News Industry collection of scrap 1737 13 May 2024

Export of raw materials increased by 25% m/m and is 19.1% of the total collection for the month

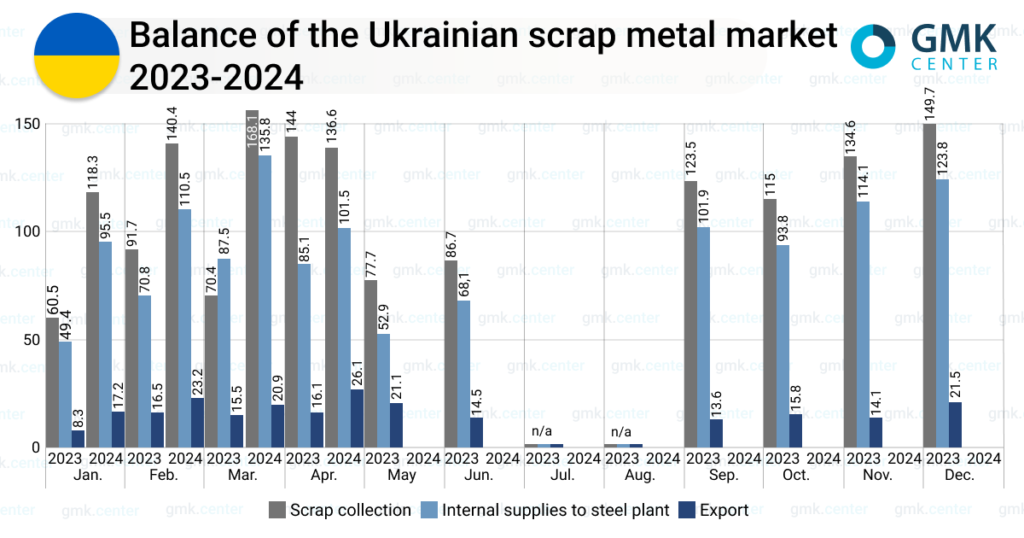

In April 2024, scrap consumption in Ukraine decreased by 18.7% compared to the previous month – to 136.6 thousand tons. Compared to April 2023, the figure fell by 5.1%. This is according to the Ukrainian Association of Secondary Metals (UAVtormet).

The supply of raw materials to Ukrainian steel mills amounted to 101.5 thousand tons for the month, which is 26.7% less than in the previous month and 19.3% more than in the previous year. The year-on-year growth is explained by a low comparison base, as in the winter-spring period of 2023, the domestic steel industry significantly limited production due to the shelling of critical energy infrastructure by Russian troops. At the same time, the figure fell month-on-month, although steel production increased by 17% m/m and 24.6% y/y – to 715 thousand tons.

Exports of scrap in April reached 26.1 thousand tons, up 24.9% month-on-month and 62.1% y/y. The figure reached record levels since the start of the full-scale invasion. Imports of raw materials in April amounted to 0.09 thousand tons compared to 0.05 thousand tons in March and 0.01 thousand tons in April 2023.

«The dynamics of steel production diverges from the dynamics of scrap supplies to the domestic market. This poses certain risks to the stable supply of Ukrainian steelmakers amid rising scrap exports and unpredictable future procurement volumes,» said Andriy Glushchenko, GMK Center analyst.

In January-April 2024, scrap collection in Ukraine amounted to 563.4 thousand tons, up 53.7% year-on-year. Over 4 months, the supply of raw materials to domestic steelmakers increased by 52.3% y/y (to 446 kt), scrap exports increased by 55% y/y (to 87.4 kt), and imports amounted to 0.34 kt (0.06 kt a year earlier).

Thus, 15.5% of Ukraine’s procured scrap is shipped for export, and monthly shipments exceeded 20 kt for the third month in a row, approaching pre-war levels, while scrap exports are currently carried out without paying any duty to the state budget.

Exports are increasing amidst difficulties in collecting raw materials due to hostilities, as most scrap companies were located in the temporarily occupied territories or in the war zone before the full-scale war.

An additional factor putting pressure on the scrap market is the lack of sales of raw materials by one of its main suppliers, Ukrainian Railways (UZ). The railroad operator stopped selling scrap in September 2023, which had an extremely negative impact on the entire Ukrainian steel industry.

In 2022, UZ successfully sold 113.04 thousand tons of ferrous scrap to the Ukrainian market, in 2023 – 76.39 thousand tons, and since the beginning of 2024, no auctions have been held. The sales stopped immediately after the Cabinet of Ministers banned UZ from selling scrap bypassing the Prozorro system, believing that it would create corruption risks.

Such conditions pose a threat to the operations of domestic steelmakers, as the partial unblocking of sea exports helps to increase the capacity of the plants. In particular, ArcelorMittal Kryvyi Rih plans to increase its utilization to 50% by launching a second blast furnace. Other Ukrainian companies have similar plans. The improved prospects for the industry are also evidenced by the steel production data for January-April, which increased by 32.8% y/y – to 2.4 million tons. To significantly increase capacity, sufficient scrap supply is critical, and exports are impractical. At the same time, UAVtormet forecasts that 250-300 thousand tons of scrap will be exported from Ukraine in 2024, with collection rates of 1.75-1.85 million tons.

Scrap is a strategic raw material for the global steel industry to achieve its carbon neutrality goals. Most developed countries are now in favor of a ban on scrap exports to preserve critical raw materials in the transition to green production.

As GMK Center reported earlier, in 2023, the volume of ferrous scrap collection in Ukraine increased by 28.1% – to 1.27 million tons compared to 2022. Over the same period, scrap supplies to steelmakers amounted to 1.034 million tons (+15.4% y/y). Exports increased by 3.4 times compared to 2022 – to 182.48 thousand tons.