News Global Market iron ore prices 2842 23 April 2025

Market participants do not predict further price increases

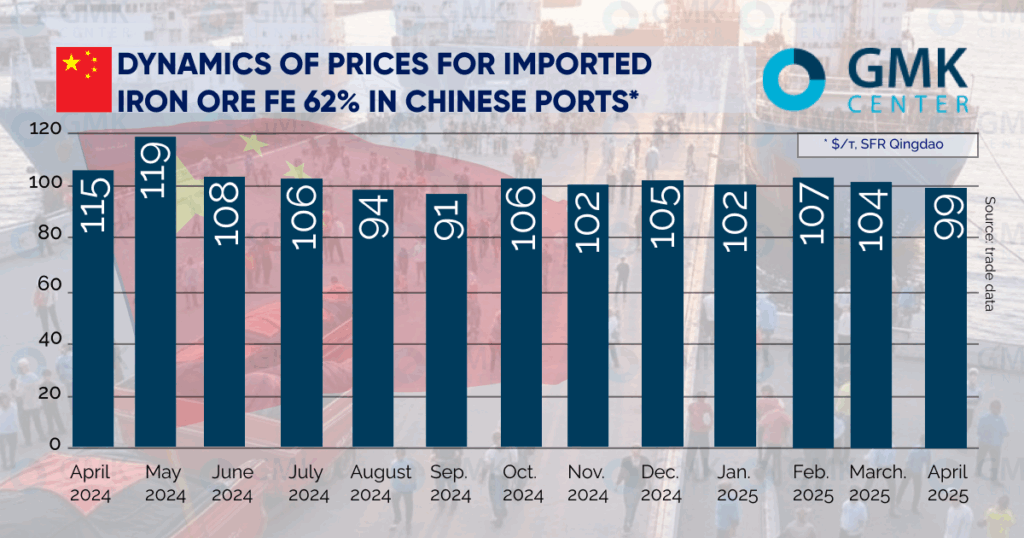

Chinese iron ore prices for Fe 62 increased by $3/t since April 7 – to $99/t CFR Qingdao by April 20, according to Kallanish. On the Singapore Exchange, futures contracts for May delivery were also trading at $99/t.

On the Dalian Commodity Exchange, futures for September delivery were offered at $98/t. This proves that market participants do not expect prices to rise above the current level in the medium term.

Steel billets in China fell by $18/t to $403/t EXW Tangshan from March 26 to April 18. At the same time, there was an increase in imported iron ore supply. In March, shipments from Australia’s Port Hedland increased by 1.15% y/y and 36.73% m/m – to 50.66 million tons.

In the face of declining prices for finished steel products, coupled with an increase in iron ore supplies from Australia, the rise in price indicates an increase in government support for the Chinese steel industry. In this way, the government is compensating steel mills for the decline in margins, stimulating further growth in steel production.

The expansion of state support for the main consumption sectors in China is indicated by the April decline in stocks of flat and long products, including hot-rolled coils and rebar. Stocks were declining both in the warehouses of traders and steel mills, etc. This stimulated demand but did not affect price dynamics.

In this regard, Premier Li Keqiang’s statement on April 17 emphasizing “the need for timely and targeted policy measures to help guide market expectations” is indicative.

The export price of high-grade Fe 65 iron ore in Brazil remained unchanged at $110/t CFR China from April 11 to 18. Since the beginning of the month, the supply of local producers has decreased by $5/t.

As reported, in January-March 2025, Ukraine reduced iron ore exports by 5.7% y/y – to 8.49 million tons. In monetary terms, the figure fell by 20.3% to $687.79 million. China is traditionally the largest consumer of Ukrainian iron ore.

As GMK Center reported earlier, Oleksandr Kalenkov, President of Ukrmetprom, said that there are serious risks for Ukraine’s mining and metals sector due to the delay in export VAT refunds to Ferrexpo.

According to him, the failure of the State Tax Service to refund VAT in March has already resulted in a reduction in production and exports of Ferrexpo, one of the key players in the Ukrainian steel industry.