News Global Market iron ore 2511 08 May 2025

Mining companies are forced to make concessions to buyers

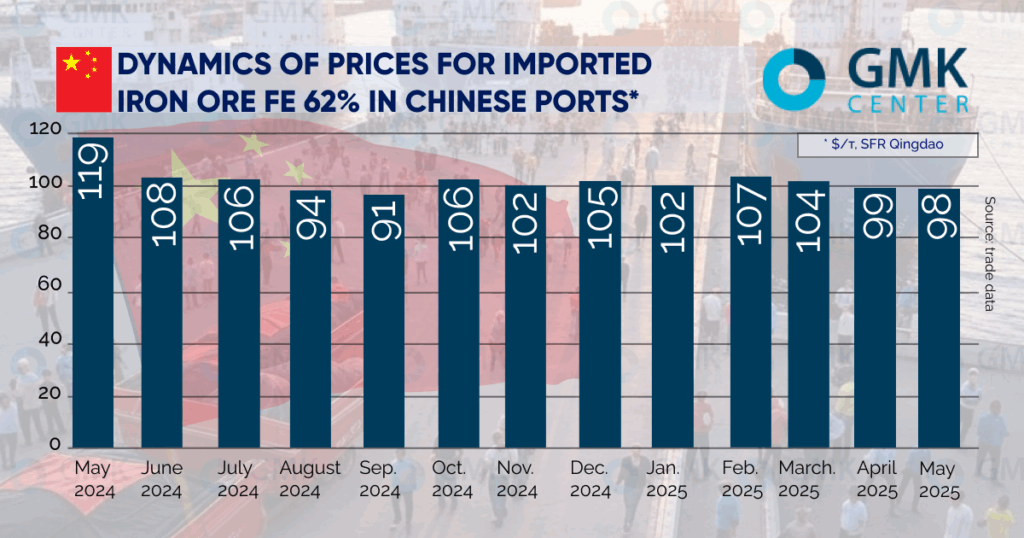

Spot quotations of Fe 62 iron ore in China decreased from $98.94/t to $97.76/t CFR Qingdao from April 29 to May 5, according to Kallanish. An increase to the psychological level of $100/t in the near future is unlikely.

This is indicated by the trading data of the Singapore Exchange. There, from April 29 to May 5, offers for futures contracts for Fe 62 increased by $0.66/t – to $95.73/t for delivery in June. This is significantly lower than current spot prices.

Brazilian prices for high-grade Fe 65 iron ore increased by $1/t – to $110/t CFR for the period from April 30 to May 6.

Fe 62 iron ore pellets in India fell by $2.5/t – to $98/t FOB Odisha from April 29 to May 5. Indian steel mills were moderately replenishing stocks before the monsoon season. Export shipments were not recorded due to lack of demand in China. May Day holidays significantly reduced economic activity in China.

India’s iron ore exports in April fell by 37% m/m – to 1.96 million tons. This is the lowest level this year. China accounted for the majority of shipments – 73%. The decline indicates a cooling of the Chinese steel market.

At the same time, the drop in prices for finished steel does not affect the financial position of Chinese steel mills. It is partly offset by the low cost of raw materials, especially iron ore.

As reported, in March 2025, 53% of steelmaking companies were profitable, according to the National Bureau of Statistics of China. In March 2024, the number was only 25%.