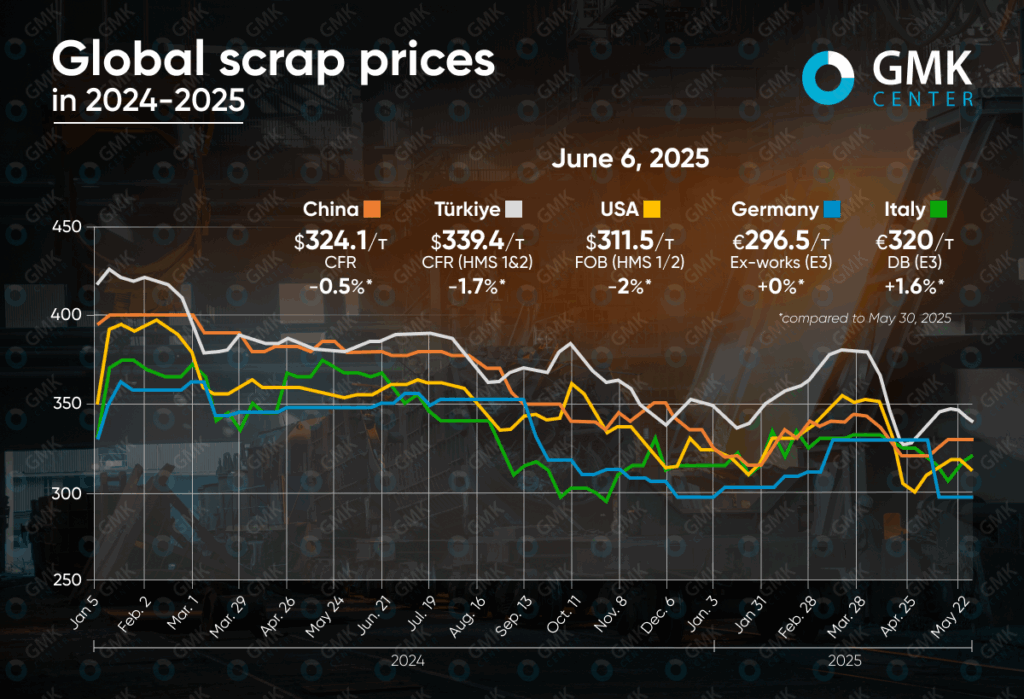

News Global Market scrap prices 418 06 June 2025

In May, the markets showed a mixed trend

At the beginning of June 2025, the global scrap market demonstrates overwhelming price stability after mixed dynamics in May. Despite some signs of localized growth, particularly in Italy, the overall sentiment remains subdued. Weakening demand for steel, seasonal factors, oversupply and instability in key export destinations are putting downward pressure on prices in most regions.

Turkey

In Turkey, scrap prices (HMS 1&2 80:20) decreased by 1.7% to $339.4/t CFR for the week of May 30-June 6, 2025. At the same time, supply increased by 5.9% in May, which increased pressure on the market and deepened the imbalance between supply and demand. Weak steel sales, falling domestic and export demand for rebar, and cheaper billets from Asia forced Turkish mills to cut prices for finished products and reduce scrap purchases. Some producers have suspended purchases ahead of the Eid al-Adha holiday break.

At the same time, the euro continued to weaken against the dollar, which stimulated additional supply from the EU at lower prices. The latest deals with European suppliers were recorded in the range of $336-340/t CFR, but the real target levels of Turkish mills have already dropped to low $330/t. The oversupply, growing number of surplus cargoes and traders’ cautiousness are creating negative expectations.

Despite the potential reduction of the discount rate by the Central Bank of Turkey on June 19, the situation is not expected to improve quickly. Given the summer slowdown and financial constraints, the market will remain under pressure at least until mid-summer.

EU

In late May and early June 2025, the European steel scrap market saw stabilization and partial recovery of prices after the previous decline. In Germany, prices for E3 grade stabilized at €296.5/t ex-works after a 9.9% drop in May, while Italy (E3) recorded a slight increase of 1.6% to €320/t ex-works. Overall, the market is cautiously expecting an increase, despite limited demand and restrained export activity.

The decline in prices in May was driven by weak domestic activity and low exports, particularly to Turkey. At the same time, supply shortages persist, especially for new scrap grades, which could put upward pressure on prices in June.

In the coming weeks, the key factor for the market will be the situation with export prices and activity in the end product markets, particularly in Italy, where rolled steel sales remain weak. Prices are expected to remain at current levels or grow moderately.

USA

The US scrap market lost ground in early June, with the average price falling by 2% – to $311.5/t (FOB East Coast), offsetting some of the 4.4% growth in May. Weakening domestic steel demand, lower capacity utilization (to 76.6%) and oversupply of scrap were the main pressure factors.

Export activity, which temporarily picked up in May, is losing momentum: Turkish steel mills, the main buyers, have completed purchases for June and are not ready to pay more than $340-350/t CFR for HMS 1&2 80:20. Against this backdrop, some US mills have begun to cancel their May contracts for the supply of scrap.

Despite short-term support from exports to Asia, the overall market sentiment remains pessimistic. Prices for some scrap grades are expected to decline further by $10-20/t in June.

China

The Chinese scrap market in early June remained under pressure from weak demand and rising short-term supply. Domestic prices decreased by 0.5% – to $324.15/t, while imported scrap remained at $329/t CFR. Market activity declined before the Dragon Boat Festival, with factories buying scrap with restraint, preferring pig iron due to lower prices for finished products.

At the same time, the decline in electric arc furnace utilization (down to 32.7%) and the drop in scrap consumption indicate a seasonal slowdown. Imports remained sluggish, with Chinese buyers refraining from bidding and Japanese suppliers not offering new prices due to weak interest.

In the short term, the market is likely to remain weak, with no signs of a recovery in demand and uncertainty over production keeping prices down.