News Global Market scrap metal 1679 28 March 2025

More than 60% of deliveries are to Turkey

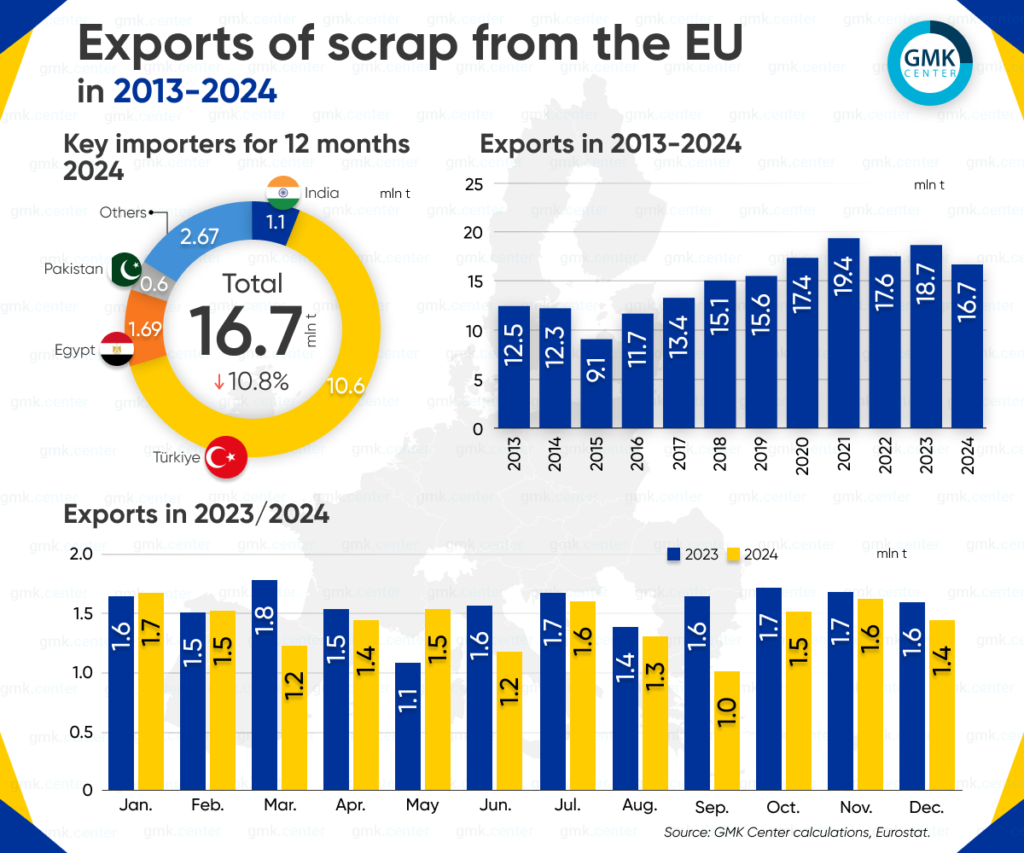

In 2024, EU companies specializing in ferrous scrap operations reduced their exports of raw materials to third countries by 10.8% compared to 2023, to 16.72 million tons. This is evidenced by GMK Center’s calculations based on Eurostat data.

More than 60% of total exports went to Turkey – 10.62 million tons (+1.7% y/y). The largest consumers of raw materials include:

- Egypt – 1.68 million tons (+1.2% y/y);

- India – 1.09 million tons (-51.3% y/y);

- Pakistan – 654.34 thousand tons (-17.5% y/y).

These four countries account for 84% of EU scrap exports.

In December 2024, the EU exported 1.36 million tons of ferrous scrap, down 14.4% compared to December 2023 and 20% m/m.

In November, 955.3 thousand tons of scrap were shipped to Turkish consumers (-6.1% y/y; -17.7% m/m), 119.59 thousand tons to Indian consumers. tons (-35.7% y/y, -9.8% m/m), to Egypt – 95.25 thousand tons (+20% y/y, -43.8% m/m), and to Pakistan – 74.14 thousand tons (-10.3% y/y, +19.9% m/m).

In 2024, scrap exports from the EU show mixed trends: the total volume of supplies is declining, but Turkey, traditionally the largest importer of European raw materials, is increasing purchases amid the recovery of the steel sector. At the same time, the decline in exports to India and Pakistan indicates a change in the regional demand structure and possible changes in supply chains. EU regulatory initiatives aimed at preserving scrap for domestic production remain an additional factor, which may limit third countries’ access to European raw materials in the future.

As GMK Center reported earlier, in 2023, exports of scrap from the European Union increased by 7% compared to 2022 to 18.53 million tons. In 2022, exports fell by 10% y/y for the first time after more than 6 years of upward trend.

EU steel production in 2024 increased by 2.6% y/y – to 129.5 million tons. Global steel production fell by 0.9% y/y – to 1.84 billion tons.