News Companies АрселорМіттал Кривий Ріг 161 01 July 2025

Without market prices for energy resources, the company will be on the verge of closure, and tens of thousands of people will be out of work

ArcelorMittal Kryvyi Rih, Ukraine’s largest steel mill, is at risk of closing due to the extremely high cost of electricity. This warning came from the company’s financial director, Pavlo Zadorozhny. According to him, the company has been forced to operate at a loss for the fourth consecutive year, and support from the parent company cannot be endless.

The situation worsened in 2024-2025, when another problem was added to the military challenges: the cost of energy. In May, the price of electricity for ArcelorMittal Kryvyi Rih exceeded €94 per MWh, which is the highest in Europe. For comparison, in France, where nuclear power also dominates, the cost of electricity was around €20.

The main reasons for this are Energoatom’s monopoly position and restrictions on imports of cheaper electricity imposed by Ukrenergo. As a result, there is no competitive energy market in Ukraine, and consumers are unable to reduce their costs.

“We cannot pass on the additional costs to consumers because the market dictates its prices. If nothing changes, we will not be able to survive,” warns Zadorozhny.

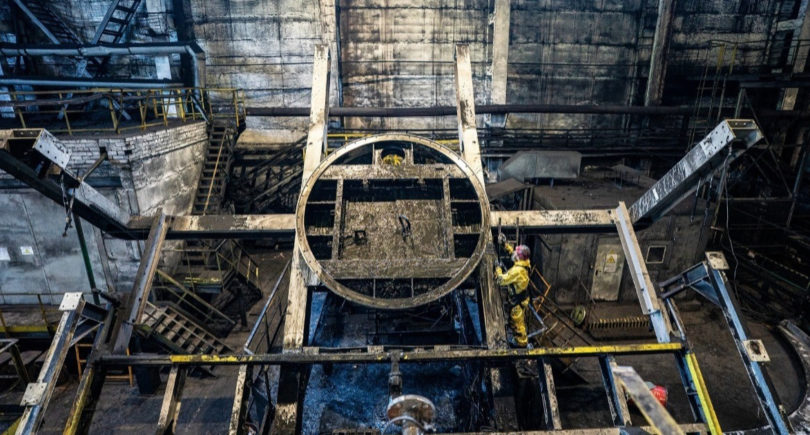

In November 2024, ArcelorMittal already shut down one of its blast furnaces due to electricity prices. The plant is currently operating at full capacity, but its future is in question. The consequences of a possible shutdown are enormous: 18,000 jobs, social stability in Kryvyi Rih, and more than a billion dollars in foreign exchange earnings each year will be at risk.

The CFO of ArcelorMittal Kryvyi Rih is calling on the government to intervene by creating a competitive energy market, unblocking electricity imports, and strengthening control over market pricing. Otherwise, the company, which has been a pillar of the economy for decades, may shut down.

According to GMK Center, electricity prices have become one of the main barriers to the operation of the metallurgical industry in Ukraine. After massive attacks by the Russian Federation, the Ukrainian energy system lost about 10 GW of capacity, which led to a sharp increase in dependence on expensive imports. At the same time, in most EU countries, where industry support programs are in place, electricity is significantly cheaper: 93% of steel in the EU is produced in countries with lower tariffs than in Ukraine. This seriously undermines the competitiveness of Ukrainian metallurgists, especially iron ore concentrate producers, for whom electricity accounts for up to 60% of the cost of production.