Opinions Infrastructure freight 1196 07 May 2025

Nowadays, sea transportation tariffs are lower than a year ago

The level of freight rates depends on many factors, which can be divided into market (economic), military-political and situational. This division is based on a subjective assessment and the proposed grouping and list is not exhaustive.

Market (economic) factors

For example, let’s take a marketing year in which a large volume of crops is formed for export. In such conditions, the rhythmicity and consistency of supplies leads to an increase in demand for ship chartering, which leads to a shortage of the fleet, which directly affects the growth of freight rates.

In the opposite situation, with a smaller harvest or a weak rhythm of deliveries, the fleet becomes larger, and demand for them falls, which leads to a decrease in freight rates.

Rates are also affected by other market factors, such as duties, quotas, exchange rates, the activity of other cargo groups and, of course, commodity prices.

Several market factors can be observed in the 2024/2025 marketing year. Lower amount of grain for export than in previous years (no carry-over stocks in 2024/2025 marketing year and reduced planted areas), competition from Russian and European exporters, the ban on wheat imports by Turkey and the global balance of grain supply and demand led to even exports without extreme conditions, which resulted in low freight rates, the lowest compared to the previous few years.

Military and political factors

Freight rates can rise or fall significantly in a short period of time depending on military conflicts or geopolitical decisions or events.

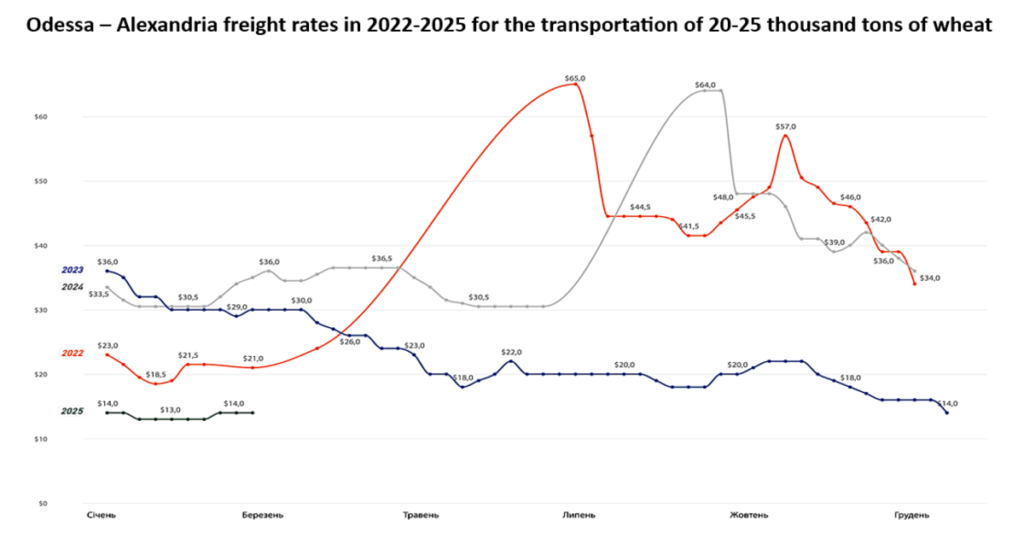

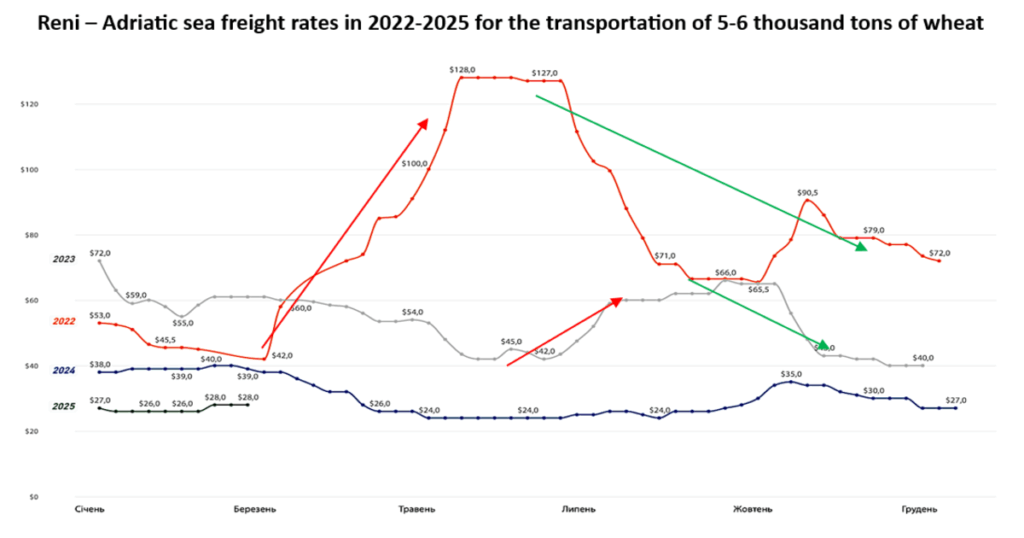

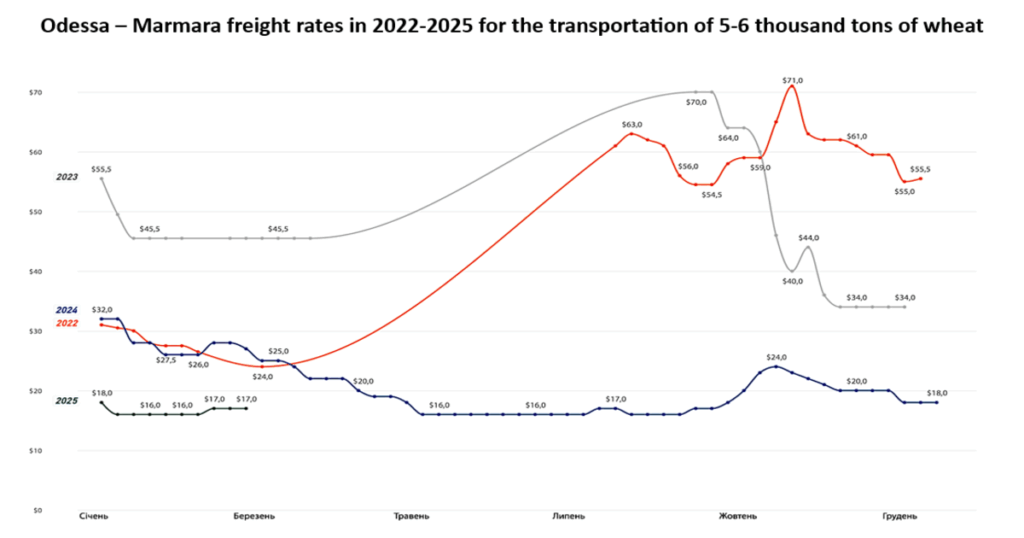

Looking at the history of freight rates from Ukraine on the three main routes, we can see a sharp increase in June 2022 due to the full-scale invasion, which led to the disruption of supply chains due to the blocking of ports and other land infrastructure.

Then a significant drop from July 2022 after the start of the maritime corridor as part of the “grain initiative”, which allowed unblocking the work of Ukraine’s deepwater ports on the Black Sea. The operation, deterioration, or termination of the grain corridor at that time directly affected the level of rates.

From the beginning of the Ukrainian grain corridor (August 2023) to the present day, due to the operation of all deep-water ports (Odesa, Chornomorsk, Pivdennyi) and Danube ports (Reni, Izmail), the impact of these factors has significantly decreased, and the level of freight rates has gradually decreased to historical (pre-war) values.

In these periods, the level of freight rates was additionally influenced by the amount of insurance premium for war risks, which the shipowner includes in the cost of transportation, provided that the shipowner’s market is available.

At present, the current grain market conditions do not allow shipowners to reflect insurance costs in the freight rate. The market is on the charterer’s side and dictates its terms for shipowners.

Situational factors

Situational factors that affect the level of freight rates include

- shelling of port infrastructure or vessels on approach or unloading in ports. In the short term, the number of shipowners willing to call at these ports decreases, and those willing to take the risk raise freight rates;

- deterioration of weather conditions or migration of the fleet to the Mediterranean due to certain factors;

- downtime on the Sulyn or Bystrom canals. Depending on the activity of exports from the Danube ports, the waiting time before entering these channels increases or decreases, which directly affected the level of freight rates. Although this factor is classified as situational, it should be noted that its impact was significantly longer than other situational factors. In 2022-2023, this factor had a significant impact on the level of interest rates;

- an increase in the cost of disbursement charges for a ship’s call at a port or passage through a strait or channel. In the short term, this may lead to an increase in freight rates.

In March-July 2022, and June-August 2023, there is no data because deepwater ports were not operating or rates were not collected due to irregular shipments.

In March-July 2022, and June-August 2023, there is no data because deepwater ports were not operating or rates were not collected due to irregular shipments.

This chart shows an increase in rates during periods when deepwater ports were not operating and a drop when the ports resumed operations.

Freight rate forecast

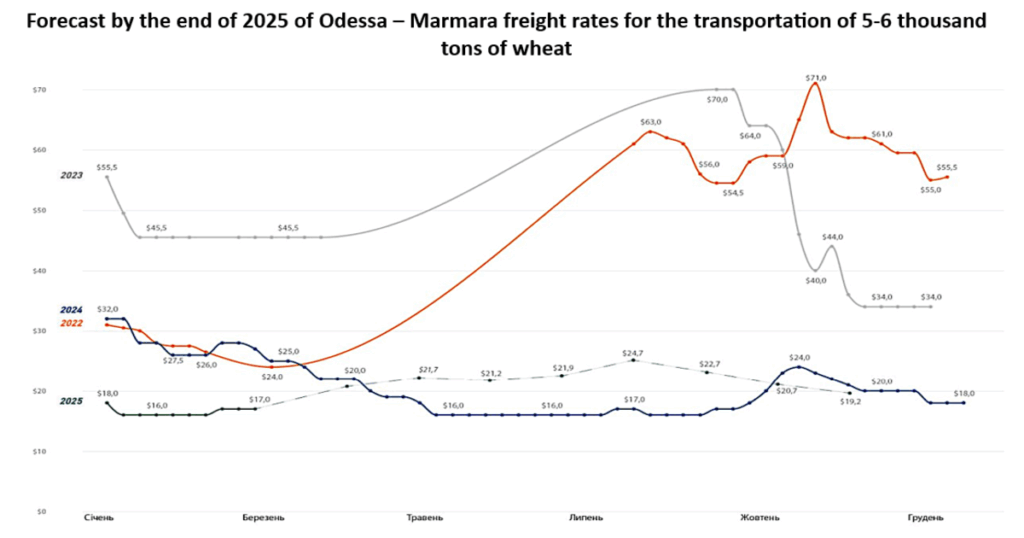

This forecast is for the period up to December 2025 in the Odesa-Marmara direction for the transportation of 5-6 thsd tonnes of wheat. It is based on a comprehensive analysis of five key parameters that directly affect the formation of freight rates in the region: the activity of the Danube ports, the dynamics of the USD/UAH exchange rate, changes in steel prices, the state of the Ukrainian economy and the total volume of Ukrainian trade in US dollars.

The forecast was based on an econometric model that takes into account the historical dependence and correlation between the analyzed parameters and freight rates. The model was built on the basis of multivariate regression analysis using time series analysis (ARIMA) and expert assessment of the impact of local economic and geopolitical events.

The model shows that a moderate increase in the activity of the Danube ports in the first half of 2025 will be driven by steadily growing export demand, followed by stabilization or a slight decrease in cargo traffic due to the expected decline in grain exports before the new harvest arrives on the market. The slight devaluation of the hryvnia and the forecasted dynamics of steel prices provide relatively stable conditions for freight rates without significant jumps in cargo flows related to the agricultural market.

The main factors that influenced the forecast results are:

- expected stabilization of the exchange rate due to significant inflows of international financial assistance;

- dynamics of the global steel market (revival of construction projects);

- a decline in grain exports due to USDA forecasts for the 2024/2025 marketing year.