News Industry rolled products 1050 28 February 2023

In January, Ukrainian consumers reduced the import of such products by 30% m/m

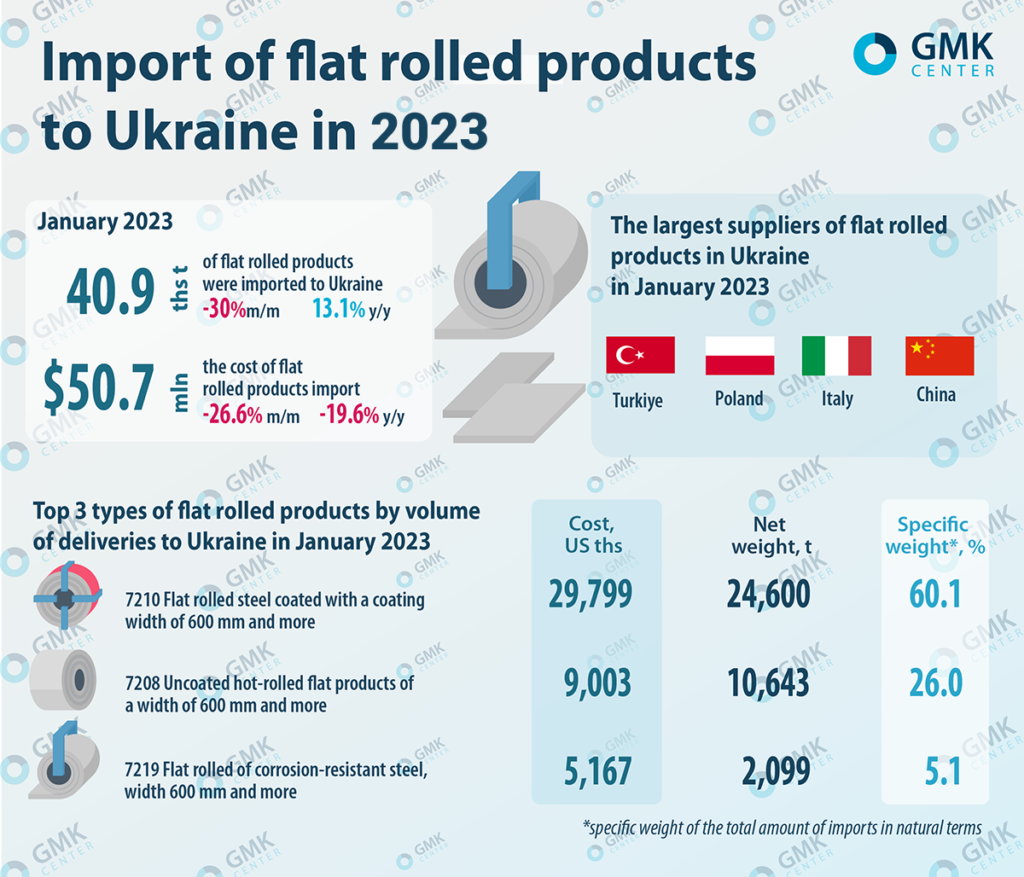

In January 2023, Ukraine reduced the import of flat rolled steel by 30% compared to December 2022 – to 40.9 thousand tons. Import costs for the month decreased by 26.6% m/m – to $50.66 million. This is evidenced by the State Customs Service’s data.

Compared to January 2022, the import of flat rolled products in January 2023 increased by 3.1% in physical terms, and decreased by 19.6% in monetary terms.

In January 2023, the largest amount of coated flat rolled products with a width of 600 mm and more (Nomenclature – 7210) was imported to Ukraine – 24.6 thousand tons (-7.5% m/m and -11.5% y/y) worth $29.8 million (-6.2% m/m and -29.7% y/y). Also 10.64 thousand tons (+50.2% m/m and +686.6% y/y) of hot-rolled uncoated flat rolled products with a width of 600 mm and more (Nomenclature – 7208) for $9 million (-55.5% m/m and +502.6% y/y) was imported.

In the top three among the types of flat rolled products in terms of import volumes to Ukraine in January 2023, there is also flat rolled steel made of corrosion-resistant steel with a width of 600 mm and more (Nomenclature – 7219) – 2.1 thousand tons for $5.17 million. This is by 3.3% more m/m and 36.2% less y/y in natural terms and by 2% m/m and 42.7% y/y less in monetary terms.

The largest suppliers of coated flat rolled products with a width of 600 mm and more in January 2023 were Turkiye, China and Poland – 25.64%, 22.38% and 20.78%, respectively, in monetary terms. Italy (27.87%), Poland (24.78%) and Turkiye (20.11%) shipped about 70% of uncoated hot-rolled flat products with a width of 600 mm and larger. China (63.75%) was the main supplier of flat rolled products made of corrosion-resistant steel with a width of 600 mm and more in January 2023.

Import of flat rolled products to Ukraine in 2023

As a result of the Russian invasion of Ukraine, several steel enterprises remained in the temporarily occupied territory, including the largest steel plants Azovstal and Ilyich Iron and Steel Works. Enterprises located in the territory under control are operating at minimum capacity due to problems with logistics, the unfavorable situation on the global steel markets, and interruptions in energy supply due to the shelling of the Ukrainian energy infrastructure by Russian forces.

The problems of Ukrainian steel industry in the near future may provoke an increase in the import of steel products to the domestic market.

As GMK Center reported earlier, in 2022, Ukraine reduced imports of flat rolled steel by 32.8% compared to 2021 – to 472.01 thousand tons. Import costs for the year decreased by 24.1% y/y – to $698.83 million. The largest suppliers of products were Turkiye, Poland, Slovakia and China.

In January 2023, Ukrainian steelmakers exported 29.5 thousand tons of flat rolled products which is 33.9% less compared to the previous month. In monetary terms, the export of such products fell by 35.2% m/m – to $19.4 million. That is, the import of flat rolled products exceeds the export of such products by Ukrainian producers by 11.4 thousand tons.