News Industry scrap metal 2190 22 April 2024

Exports of raw materials accounted for 12.4% of the total harvesting volume

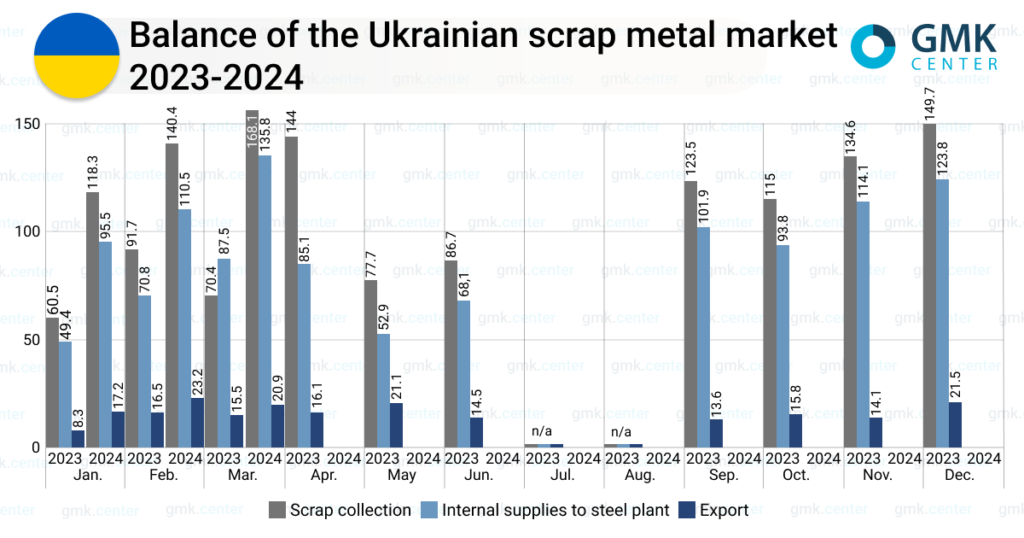

In March 2024, scrap collection in Ukraine increased by 19.7% compared to the previous month – to 168.1 thousand tons. The figure increased by 2.4 times compared to March 2023. This is according to the Ukrainian Association of Secondary Metals (UAVtormet).

Raw material supplies to Ukrainian steel mills amounted to 138.5 thousand tons in the month, up 25.3% m/m and 58.3% y/y. The significant year-on-year growth is explained by the low comparison base, as in the winter-spring period of 2023, the domestic steel industry significantly limited production due to the shelling of critical energy infrastructure by Russian troops. At the same time, the monthly growth indicates a previously planned gradual increase in capacity utilization in the Ukrainian steel and mining sector.

Exports of scrap in March reached 20.9 thousand tons, down 9.9% month-on-month and up 34.8% y/y. The figure rose sharply in February this year and continues to exceed 20 thousand tons, compared to the average monthly exports in 2023 at 15.7 thousand tons. Imports of raw materials for the month amounted to 0.05 thousand tons (0.01 thousand tons in March 2023).

In January-March 2024, scrap collection in Ukraine amounted to 426.8 kt, up 91.7% compared to the same period in 2023. In Q1 2024, the supply of raw materials to domestic steelmakers increased by 65.9% y/y (to 344.5 kt), scrap exports increased by 52.1% y/y (to 61.3 kt), and imports amounted to 0.25 kt (0.05 kt a year earlier).

Thus, 14.4% of Ukraine’s scrap is shipped for export, and monthly shipments exceeded 20 thousand tons for the second month in a row, approaching pre-war levels, while scrap exports are currently carried out without paying any duty to the state budget.

Exports are increasing amidst difficulties in collecting raw materials due to hostilities, as most scrap procurement companies were located in the temporarily occupied territories or in the war zone before the full-scale war.

An additional factor putting pressure on the scrap market is the lack of sales of raw materials by one of its main suppliers, Ukrainian Railways (UZ). The railroad operator stopped selling scrap in September 2023, which had an extremely negative impact on the entire Ukrainian steel industry.

In 2022, UZ successfully sold 113.04 thousand tons of ferrous scrap to the Ukrainian market, in 2023 – 76.39 thousand tons, and since the beginning of 2024, no auctions have been held. The sales stopped immediately after the Cabinet of Ministers banned UZ from selling scrap bypassing the Prozorro system, believing that it would create corruption risks.

Such conditions pose a threat to the operations of domestic steelmakers, as the partial unblocking of sea exports helps to increase the capacity of the plants. In particular, ArcelorMittal Kryvyi Rih plans to increase its utilization to 50% by launching a second blast furnace. Other Ukrainian companies have similar plans. The improved prospects for the industry are also evidenced by the steel production data for January-March, which increased by 36.6% y/y – to 1.69 million tons. For a significant increase in capacity, sufficient scrap supply is critical, and exports are impractical. At the same time, according to UAVtormet’s forecasts, 250-300 thousand tons of scrap will be exported from Ukraine in 2024, with collection rates of 1.75-1.85 million tons.

«Since July last year, steel production in Ukraine has been relatively stable and, therefore, has not required a significant increase in scrap supplies. However, an increase in steel capacity utilization could have a significant impact on the situation, as the launch of at least one blast furnace will require an increase in scrap supplies by about 30%. This could be a challenge for scrap producers and a shock to the market, given that scrap procurement is supported by export opportunities and Ukrzaliznytsia has stopped selling scrap to the domestic market,» said Andriy Glushchenko, GMK Center analyst.

Scrap is a strategic raw material for the global steel industry to achieve its carbon neutrality goals. Most developed countries are now in favor of a ban on scrap exports to preserve critical raw materials in the transition to green production.

As GMK Center reported earlier, in 2023, ferrous scrap collection in Ukraine increased by 28.1% to 1.27 million tons compared to 2022. Over the same period, scrap supplies to steelmakers amounted to 1.034 million tons (+15.4% y/y). Exports increased by 3.4 times compared to 2022 – to 182.48 thousand tons.