News Global Market gas prices 3549 10 April 2025

Reduced demand after the end of the heating season in Europe and North America contributed to the price correction

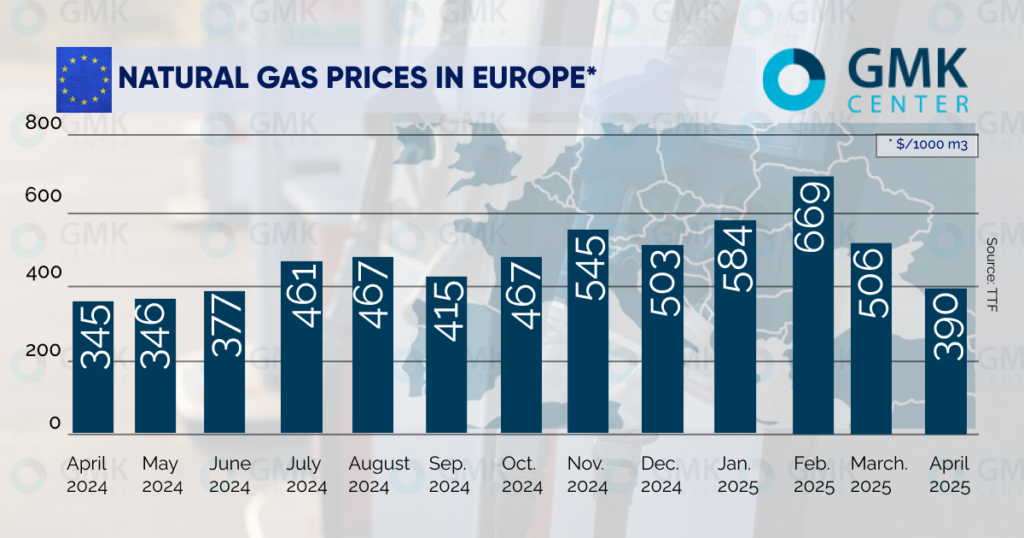

In Europe, spot quotations for natural gas on the Dutch TTF exchange fell by $102 to $390/1000 m3 in the first ten days of April.

This is evidenced by trading data.

In North America, offers on the American gas exchange Henry Hub fell to $136/1000 m3 as of April 4, compared to $147/1000 m3 as of March 31.

At the same time, Asian spot prices of JKM for liquefied natural gas remained unchanged at $430/1000 m3 from March 31 to April 4, according to the Tokyo Mercantile Exchange.

The drop in gas prices in the European and North American region, in addition to the seasonal factor, was caused by the decline in oil prices, as gas quotations are tied to them. Between March 31 and April 9, Brent crude oil offers on the London ICE exchange fell from $74.6/barrel to $60.5/barrel.

At the same time, gas traders’ transition to the stockpiling phase will keep prices from falling further. According to AGSI, the EU’s underground gas storage facilities were 34.6% full on April 4. This is 1% more than a week earlier.

Stocks in US underground storage facilities increased by 820 million m3 over the same period, to 50.2 billion m3, according to the EIA. This is 21.7% less than as of April 4, 2024.

It is worth noting that in mid-March, the US Department of Energy raised its forecast for the average gas price at Henry Hub in 2025 from the previous $136/1000 m3 to $150/1000 m3.

Falling natural gas prices should lead to a decrease in the cost of greenhouse gas emission allowances, as they are correlated. This, in turn, will reduce the costs of industrial enterprises, especially in the metallurgical sector.

As GMK Center reported earlier, the European Emission Allowances (EUAs) fell to €68.7 per tonne by April 3, down from €70.83 per tonne as of March 14. In general, in March, the decline amounted to €1.87/t, and for the quarter – €4/t.