Shipments of raw materials increased by 45.5% y/y since the beginning of the year

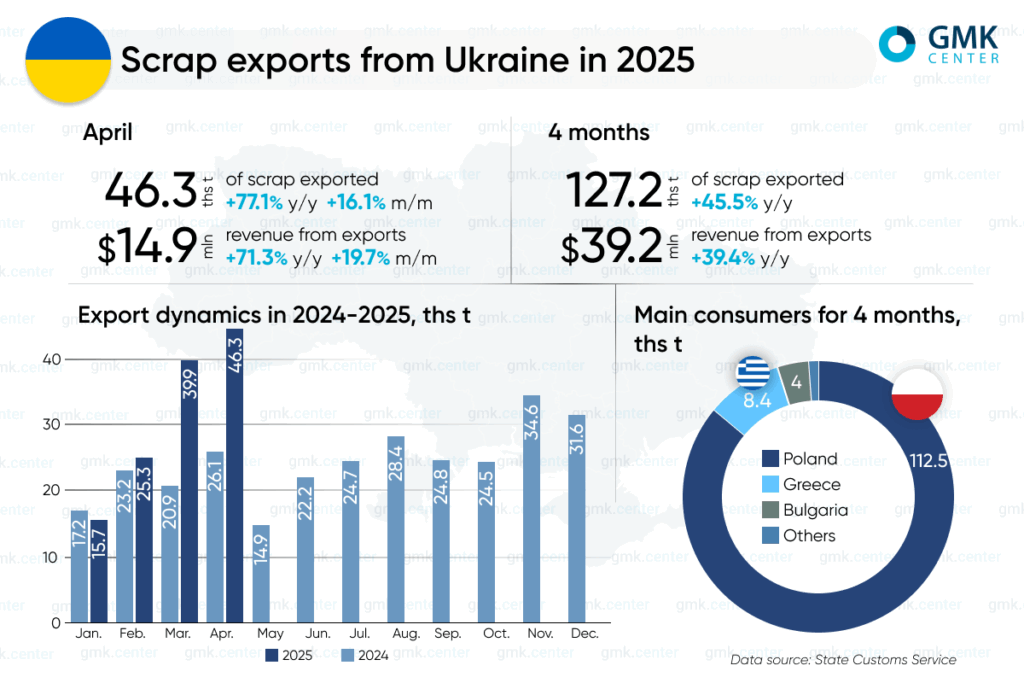

In April 2025, the Ukrainian scrap industry increased exports of ferrous scrap by 77.1% compared to April 2024 and by 16.1% compared to the previous month, up to 46.32 thousand tons. This is based on GMK Center’s calculations based on data from the State Customs Service.

Poland remains the key export destination for raw materials. The Polish market received 40.15 thousand tons of scrap (+19.9% m/m), which is 88.4% of the total supply. A small part was shipped to Greece – 2.69 thousand tons (-53.1% y/y), Bulgaria – 2.4 thousand tons, and Germany – 1 thousand tons (+66.1% m/m).

In January-April, shipments of scrap from Ukraine increased by 45.5% compared to the same period in 2024 – up to 127.21 thousand tons. Poland shipped 112.49 thousand tons of raw materials (0.04 thousand tons in January-April 2024), Greece – 8.42 thousand tons (-7.2% y/y), Bulgaria – 3.97 thousand tons (0 thousand tons in January-April 2024), and Germany – 2.13 thousand tons (0 thousand tons in January-April 2024).

Revenues from scrap exports in April increased by 19.7% month-on-month and by 71.3% y/y – to $14.94 million. In January-April, the figure increased by 39.4% y/y – to $39.25 million.

As a reminder, in 2024, Ukraine’s scrap exports increased by 60% compared to 2023, to 293.2 thousand tons. In 2023, shipments of raw materials abroad exceeded 182.5 thousand tons, up 3.4 times year-on-year, while in 2022 the figure was 54.1 thousand tons. The key consumers of raw materials last year were Poland (248.6 thousand tons), Greece (34.2 thousand tons), and Germany (6.5 thousand tons).

In early May 2025, the Ministry of Economy of Ukraine submitted for public discussion a draft resolution of the Cabinet of Ministers, which proposes to introduce licensing and quota for the export of ferrous scrap with a zero quota for the current year. This approach has been used in Ukraine before, particularly during periods of peak demand for raw materials for the domestic steel industry.

According to GMK Center’s research, in the long term, scrap metal will gradually lose its status as an export commodity due to global trade barriers. Scrap is increasingly seen as a strategic resource for green metallurgy and decarbonization, so countries are seeking to preserve raw materials for their own needs. It cannot be produced in the required quantity in a timely manner, so an affordable price in the domestic market is becoming a key condition for the competitiveness of national steel producers.

Currently, 48 countries have already imposed restrictions on scrap exports, and more than a third of them have completely banned them. This trend will only intensify as global demand for scrap grows: in the EU due to decarbonization and the CBAM mechanism, and in other countries due to the transition to greener production technologies. In total, 77% of the world’s steel is produced in countries that have already imposed or plan to impose restrictions on scrap exports.

In such circumstances, it is more reasonable to export finished steel made from scrap rather than scrap itself, as steelmakers are among the largest taxpayers in Ukraine.