News Companies Thyssenkrupp 2321 14 February 2025

In October-December, the steel division reduced sales by 11% y/y in monetary terms

Thyssenkrupp’s steel division decreased sales by 11% y/y in monetary terms to €2.18 million in the first quarter of fiscal year 2024/2025 (October-December 2024). This was discussed during a conference call on the company’s results for the period, S&P Global reports.

This was mainly due to lower spot market prices in all customer segments. Deliveries declined significantly, especially in the automotive and industrial sectors, although there was some offsetting demand for packaging steel and grain electrical steel.

This had a negative impact on the overall performance. However, the division benefited from compensation for electricity prices and additional cost advantages, particularly for raw materials.

Thyssenkrupp noted that the market environment remains challenging due to uncertainty about future global economic growth and new US steel tariffs. This creates potential additional obstacles.

CFO Jens Schulte noted that there could be secondary effects if cheap steel from other countries, such as China, enters the European market as a result of the US tariffs.

‘This would further increase price pressure in Europe. However, a reliable estimate of this effect is not yet possible, as the newly announced tariffs have not yet come into effect,’ he explained.

In a separate letter to S&P Global, the company confirmed that the import duties announced by the US will have a very limited impact on Thyssenkrupp’s business, as Europe is the main market for its steel. Thyssenkrupp Steel Europe’s exports of steel products to the United States are insignificant and mainly relate to high-quality products with a good market position.

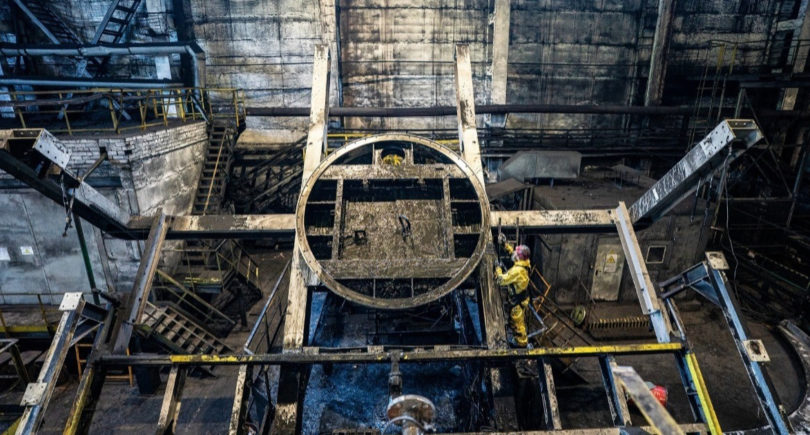

The company is finalising its business plan for Thyssenkrupp Steel Europe and sees a 50/50 joint venture with Czech EPCG as the logical next step in its independence.

During a conversation with analysts, the company’s CEO Miguel Lopez reiterated the group’s current view that it is necessary to initially launch DRI production on natural gas, as the cost of green hydrogen is currently not competitive.

As GMK Center reported earlier, Thyssenkrupp’s green steel plan includes alternatives to hydrogen. The company is open to all technologies for further transformation.